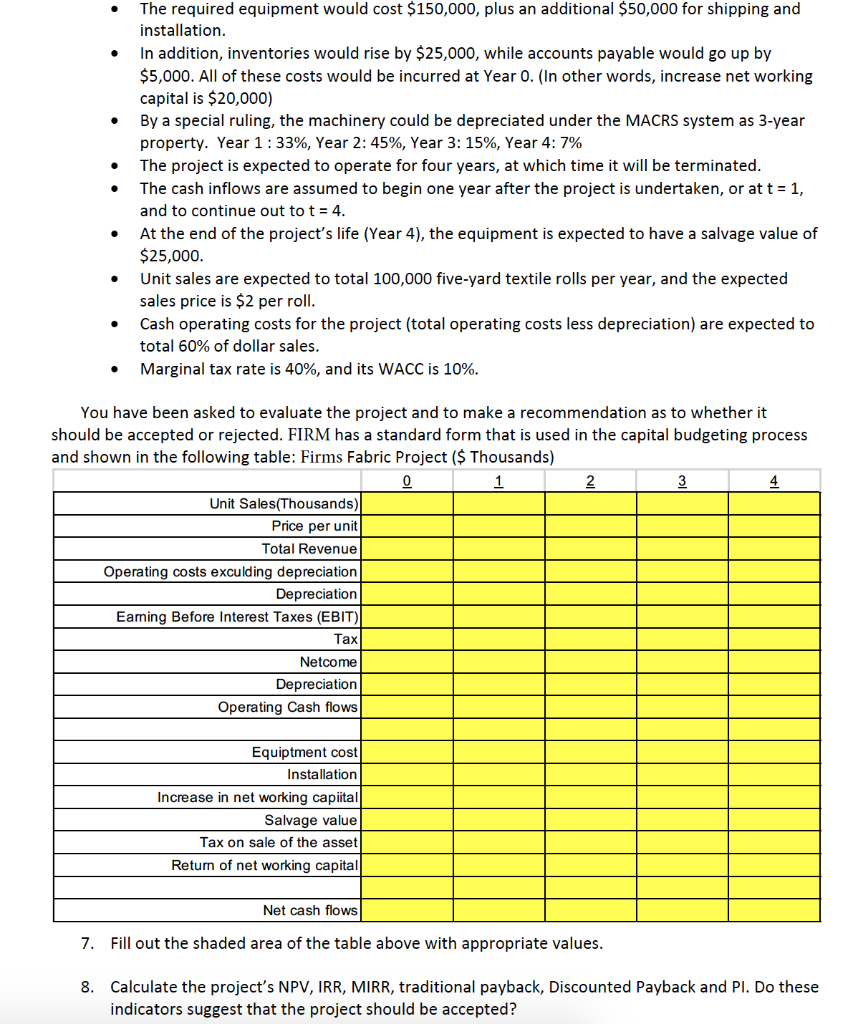

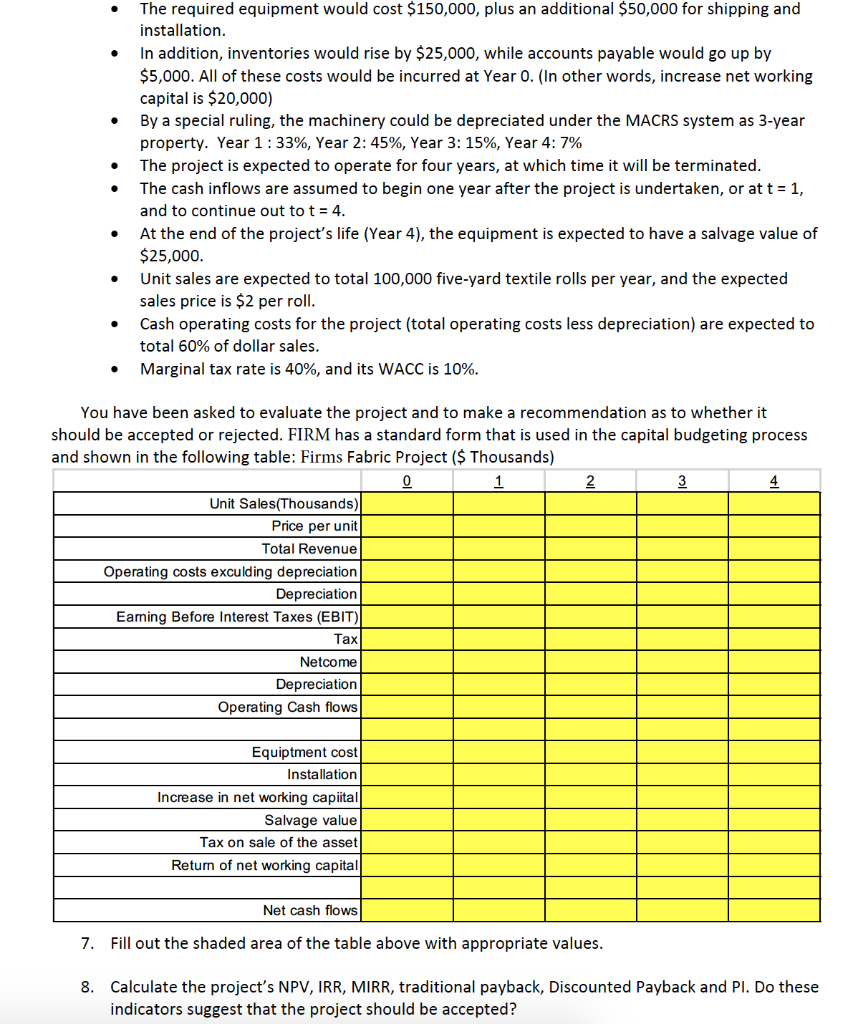

The required equipment would cost $150,000, plus an additional $50,000 for shipping and installation. In addition, inventories would rise by $25,000, while accounts payable would go up by $5,000. All of these costs would be incurred at Year 0. (In other words, increase net working capital is $20,000) By a special ruling, the machinery could be depreciated under the MACRS system as 3-year property. Year 1:33%, Year 2: 45%, Year 3: 15%, Year 4: 7% The project is expected to operate for four years, at which time it will be terminated. The cash inflows are assumed to begin one year after the project is undertaken, or at t = 1, and to continue out to t = 4. At the end of the project's life (Year 4), the equipment is expected to have a salvage value of $25,000. Unit sales are expected to total 100,000 five-yard textile rolls per year, and the expected sales price is $2 per roll. Cash operating costs for the project (total operating costs less depreciation) are expected to total 60% of dollar sales. Marginal tax rate is 40%, and its WACC is 10%. You have been asked to evaluate the project and to make a recommendation as to whether it should be accepted or rejected. FIRM has a standard form that is used in the capital budgeting process and shown in the following table: Firms Fabric Project ($ Thousands) 0 1 23 2 Unit Sales(Thousands) Price per unit Total Revenue Operating costs exculding depreciation Depreciation Earning Before Interest Taxes (EBIT) Tax Netcome Depreciation Operating Cash flows Equipment cost Installation Increase in net working capital Salvage value Tax on sale of the asset Return of net working capital Net cash flows 7. Fill out the shaded area of the table above with appropriate values. 