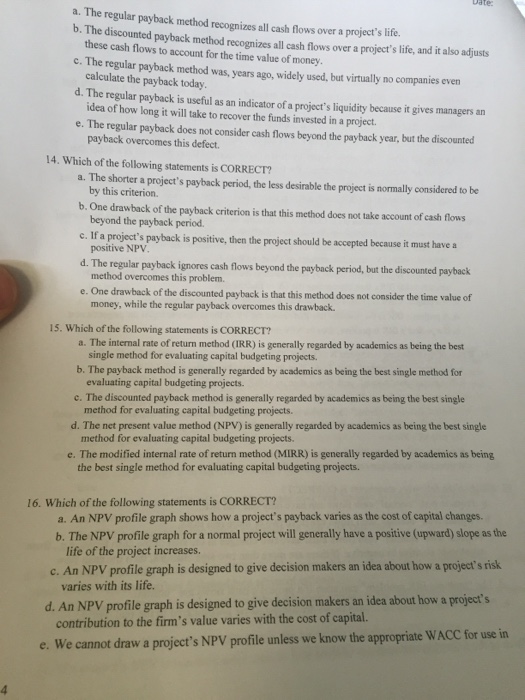

The regular payback method recognizes all each flows over a project's life. The discounted payback method recognizes all each flows over a project's life, and it also adjusts these cash flows to account for the time value of money. The regular payback method was, year ago, widely used, but virtually no companies even calculate the payback today. The regular payback is useful as an indicator of a project's liquidity because it gives manages an idea of how long it will take to recover the funds invested in a project. The regular payback does not consider each flows beyond the payback year, but the discounted payback overcomes this defect. Which of the following statements is CORRECT? The shorter a project s payback period, the less desirable the project is normally considered to be by this criterion. One drawback of the payback criterion is that this method does not take account of cash flows beyond the payback period. If a project's payback is positive, then the project should be accepted because it must have a positive NPV. The regular payback ignores cash flows beyond the payback period, but the discounted payback method overcomes this problem. One drawback of the discounted payback is that this method does not consider the time value of money, while the regular payback overcomes this drawback. Which of the following statements is CORRECT? The internal rate of return method (IRR) is generally regarded by academics as being the best single method for evaluating capital budgeting projects. The pay back method is generally regarded by academics as being the best single method for evaluating capital budgeting projects. The discounted pay back method is generally regarded by academics as being the best single method for evaluating capital budgeting projects, d. The net present value method (NPV) is generally regarded by academics as being the best single method for evaluating capital budgeting projects. The modified internal rate of return method (MIRR) is generally regarded by academics as being the best single method for evaluating capital budgeting projects. Which of the following statements is CORRECT? An NPV profile graph shows how a project's payback varies as the cost of capital changes. The NPV profile graph for a normal project will generally have a positive (upward) slope s life of the project increases. An NPV profile graph is designed to give decision makers an idea about how a project's risk varies with its life. An NPV profile graph is designed to give decision makers an idea about how a project's contribution to the firm's value varies with the cost of capital. We cannot draw a project's NPV profile unless we know the appropriate WACC for use in