Answered step by step

Verified Expert Solution

Question

1 Approved Answer

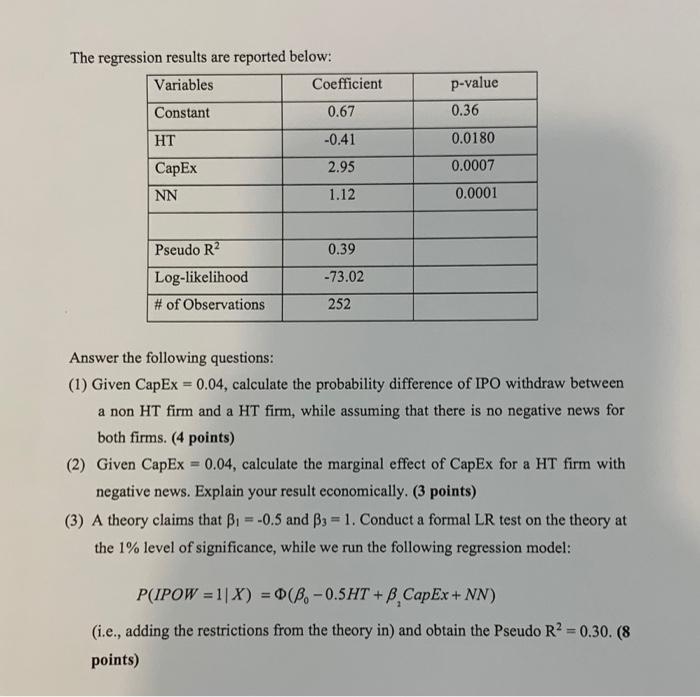

The regression results are reported below: Variables Constant HT CapEx NN Pseudo R2 Log-likelihood # of Observations Coefficient 0.67 -0.41 2.95 1.12 0.39 -73.02

The regression results are reported below: Variables Constant HT CapEx NN Pseudo R2 Log-likelihood # of Observations Coefficient 0.67 -0.41 2.95 1.12 0.39 -73.02 252 = p-value 0.36 0.0180 0.0007 0.0001 Answer the following questions: (1) Given CapEx = 0.04, calculate the probability difference of IPO withdraw between a non HT firm and a HT firm, while assuming that there is no negative news for both firms. (4 points) (2) Given CapEx 0.04, calculate the marginal effect of CapEx for a HT firm with negative news. Explain your result economically. (3 points) (3) A theory claims that B = -0.5 and 3 = 1. Conduct a formal LR test on the theory at the 1% level of significance, while we run the following regression model: P(IPOW=1|X) = (-0.5HT + B,CapEx + NN) (i.e., adding the restrictions from the theory in) and obtain the Pseudo R = 0.30. (8 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To calculate the probability difference of IPO withdrawal between a nonHT firm and an HT firm we use the logistic regression coefficients for the HT ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started