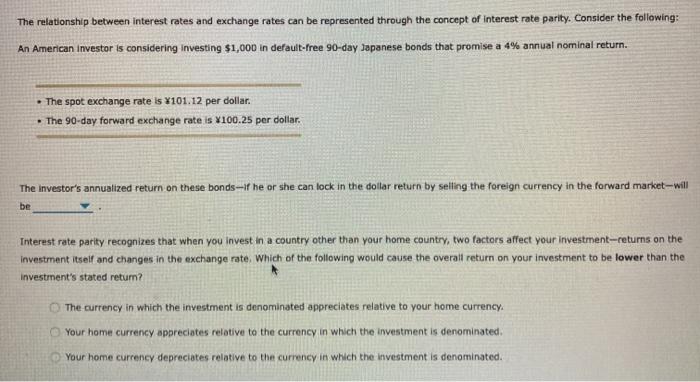

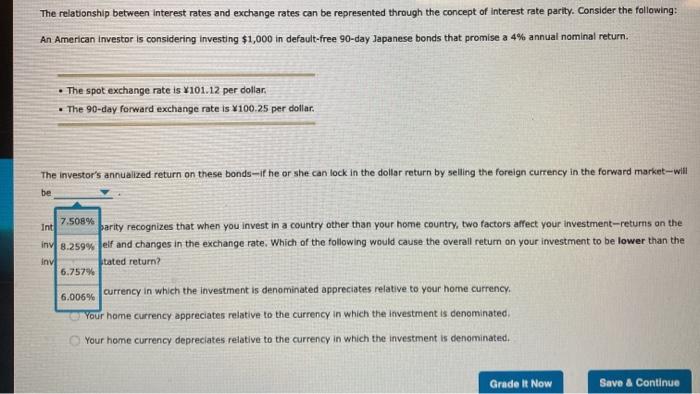

The relationship between interest rates and exchange rates can be represented through the concept of Interest rate parity. Consider the following: An American Investor is considering investing $1,000 in default-free 90-day Japanese bonds that promise a 4% annual nominal return. The spot exchange rate is 101.12 per dollar. The 90-day forward exchange rate is 100.25 per dollar. The Investor's annualized return on these bonds--if he or she can lock in the dollar return by selling the foreign currency in the forward market-will be Interest rate parity recognizes that when you invest in a country other than your home country, two factors affect your investment-returns on the Investment itself and changes in the exchange rate. Which of the following would cause the overall return on your investment to be lower than the investment's stated return? The currency in which the investment is denominated appreciates relative to your home currency. Your home currency appreciates relative to the currency in which the investment is denominated Your home currency depreciates relative to the currency in which the investment is denominated. The relationship between Interest rates and exchange rates can be represented through the concept of interest rate parity. Consider the following: An American Investor is considering Investing $1,000 in default-free 90-day Japanese bonds that promise a 4% annual nominal return. The spot exchange rate is 101.12 per dollar The 90-day forward exchange rate is 100.25 per dollar. The investor's annualized return on these bonds-If he or she can lock in the dollor return by selling the foreign currency in the forward market-Will be 7.508% Int 6.7579 parity recognizes that when you invest in a country other than your home country, two factors affect your investment-returns on the iny 8.259wfeif and changes in the exchange rate. Which of the following would cause the overall return on your investment to be lower than the Iny tated return? Currency in which the investment is denominated appreciates relative to your home currency o your home currency appreciates relative to the currency in which the investment is denominated, Your home currency depreciates relative to the currency in which the investment is denominated. 6.006% Grade it Now Save & Continue