Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the regal cycle company manufactures three types of bicyclesa dirt bike, a mountain bike, and a racing bike. data on sales and expenses for the

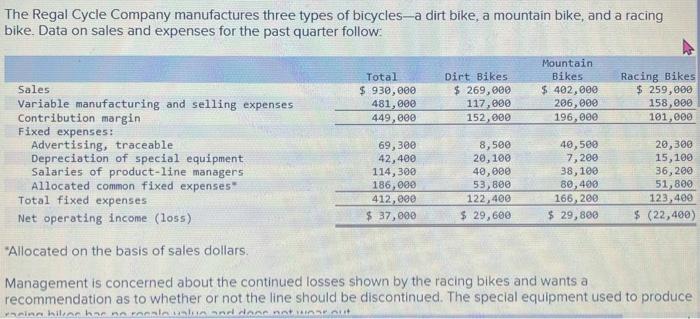

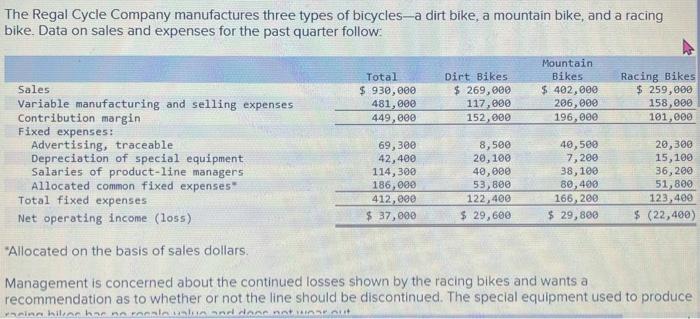

the regal cycle company manufactures three types of bicyclesa dirt bike, a mountain bike, and a racing bike. data on sales and expenses for the past quarter follow: totaldirt bikesmountain bikesracing bikessales$ 930,000$ 269,000$ 402,000$ 259,000variable manufacturing and selling expenses481,000117,000206,000158,000contribution margin449,000152,000196,000101,000fixed expenses: advertising, traceable69,3008,50040,50020,300depreciation of special equipment42,40020,1007,20015,100salaries of product-line managers114,30040,00038,10036,200allocated common fixed expenses*186,00053,80080,40051,800total fixedexpenses412,000122,400166,200123,400net operating income (loss)$ 37,000$ 29,600$ 29,800$ (22,400)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started