Answered step by step

Verified Expert Solution

Question

1 Approved Answer

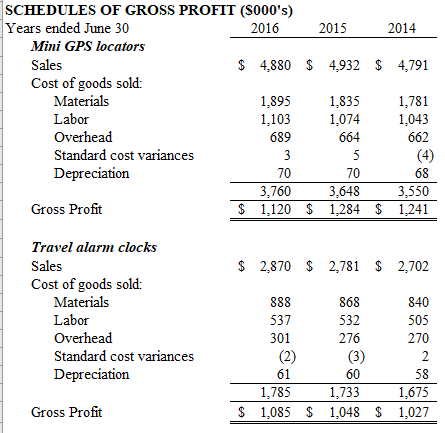

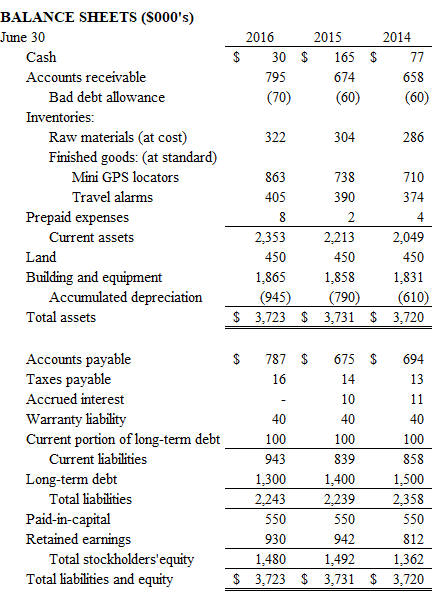

The requirment is Accounts receivable Inventory Interest expenses legal expense Please make it simple and clear to the point thank you Divergent Company 1 It

