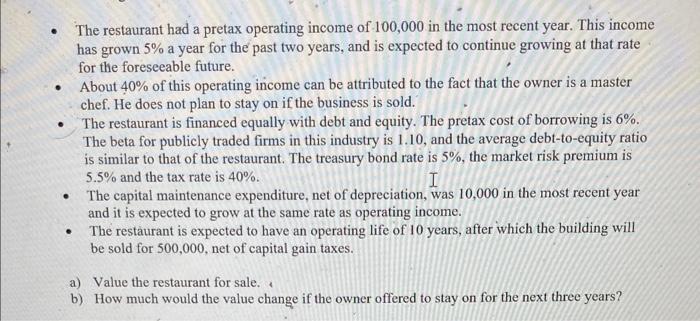

The restaurant had a pretax operating income of 100,000 in the most recent year. This income has grown 5% a year for the past two years, and is expected to continue growing at that rate for the foreseeable future. About 40% of this operating income can be attributed to the fact that the owner is a master chef. He does not plan to stay on if the business is sold. The restaurant is financed equally with debt and equity. The pretax cost of borrowing is 6%. The beta for publicly traded firms in this industry is 1.10, and the average debt-to-equity ratio is similar to that of the restaurant. The treasury bond rate is 5%, the market risk premium is 5.5% and the tax rate is 40%. I The capital maintenance expenditure, net of depreciation, was 10,000 in the most recent year and it is expected to grow at the same rate as operating income. The restaurant is expected to have an operating life of 10 years, after which the building will be sold for 500,000, net of capital gain taxes. a) Value the restaurant for sale. b) How much would the value change if the owner offered to stay on for the next three years? The restaurant had a pretax operating income of 100,000 in the most recent year. This income has grown 5% a year for the past two years, and is expected to continue growing at that rate for the foreseeable future. About 40% of this operating income can be attributed to the fact that the owner is a master chef. He does not plan to stay on if the business is sold. The restaurant is financed equally with debt and equity. The pretax cost of borrowing is 6%. The beta for publicly traded firms in this industry is 1.10, and the average debt-to-equity ratio is similar to that of the restaurant. The treasury bond rate is 5%, the market risk premium is 5.5% and the tax rate is 40%. I The capital maintenance expenditure, net of depreciation, was 10,000 in the most recent year and it is expected to grow at the same rate as operating income. The restaurant is expected to have an operating life of 10 years, after which the building will be sold for 500,000, net of capital gain taxes. a) Value the restaurant for sale. b) How much would the value change if the owner offered to stay on for the next three years