Answered step by step

Verified Expert Solution

Question

1 Approved Answer

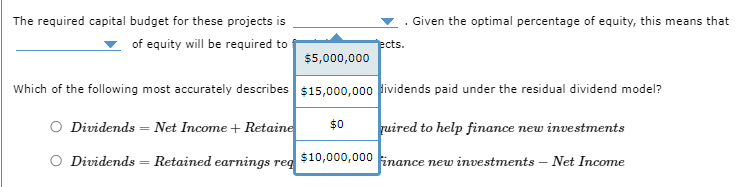

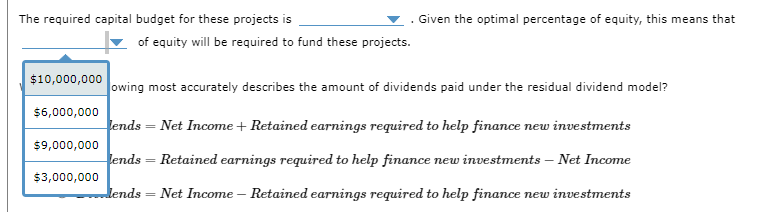

The required capital budget for these projects is . Given the optimal percentage of equity, this means that of equity will be required to fund

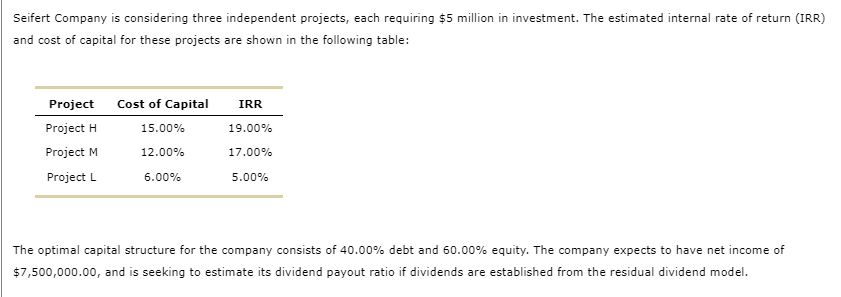

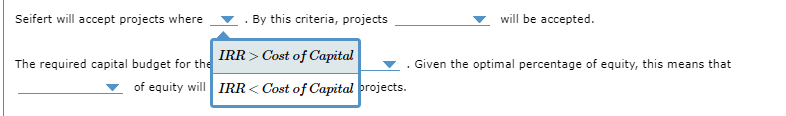

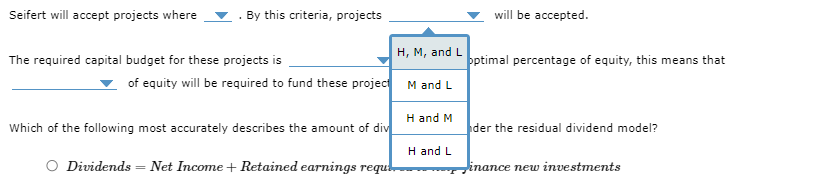

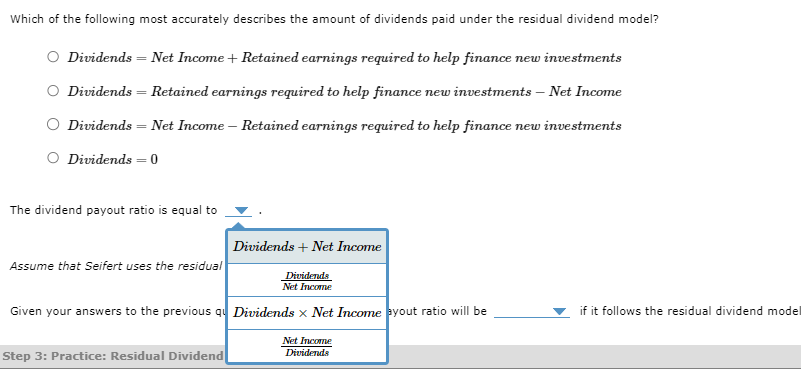

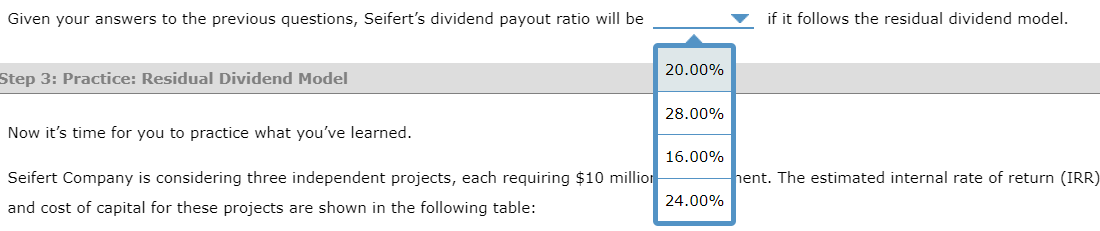

The required capital budget for these projects is . Given the optimal percentage of equity, this means that of equity will be required to fund these projects. \begin{tabular}{|l|l} $10,000,000 & owing most accurately describes the amount of dividends paid under the residual dividend model? \\ $6,000,000 & ends = Net Income + Retained earnings required to help finance new investments \\ $9,000,000 & ends = Retained earnings required to help finance new investments - Net Income \\ $3,000,000 & lends = Net Income - Retained earnings required to help finance new investments \end{tabular} The required capital budget for these projects is . Given the optimal percentage of equity, this means that Seifert will accept projects where Therequiredcapitalbudgetfortheseprojectsisofequitywillberequiredtofundtheseproject Which of the following most accurately describes the amount of div Dividends = Net Income + Retained earnings requ Given your answers to the previous questions, Seifert's dividend payout ratio will be if it follows the residual dividend model. Step 3: Practice: Residual Dividend Model Now it's time for you to practice what you've learned. Seifert Company is considering three independent projects, each requiring $10 milliol hent. The estimated internal rate of return (IRR) and cost of capital for these projects are shown in the following table: 24.00% Seifert will accept projects where . By this criteria, projects will be accepted. The required capital budget for the IRR > Cost of Capital . Given the optimal percentage of equity, this means that of equity will IRR

The required capital budget for these projects is . Given the optimal percentage of equity, this means that of equity will be required to fund these projects. \begin{tabular}{|l|l} $10,000,000 & owing most accurately describes the amount of dividends paid under the residual dividend model? \\ $6,000,000 & ends = Net Income + Retained earnings required to help finance new investments \\ $9,000,000 & ends = Retained earnings required to help finance new investments - Net Income \\ $3,000,000 & lends = Net Income - Retained earnings required to help finance new investments \end{tabular} The required capital budget for these projects is . Given the optimal percentage of equity, this means that Seifert will accept projects where Therequiredcapitalbudgetfortheseprojectsisofequitywillberequiredtofundtheseproject Which of the following most accurately describes the amount of div Dividends = Net Income + Retained earnings requ Given your answers to the previous questions, Seifert's dividend payout ratio will be if it follows the residual dividend model. Step 3: Practice: Residual Dividend Model Now it's time for you to practice what you've learned. Seifert Company is considering three independent projects, each requiring $10 milliol hent. The estimated internal rate of return (IRR) and cost of capital for these projects are shown in the following table: 24.00% Seifert will accept projects where . By this criteria, projects will be accepted. The required capital budget for the IRR > Cost of Capital . Given the optimal percentage of equity, this means that of equity will IRR Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started