Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Red Saga Partnership is a manufacturing business owned by Azman, Wong and Bashir. Profit and loss are shared at a ratio of 5:

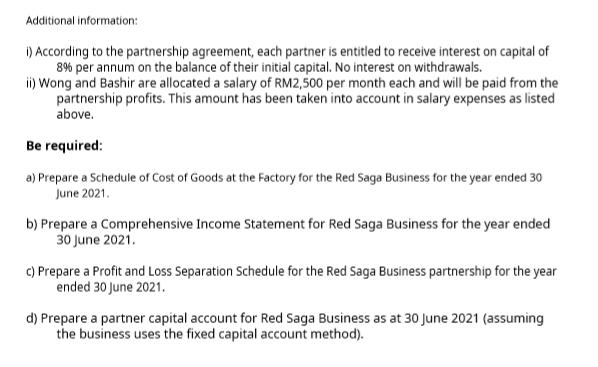

The Red Saga Partnership is a manufacturing business owned by Azman, Wong and Bashir. Profit and loss are shared at a ratio of 5: 3: 2. The capital account balances as at 1 July 2020 and withdrawals during the current accounting period are as follows: Current account Take (RM) 3,400 2,100 (500) Partner Azman People Bashir Capital (RM) 80,000 50,000 40,000 (RM) 6,000 8,000 4,500 The following is the revenue and expenditure account balance for the business for the year ended 30 June 2021: RM 28,600 36,800 33,400 57,500 16,720 8,500 20,200 17,500 1,150,000 225,000 18,880 6,800 305,000 15,500 351,200 25,200 45,600 50,400 75,000 50,500 2,500 Account Indirect labor Work in progress (1 July 2020) Raw material inventory (1 July 2020) Finished goods inventory (1 July 2020) Factory insurance expenses Office insurance expenses Factory utility spending Office utility expenses Sales Spend the salary Factory depreciation expense Outbound freight shopping Purchase of raw materials Office depreciation expenses Direct labor Factory repair expenses Raw material inventory (30 Jun 2021) Work -in -progress inventory (June 30, 2021) Inventory of finished goods (30 Jun 2021) Sales and service expenses Interest spending Additional information: I) According to the partnership agreement, each partner is entitled to receive interest on capital of 8% per annum on the balance of their initial capital. No interest on withdrawals. ii) Wong and Bashir are allocated a salary of RM2,500 per month each and will be paid from the partnership profits. This amount has been taken into account in salary expenses as listed above. Be required: a) Prepare a Schedule of Cost of Goods at the Factory for the Red Saga Business for the year ended 30 June 2021. b) Prepare a Comprehensive Income Statement for Red Saga Business for the year ended 30 June 2021. ) Prepare a Profit and Loss Separation Schedule for the Red Saga Business partnership for the year ended 30 June 2021. d) Prepare a partner capital account for Red Saga Business as at 30 June 2021 (assuming the business uses the fixed capital account method).

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution RED SAGA PARTNERSHIP SCHEDULE OF COST OF GOODS MANUFACTURED a FOR THE YEAR ENDED 30 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started