Question

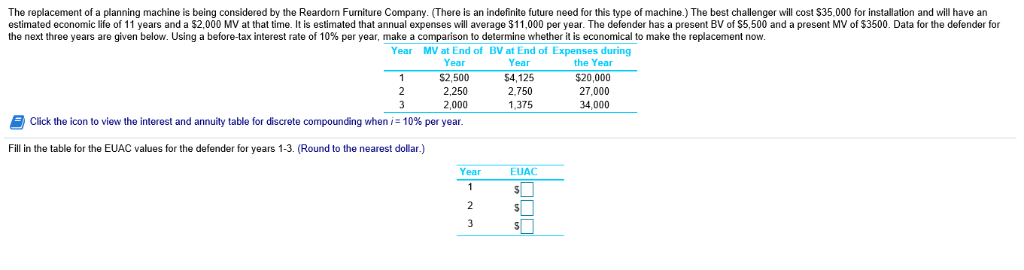

The replacement of a planning machine is being considered by the Reardorn Furniture Company. (There is an indefinite future need for this type of machine.)

The replacement of a planning machine is being considered by the Reardorn Furniture Company. (There is an indefinite future need for this type of machine.) The best challenger will cost

$35 comma 00035,000

for installation and will have an estimated economic life of

1111

years and a

$2 comma 0002,000

MV at that time. It is estimated that annual expenses will average

$11 comma 00011,000

per year. The defender has a present BV of

$5 comma 5005,500

and a present MV of

$35003500.

Data for the defender for the next three years are given below. Using a before-tax interest rate of

1010%

per year, make a comparison to determine whether it is economical to make the replacement now.

| Year | MV at End of Year | BV at End of Year | Expenses during the Year |

| 1 | $2 comma 5002,500 | $4 comma 1254,125 | $20 comma 00020,000 |

| 2 | 2 comma 2502,250 | 2 comma 7502,750 | 27 comma 00027,000 |

| 3 | 2 comma 0002,000 | 1 comma 3751,375 | 34 comma 00034,000 |

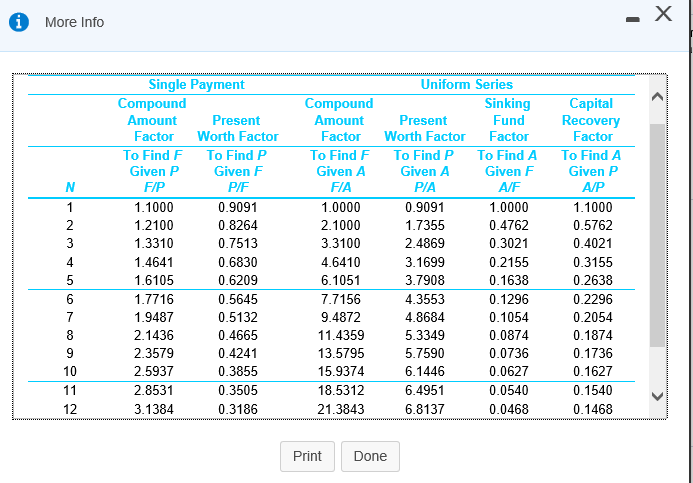

Click the icon to view the interest and annuity table for discrete compounding when

iequals=1010%

per year.

Fill in the table for the EUAC values for the defender for years 1-3. (Round to the nearest dollar.)

| Year | EUAC |

| 1 | $nothing |

| 2 | $nothing |

| 3 | $nothing |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started