The requirment is

Accounts receivable

Inventory

Interest expenses

legal expense

Please make it simple and clear to the point

thank you

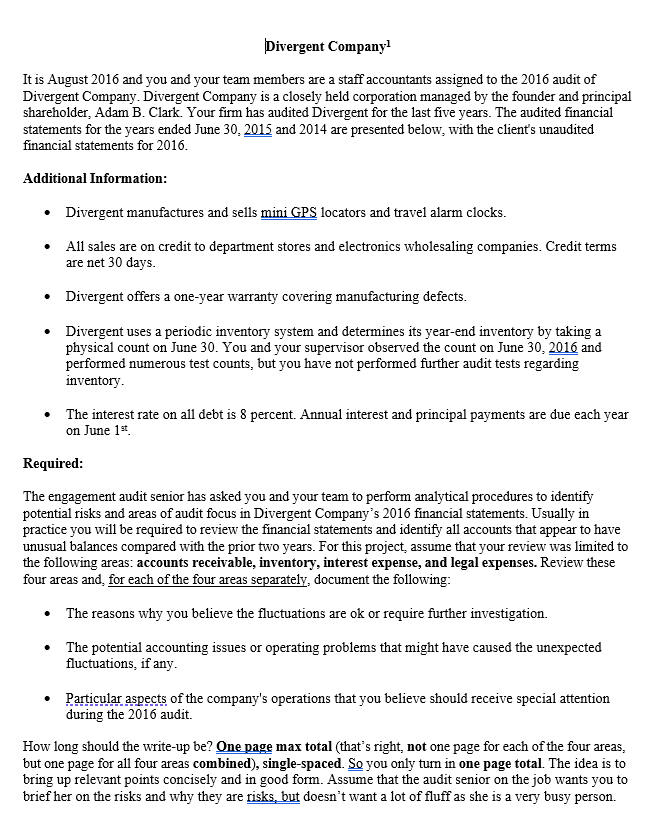

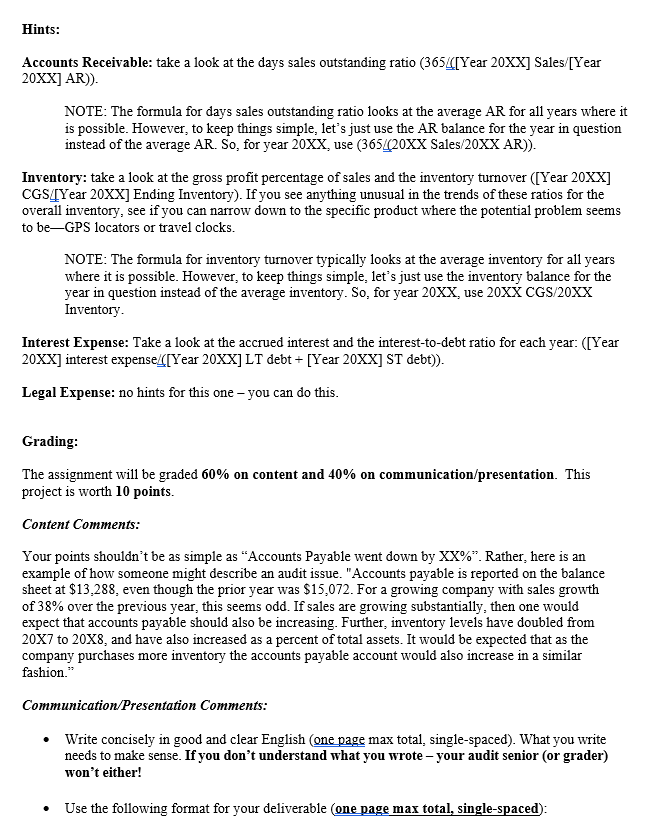

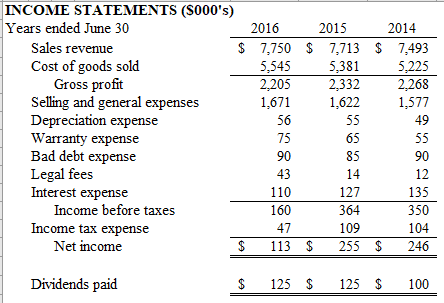

Divergent Company 1 It is August 2016 and you and your team members are a staff accountants assigned to the 2016 audit of Divergent Company. Divergent Company is a closely held corporation managed by the founder and principal shareholder, Adam B. Clark. Your firm has audited Divergent for the last five years. The audited financial statements for the years ended June 30,2015 and 2014 are presented below, with the client's unaudited financial statements for 2016 Additional Information: - Divergent manufactures and sells mini GPS locators and travel alarm clocks. - All sales are on credit to department stores and electronics wholesaling companies. Credit terms are net 30 days. - Divergent offers a one-year warranty covering manufacturing defects. - Divergent uses a periodic inventory system and determines its year-end inventory by taking a physical count on June 30 . You and your supervisor observed the count on June 30,2016 and performed numerous test counts, but you have not performed further audit tests regarding inventory. - The interest rate on all debt is 8 percent. Annual interest and principal payments are due each year on June 1st. Required: The engagement audit senior has asked you and your team to perform analytical procedures to identify potential risks and areas of audit focus in Divergent Company's 2016 financial statements. Usually in practice you will be required to review the financial statements and identify all accounts that appear to have unusual balances compared with the prior two years. For this project, assume that your review was limited to the following areas: accounts receivable, inventory, interest expense, and legal expenses. Review these four areas and, for each of the four areas separately, document the following: - The reasons why you believe the fluctuations are ok or require further investigation. - The potential accounting issues or operating problems that might have caused the unexpected fluctuations, if any. - Particular aspects of the company's operations that you believe should receive special attention during the 2016 audit. How long should the write-up be? One page max total (that's right, not one page for each of the four areas, but one page for all four areas combined), single-spaced. So you only turn in one page total. The idea is to bring up relevant points concisely and in good form. Assume that the audit senior on the job wants you to brief her on the risks and why they are risks, but doesn't want a lot of fluff as she is a very busy person. Hints: Accounts Receivable: take a look at the days sales outstanding ratio (365 \( \[ \) Year 20XX] Sales/[Year 20XX] AR)). NOTE: The formula for days sales outstanding ratio looks at the average AR for all years where it is possible. However, to keep things simple, let's just use the AR balance for the year in question instead of the average AR. So, for year 20XX, use (365 (20XX Sales/20XX AR)). Inventory: take a look at the gross profit percentage of sales and the inventory turnover ([Year 20XX] CGS [Year 20XX ] Ending Inventory). If you see anything unusual in the trends of these ratios for the overall inventory, see if you can narrow down to the specific product where the potential problem seems to be-GPS locators or travel clocks. NOTE: The formula for inventory turnover typically looks at the average inventory for all years where it is possible. However, to keep things simple, let's just use the inventory balance for the year in question instead of the average inventory. So, for year 20XX, use 20XX CGS/20XX Inventory. Interest Expense: Take a look at the accrued interest and the interest-to-debt ratio for each year: ([Year 20XX] interest expense/( [ Year 20XX] LT debt + [Year 20XX] ST debt)). Legal Expense: no hints for this one - you can do this. Grading: The assignment will be graded 60% on content and 40% on communication/presentation. This project is worth 10 points. Content Comments: Your points shouldn't be as simple as "Accounts Payable went down by XX\%". Rather, here is an example of how someone might describe an audit issue. "Accounts payable is reported on the balance sheet at $13,288, even though the prior year was $15,072. For a growing company with sales growth of 38% over the previous year, this seems odd. If sales are growing substantially, then one would expect that accounts payable should also be increasing. Further, inventory levels have doubled from 20X7 to 20X8, and have also increased as a percent of total assets. It would be expected that as the company purchases more inventory the accounts payable account would also increase in a similar fashion." Communication/Presentation Comments: - Write concisely in good and clear English (one page max total, single-spaced). What you write needs to make sense. If you don't understand what you wrote - your audit senior (or grader) won't either! - Use the following format for your deliverable (one page max total, single-spaced): [Your team members' names with ASU email addresses] [Date] Accounts Receivable [Text] Inventory [Text] INCOME STATEMENTS (S000's) SCHEDULES OF GROSS PROFIT (S000's) Travel alarm clocks B Divergent Company 1 It is August 2016 and you and your team members are a staff accountants assigned to the 2016 audit of Divergent Company. Divergent Company is a closely held corporation managed by the founder and principal shareholder, Adam B. Clark. Your firm has audited Divergent for the last five years. The audited financial statements for the years ended June 30,2015 and 2014 are presented below, with the client's unaudited financial statements for 2016 Additional Information: - Divergent manufactures and sells mini GPS locators and travel alarm clocks. - All sales are on credit to department stores and electronics wholesaling companies. Credit terms are net 30 days. - Divergent offers a one-year warranty covering manufacturing defects. - Divergent uses a periodic inventory system and determines its year-end inventory by taking a physical count on June 30 . You and your supervisor observed the count on June 30,2016 and performed numerous test counts, but you have not performed further audit tests regarding inventory. - The interest rate on all debt is 8 percent. Annual interest and principal payments are due each year on June 1st. Required: The engagement audit senior has asked you and your team to perform analytical procedures to identify potential risks and areas of audit focus in Divergent Company's 2016 financial statements. Usually in practice you will be required to review the financial statements and identify all accounts that appear to have unusual balances compared with the prior two years. For this project, assume that your review was limited to the following areas: accounts receivable, inventory, interest expense, and legal expenses. Review these four areas and, for each of the four areas separately, document the following: - The reasons why you believe the fluctuations are ok or require further investigation. - The potential accounting issues or operating problems that might have caused the unexpected fluctuations, if any. - Particular aspects of the company's operations that you believe should receive special attention during the 2016 audit. How long should the write-up be? One page max total (that's right, not one page for each of the four areas, but one page for all four areas combined), single-spaced. So you only turn in one page total. The idea is to bring up relevant points concisely and in good form. Assume that the audit senior on the job wants you to brief her on the risks and why they are risks, but doesn't want a lot of fluff as she is a very busy person. Hints: Accounts Receivable: take a look at the days sales outstanding ratio (365 \( \[ \) Year 20XX] Sales/[Year 20XX] AR)). NOTE: The formula for days sales outstanding ratio looks at the average AR for all years where it is possible. However, to keep things simple, let's just use the AR balance for the year in question instead of the average AR. So, for year 20XX, use (365 (20XX Sales/20XX AR)). Inventory: take a look at the gross profit percentage of sales and the inventory turnover ([Year 20XX] CGS [Year 20XX ] Ending Inventory). If you see anything unusual in the trends of these ratios for the overall inventory, see if you can narrow down to the specific product where the potential problem seems to be-GPS locators or travel clocks. NOTE: The formula for inventory turnover typically looks at the average inventory for all years where it is possible. However, to keep things simple, let's just use the inventory balance for the year in question instead of the average inventory. So, for year 20XX, use 20XX CGS/20XX Inventory. Interest Expense: Take a look at the accrued interest and the interest-to-debt ratio for each year: ([Year 20XX] interest expense/( [ Year 20XX] LT debt + [Year 20XX] ST debt)). Legal Expense: no hints for this one - you can do this. Grading: The assignment will be graded 60% on content and 40% on communication/presentation. This project is worth 10 points. Content Comments: Your points shouldn't be as simple as "Accounts Payable went down by XX\%". Rather, here is an example of how someone might describe an audit issue. "Accounts payable is reported on the balance sheet at $13,288, even though the prior year was $15,072. For a growing company with sales growth of 38% over the previous year, this seems odd. If sales are growing substantially, then one would expect that accounts payable should also be increasing. Further, inventory levels have doubled from 20X7 to 20X8, and have also increased as a percent of total assets. It would be expected that as the company purchases more inventory the accounts payable account would also increase in a similar fashion." Communication/Presentation Comments: - Write concisely in good and clear English (one page max total, single-spaced). What you write needs to make sense. If you don't understand what you wrote - your audit senior (or grader) won't either! - Use the following format for your deliverable (one page max total, single-spaced): [Your team members' names with ASU email addresses] [Date] Accounts Receivable [Text] Inventory [Text] INCOME STATEMENTS (S000's) SCHEDULES OF GROSS PROFIT (S000's) Travel alarm clocks BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started