8. Calculate the project's NPV, IRR, MIRR, traditional payback, Discounted Payback and Pl. Do these indicators suggest that the project should be accepted? The required equipment would cost $150,000, plus an additional $50,000 for shipping and installation. In addition, inventories would rise by $25,000, while accounts payable would go up by $5,000. All of these costs would be incurred at Year 0. (In other words, increase net working capital is $20,000) By a special ruling, the machinery could be depreciated under the MACRS system as 3-year property. Year 1:33%, Year 2: 45%, Year 3: 15%, Year 4: 7% The project is expected to operate for four years, at which time it will be terminated. The cash inflows are assumed to begin one year after the project is undertaken, or at t = 1, and to continue out to t = 4. At the end of the project's life (Year 4), the equipment is expected to have a salvage value of $25,000. Unit sales are expected to total 100,000 five-yard textile rolls per year, and the expected sales price is $2 per roll. Cash operating costs for the project (total operating costs less depreciation) are expected to total 60% of dollar sales. Marginal tax rate is 40%, and its WACC is 10%. You have been asked to evaluate the project and to make a recommendation as to whether it should be accepted or rejected. FIRM has a standard form that is used in the capital budgeting process and shown in the following table: Firms Fabric Project ($ Thousands) 0 1 23 2 Unit Sales(Thousands) Price per unit Total Revenue Operating costs exculding depreciation Depreciation Earning Before Interest Taxes (EBIT) Tax Netcome Depreciation Operating Cash flows Equipment cost Installation Increase in net working capital Salvage value Tax on sale of the asset Return of net working capital Net cash flows 7. Fill out the shaded area of the table above with appropriate values. 8. Calculate the project's NPV, IRR, MIRR, traditional payback, Discounted Payback and Pl. Do these indicators suggest that the project should be accepted