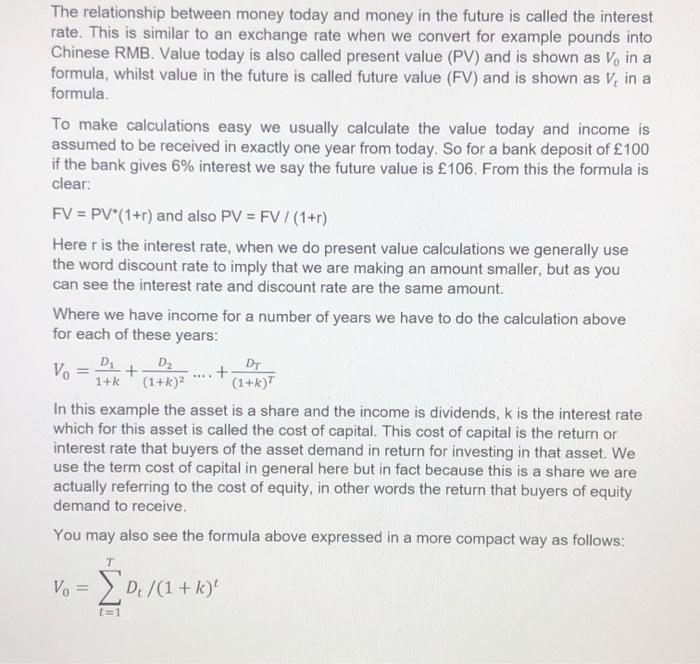

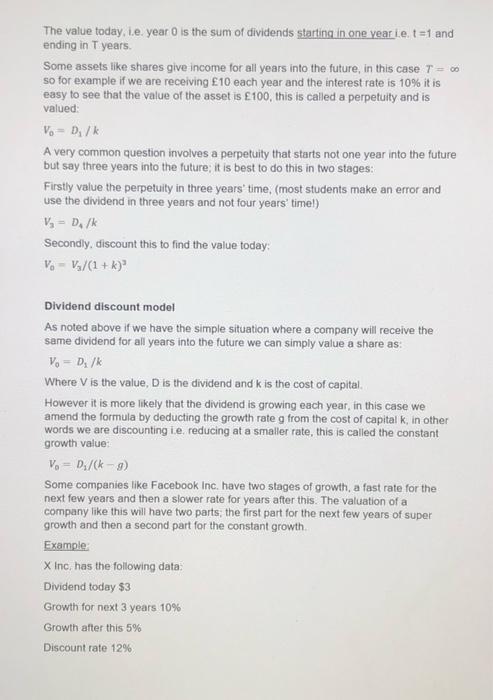

The relationship between money today and money in the future is called the interest rate. This is similar to an exchange rate when we convert for example pounds into Chinese RMB. Value today is also called present value (PV) and is shown as V, in a formula, whilst value in the future is called future value (FV) and is shown as V, in a formula To make calculations easy we usually calculate the value today and income is assumed to be received in exactly one year from today. So for a bank deposit of 100 if the bank gives 6% interest we say the future value is 106. From this the formula clear: FV = PV*(1+r) and also PV = FV / (1+r) Here r is the interest rate, when we do present value calculations we generally use the word discount rate to imply that we are making an amount smaller, but as you can see the interest rate and discount rate are the same amount. Where we have income for a number of years we have to do the calculation above for each of these years: V. + Dz Dr 1+k (1+k) (1+k)? In this example the asset is a share and the income is dividends, k is the interest rate which for this asset is called the cost of capital. This cost of capital is the return or interest rate that buyers of the asset demand in return for investing in that asset. We use the term cost of capital in general here but in fact because this is a share we are actually referring to the cost of equity, in other words the return that buyers of equity demand to receive You may also see the formula above expressed in a more compact way as follows: Di ... + Vo . D/(1+k) t=1 The value today, i.e. year is the sum of dividends starting in one year.e. t =1 and ending in T years. Some assets like shares give income for all years into the future, in this case T = 60 so for example if we are receiving 10 each year and the interest rate is 10% it is easy to see that the value of the asset is 100, this is called a perpetuity and is valued Vo = 0; / A very common question involves a perpetuity that starts not one year into the future but say three years into the future; it is best to do this in two stages: Firstly value the perpetuity in three years' time, (most students make an error and use the dividend in three years and not four years timel) Vs - D. / Secondly, discount this to find the value today: Vo - V/(1+k) Dividend discount model As noted above if we have the simple situation where a company will receive the same dividend for all years into the future we can simply value a share as: Vo = D. / Where Vis the value, D is the dividend and k is the cost of capital However it is more likely that the dividend is growing each year, in this case we amend the formula by deducting the growth rate from the cost of capital k, in other words we are discounting ie, reducing at a smaller rate, this is called the constant growth value Vo = D./(-9) Some companies like Facebook Inc. have two stages of growth, a fast rate for the next few years and then a slower rate for years after this. The valuation of a company like this will have two parts; the first part for the next few years of super growth and then a second part for the constant growth Example X Inc, has the following data Dividend today $3 Growth for next 3 years 10% Growth after this 5% Discount rate 12% (Note: the symbol means taking to a power) The next three years are worth: 3*1.1/1.12 + 3*1.12/1.12^2 + 3*1.113 / 1.1243 = 2.95 +2.89 +2.84 After this period we calculate the value of the dividends received in year 4 and beyond, (this is the same as a perpetuity received after a delay as noted above): The value in three years' time is the constant growth value, this is the dividend to be received in four years discounted at k-g, as follows: 3*1.13*1,05/0.12 -0.05 = 59.90 However we need the value of this today, so we discount back three years: 59.90/1.1243 = 42.64 We add together these two parts to get the total value per share: 2.95 + 2.89 +2.84 + 42.64 = $51.32 The formula for this calculation called the 2 stage growth model is: Vo = D. (1+k) + Vr/(1+k)" V = Dr+1/k-9) Based on the above information kindly answer the following questions Question 1 You want to buy a car, the garage gives the following choices a) Pay 3,000 today b) Pay a deposit of 1,000 today and 2,000 in one year and 500 in two years' time c) Pay 1,100 for three years, first payment in one years' time The interest rate is 8%, which is the best offer? Question 2 Suppose you win money from a game and are offered the following choices: a) A cheque today for $5,000,000 b) A cheque every year for all years into the future of 300,000 starting in one year c) A cheque every year for all years into the future of 250,000 first cheque paid today The interest rate is 5%, which do you choose? Question 3 Your grandfather has bought you an investment that gives a dividend of $100 each year, you will receive the first dividend in one year, and the discount rate is 10%. a) How much is this investment worth today? b) How much is this investment worth today if you receive the first dividend today? Question 4 You are interested in buying shares in ABC Plc. and obtain the following data: Dividend today: 1 Cost of capital: 12% Growth: 5% a) What is the value of the stock today if you assume that it will continue like this into the future b) What is the value of the stock today if it has an offer to be bought for 10 per share in three years' time (note this implies you will also receive 3 dividends)