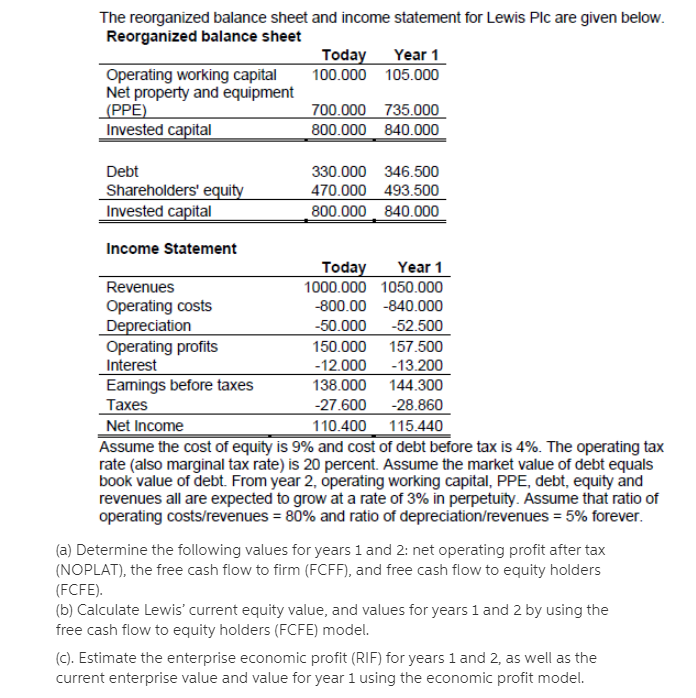

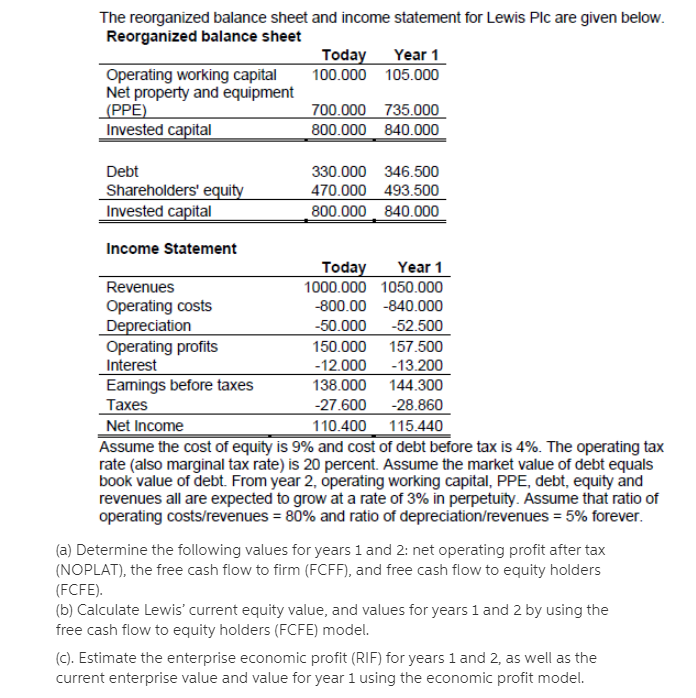

The reorganized balance sheet and income statement for Lewis Plc are given below. Reorganized balance sheet Today Year 1 Operating working capital 100.000 105.000 Net property and equipment (PPE) 700.000 735.000 Invested capital 800.000 840.000 Debt Shareholders' equity Invested capital 330.000 346,500 470.000 493.500 800.000 840.000 Income Statement Today Year 1 Revenues 1000.000 1050.000 Operating costs -800.00 -840.000 Depreciation -50.000 -52.500 Operating profits 150.000 157.500 Interest -12.000 -13.200 Eamings before taxes 138.000 144.300 Taxes -27.600 -28.860 Net Income 110.400 115.440 Assume the cost of equity is 9% and cost of debt before tax is 4%. The operating tax rate (also marginal tax rate) is 20 percent. Assume the market value of debt equals book value of debt. From year 2, operating working capital, PPE, debt, equity and revenues all are expected to grow at a rate of 3% in perpetuity. Assume that ratio of operating costs/revenues = 80% and ratio of depreciation/revenues = 5% forever. (a) Determine the following values for years 1 and 2: net operating profit after tax (NOPLAT), the free cash flow to firm (FCFF), and free cash flow to equity holders (FCFE). (b) Calculate Lewis' current equity value, and values for years 1 and 2 by using the free cash flow to equity holders (FCFE) model. (C). Estimate the enterprise economic profit (RIF) for years 1 and 2, as well as the current enterprise value and value for year 1 using the economic profit model. The reorganized balance sheet and income statement for Lewis Plc are given below. Reorganized balance sheet Today Year 1 Operating working capital 100.000 105.000 Net property and equipment (PPE) 700.000 735.000 Invested capital 800.000 840.000 Debt Shareholders' equity Invested capital 330.000 346,500 470.000 493.500 800.000 840.000 Income Statement Today Year 1 Revenues 1000.000 1050.000 Operating costs -800.00 -840.000 Depreciation -50.000 -52.500 Operating profits 150.000 157.500 Interest -12.000 -13.200 Eamings before taxes 138.000 144.300 Taxes -27.600 -28.860 Net Income 110.400 115.440 Assume the cost of equity is 9% and cost of debt before tax is 4%. The operating tax rate (also marginal tax rate) is 20 percent. Assume the market value of debt equals book value of debt. From year 2, operating working capital, PPE, debt, equity and revenues all are expected to grow at a rate of 3% in perpetuity. Assume that ratio of operating costs/revenues = 80% and ratio of depreciation/revenues = 5% forever. (a) Determine the following values for years 1 and 2: net operating profit after tax (NOPLAT), the free cash flow to firm (FCFF), and free cash flow to equity holders (FCFE). (b) Calculate Lewis' current equity value, and values for years 1 and 2 by using the free cash flow to equity holders (FCFE) model. (C). Estimate the enterprise economic profit (RIF) for years 1 and 2, as well as the current enterprise value and value for year 1 using the economic profit model