Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The required elimination entry of the investment at 1/1/25 will include a credit to Investment in Spice in the amount of The required elimination entry

The required elimination entry of the investment at 1/1/25 will include a credit to Investment in Spice in the amount of

The required elimination entry of the investment will include a credit to establish the Noncontrolling Interest at 1/1/25 in the amount of

The required elimination entry of the investment will include an entry for the Retained Earnings of Spice at 1/1/25 in the amount of

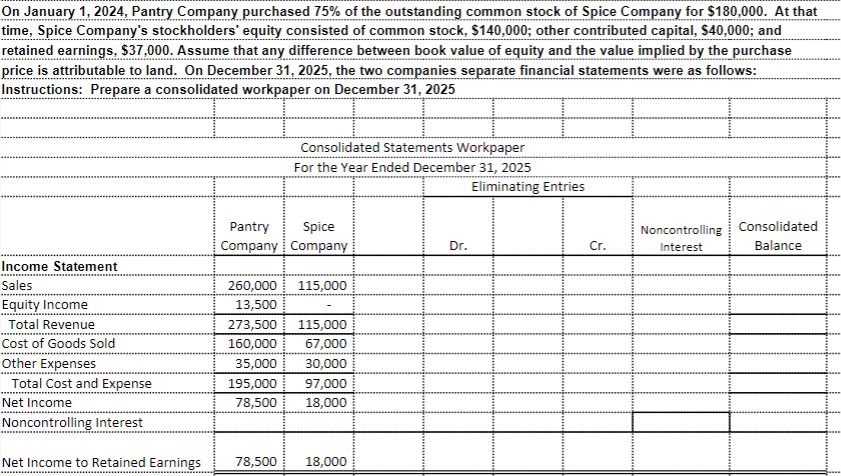

On January 1, 2024, Pantry Company purchased 75% of the outstanding common stock of Spice Company for $180,000. At that time, Spice Company's stockholders' equity consisted of common stock, $140,000; other contributed capital, $40,000; and retained earnings, $37,000. Assume that any difference between book value of equity and the value implied by the purchase price is attributable to land. On December 31,2025 , the two companies separate financial statements were as follows: Instructions: Prepare a consolidated workpaper on December 31, 2025 Consolidated Statements Workpaper For the Year Ended December 31, 2025 \begin{tabular}{|c|c|c|c|c|c|c|} \hline & \multirow[b]{2}{*}{\begin{tabular}{c} Pantry \\ Company \end{tabular}} & \multirow[b]{2}{*}{\begin{tabular}{l} Spice \\ Company \end{tabular}} & \multicolumn{2}{|c|}{ Eliminating Entries } & \multirow[b]{2}{*}{\begin{tabular}{c} Noncontrolling \\ Interest \end{tabular}} & \multirow[b]{2}{*}{\begin{tabular}{c} Consolidated \\ Balance \end{tabular}} \\ \hline & & & Dr. & Cr. & & \\ \hline \multicolumn{7}{|l|}{ Income Statement } \\ \hline Sales & 260,000 & 115,000 & & & & \\ \hline Equity Income & 13,500 & - & & & & \\ \hline Total Revenue & 273,500 & 115,000 & & & & \\ \hline Cost of Goods Sold & 160,000 & 67,000 & & & & \\ \hline Other Expenses & 35,000 & 30,000 & & & & \\ \hline Total Cost and Expense & 195,000 & 97,000 & & & & \\ \hline Net Income & 78,500 & 18,000 & & & & \\ \hline \multicolumn{7}{|l|}{ Noncontrolling Interest } \\ \hline Net Income to Retained Earnings & 78,500 & 18,000 & & & & \\ \hline \end{tabular} On January 1, 2024, Pantry Company purchased 75% of the outstanding common stock of Spice Company for $180,000. At that time, Spice Company's stockholders' equity consisted of common stock, $140,000; other contributed capital, $40,000; and retained earnings, $37,000. Assume that any difference between book value of equity and the value implied by the purchase price is attributable to land. On December 31,2025 , the two companies separate financial statements were as follows: Instructions: Prepare a consolidated workpaper on December 31, 2025 Consolidated Statements Workpaper For the Year Ended December 31, 2025 \begin{tabular}{|c|c|c|c|c|c|c|} \hline & \multirow[b]{2}{*}{\begin{tabular}{c} Pantry \\ Company \end{tabular}} & \multirow[b]{2}{*}{\begin{tabular}{l} Spice \\ Company \end{tabular}} & \multicolumn{2}{|c|}{ Eliminating Entries } & \multirow[b]{2}{*}{\begin{tabular}{c} Noncontrolling \\ Interest \end{tabular}} & \multirow[b]{2}{*}{\begin{tabular}{c} Consolidated \\ Balance \end{tabular}} \\ \hline & & & Dr. & Cr. & & \\ \hline \multicolumn{7}{|l|}{ Income Statement } \\ \hline Sales & 260,000 & 115,000 & & & & \\ \hline Equity Income & 13,500 & - & & & & \\ \hline Total Revenue & 273,500 & 115,000 & & & & \\ \hline Cost of Goods Sold & 160,000 & 67,000 & & & & \\ \hline Other Expenses & 35,000 & 30,000 & & & & \\ \hline Total Cost and Expense & 195,000 & 97,000 & & & & \\ \hline Net Income & 78,500 & 18,000 & & & & \\ \hline \multicolumn{7}{|l|}{ Noncontrolling Interest } \\ \hline Net Income to Retained Earnings & 78,500 & 18,000 & & & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started