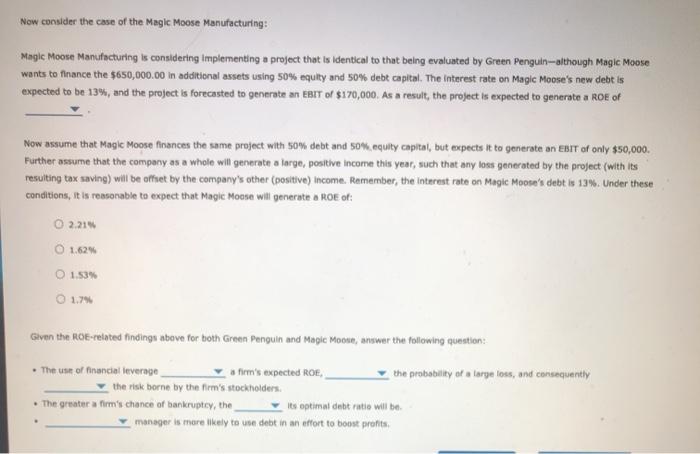

The resulting ROE will be: 6.48%; 4.59%; 5.40%; 4.32%

generate a ROE of: 27.52%; 20.64%; 19.26%; 30.27%

financial leverage: decreases; increases

expected ROE: increases; decreases

and consequently: increases; decreases

bankruptcy, the: lower;higher

An aggressive; A conservative: manager is more

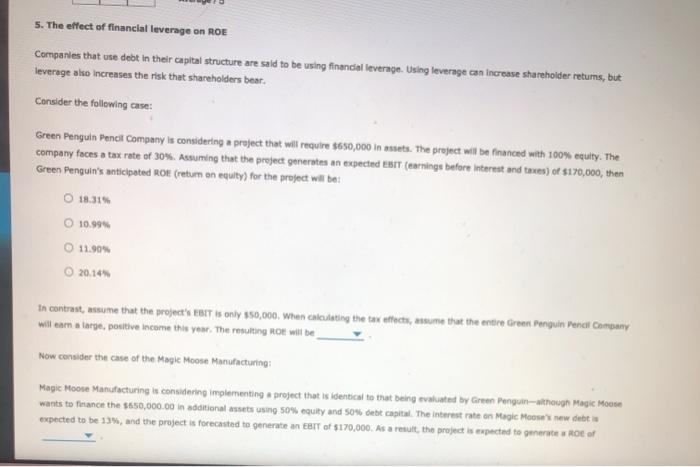

5. The effect of financial leverage on ROE Companies that use debt in their capital structure are said to be using financial leverage. Using leverage can increase shareholder returns, but leverage also increases the risk that shareholders bear. Consider the following case: Green Penguin Pencil Company is considering a project that will require $650,000 in assets. The project will be financed with 100% equity. The company faces a tax rate of 30%. Assuming that the project generates an expected EBIT (earnings before interest and trees) of $170,000, then Green Penguin's anticipated Rot (retum en equity) for the project will be: 18.315 10.995 11.90 20.14% In contrast, assume that the project's EBIT is only $50,000. When calculating the tax effects, assume that the entire Green Penguin Penal Company will com a large, positive Income this year. The resulting Hot will be Now consider the case of the Magic Moose Manufacturing Magic Moose Manufacturing is considering implementing a project that is identical to that being evaluated by Green Penguin-although Magie Mode wants to finance the $650,000.00 in additional sets using 50% equity and 50% debt capital. The interest rate on Magic Mooses news expected to be 13%, and the project is forecasted to generate an eart of $170,000. As a result, the project is expected to generate a Roof Now consider the case of the Magic Moose Manufacturing: Magic Moose Manufacturing is considering implementing a project that is identical to that belng evaluated by Green Penguin-although Magic Moose wants to finance, the $650,000.00 In additional assets using 50% equity and 50% debt capital. The interest rate on Magic Moose's new debt is expected to be 13%, and the project is forecasted to generate an EBIT of $170,000. As a result, the project is expected to generate a ROE of Now assume that Magic Moose finance the same project with 50% debt and 50% equity capital, but expects it to generate an EBIT of only $50,000. Further assume that the company as a whole will generate a large, positive Income this year, such that any loss generated by the project (with its resulting tax saving) will be offset by the company's other (positive) Income. Remember, the Interest rate on Magle Moose's debt is 13%. Under these conditions, it is reasonable to expect that Magie Mouse will generate a ROE of: 0 2.214 O 1.629 O 1.53% 1.79 Given the O-related findings above for both Green Penguin and Magic Moose, answer the following question: The use of financial leverage afirm's expected ROE the probability of a large loss, and consequently the risk borne by the firm's stockholders. The greater a firm's chance of bankruptcy, the its optimal debt ratio will be manager is more likely to use debt in an effort to boost profits