Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The relationship between interest rates and exchange rates can be represented through the concept of interest rate parity. Consider the following: An American investor is

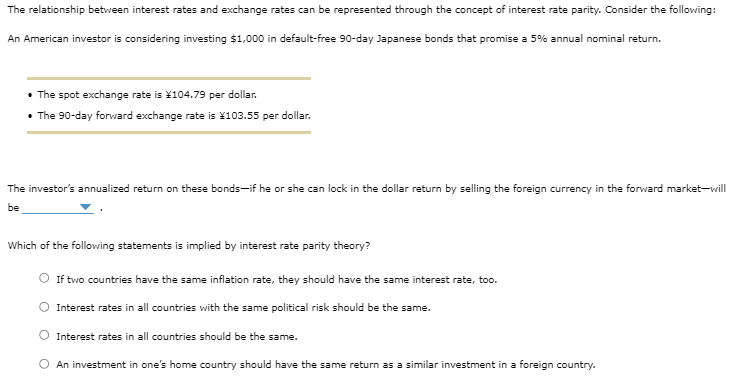

The relationship between interest rates and exchange rates can be represented through the concept of interest rate parity. Consider the following: An American investor is considering investing $1,000 in default-free 90 -day Japanese bonds that promise a 5% annual nominal return. - The spot exchange rate is 104.79 per dollar. - The 90-day forward exchange rate is 103.55 per dollar. The investor's annualized return on these bonds-if he or she can lock in the dollar return by selling the foreign currency in the forward market-will be Which of the following statements is implied by interest rate parity theory? If two countries have the same inflation rate, they should have the same interest rate, too. Interest rates in all countries with the same political risk should be the same. Interest rates in all countries should be the same. An investment in one's home country should have the same return as a similar investment in a foreign country

The relationship between interest rates and exchange rates can be represented through the concept of interest rate parity. Consider the following: An American investor is considering investing $1,000 in default-free 90 -day Japanese bonds that promise a 5% annual nominal return. - The spot exchange rate is 104.79 per dollar. - The 90-day forward exchange rate is 103.55 per dollar. The investor's annualized return on these bonds-if he or she can lock in the dollar return by selling the foreign currency in the forward market-will be Which of the following statements is implied by interest rate parity theory? If two countries have the same inflation rate, they should have the same interest rate, too. Interest rates in all countries with the same political risk should be the same. Interest rates in all countries should be the same. An investment in one's home country should have the same return as a similar investment in a foreign country Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started