Answered step by step

Verified Expert Solution

Question

1 Approved Answer

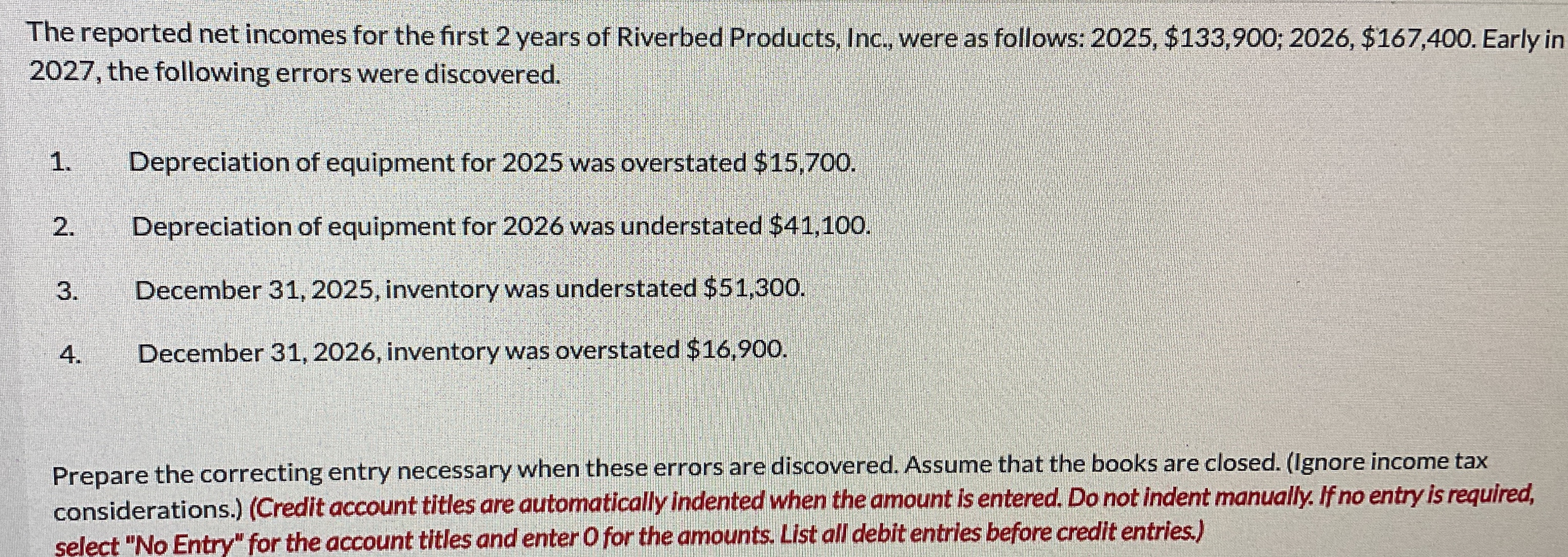

The reported net incomes for the first 2 years of Riverbed Products, Inc., were as follows: 2 0 2 5 , $ 1 3 3

The reported net incomes for the first years of Riverbed Products, Inc., were as follows: $;$ Early in the following errors were discovered.

Depreciation of equipment for was overstated $

Depreciation of equipment for was understated $

December inventory was understated $

December inventory was overstated $

Prepare the correcting entry necessary when these errors are discovered. Assume that the books are closed. Ignore income tax considerations.Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started