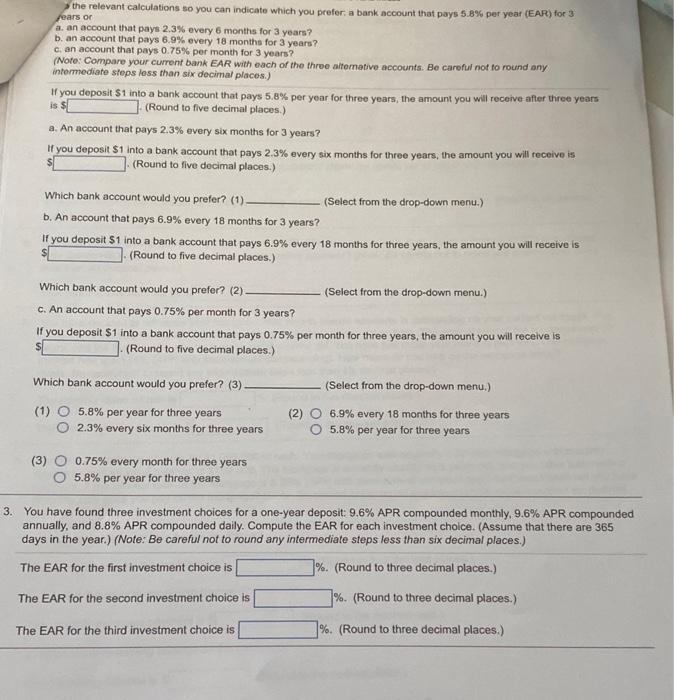

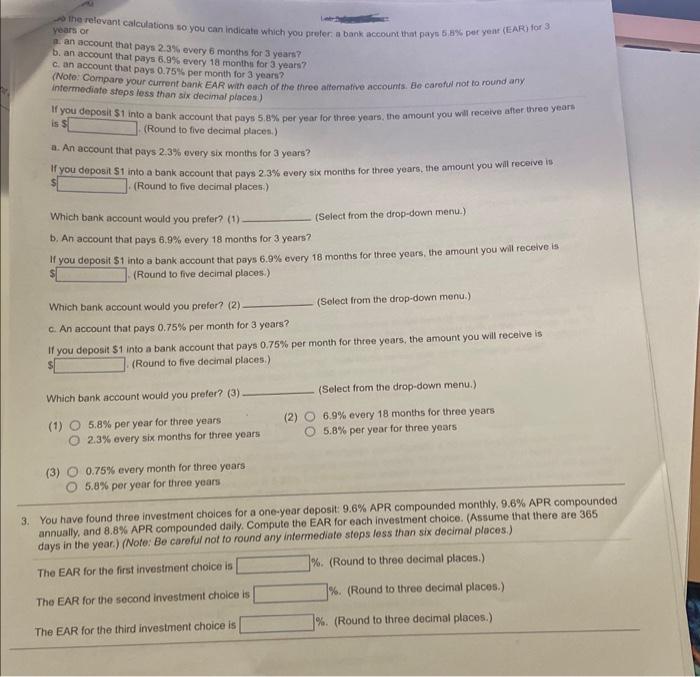

the relevant calculations so you can indicate which you prefer; a bank account that pays 5.8% per year (EAR) for 3 . fears or a. an account that pays 2.3% every 6 months for 3 years? b. an account that pays 6.9% every 18 months for 3 years? c. an account that pays 0.75% per month for 3 years? (Noto: Compare your current bank EAR with each of the three altomative accounts. Be careful not to round any intermediate steps loss than six decimal places.) If you deposit $1 into a bank account that pays 5.8% per year for three years, the amount you will receive after three years is 5 (Round to five decimal places.) a. An account that pays 2.3% every six months for 3 years? If you deposit $1 into a bank account that pays 2.3% every six months for three years, the amount you will receive is (Round to five docimal places.) Which bank account would you prefer? (1) (Select from the drop-down menu.) b. An account that pays 6.9% every 18 months for 3 years? If you deposit 51 into a bank account that pays 6.9% every 18 months for three years, the amount you will receive is $ (Round to five decimal places.) Which bank account would you prefer? (2) (Select from the drop-down menu.) c. An account that pays 0.75% per month for 3 years? If you deposit $1 into a bank account that pays 0.75% per month for three years, the amount you will receive is 5 (Round to five decimal places.) Which bank account would you prefer? (3) (Select from the drop-down menu,) (1) 5.8% per year for three years 2.3% every six months for three years (2) 6.9% every 18 months for three years 5.8% per year for three years (3) 0.75% every month for three years 5.8% per year for three years You have found three investment choices for a one-year deposit: 9.6% APR compounded monthly, 9.6% APR compounded annually, and 8.8% APR compounded daily. Compute the EAR for each investment choice. (Assume that there are 365 days in the year.) (Note: Be careful not to round any intermediate steps less than six decimal places.) The EAR for the first investment choice is \%. (Round to three decimal places.) The EAR for the second investment choice is \%. (Round to three decimal places.) The EAR for the third investment choice is \%. (Round to three decimal places.) years of 2. an account that pays 2.3% every 6 months for 3 years? b. an account that pays 6.9% every 18 monthin for 3 years? c. an account that pays 0.75% per month for 3 yearn? (Noto: Compare your current bank EAR with each of the three aitemative accounts. Be caroful not to round any intermodiafe steps fess than six decimal places) If you deposit Si inito a bank account that pays 5.8% per year for three years, the amount you will recoive after three years is 3 (Round to tive decimal places.) a. An account that pays 2.3\% every six months for 3 years? If you debosit St into a bank account that pays 2.3% every six months for three years, the amount you will receive is (Round to five decimal places,) Which bank account would you prefer? (1) (Select from the drop-down menu.) b. An account that pays 6.9% every 18 months for 3 years? If vou dedosit $1 into a bank account that pays 6.9% overy 18 months for three years, the amount you will recetve is (Round to five decimal places.) Which bank account would you prefor? (2) (Select from the drop-down menu.) c. An account that pays 0.75% per month for 3 years? If vou deposit $1 into a bank account that pays 0.75% per mont for three years, the amount you will receive is (Round to five decimal places.) (3) (Select from the drop-down menu.) Which bank account would you prefer? (3) (1) 5.8% per year for three years 2.3% every six months for three years (2) 6.9% every 18 months for three years 5.8% per year for three years 0.75% every month for three years 5.8% per year for three years You have found three investment choices for a one-year deposit. 9.6% APR compounded monthly, 9.6% APR compounded annually, and 8.8\% APR compounded daily. Compute the EAR for each investment choice. (Assume that there are 365 days in the year.) (Note: Be caroful not to round any intermediate steps less than six decimal places.) The EAR for the first investment choice is \%. (Round to three decimal places.) The EAR for the second investment choice is \%. (Round to three decimal places.) The EAR for the third investment choice is \%. (Round to three decimal places.)