Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Return on bonds of varying risk (Answer All) 1st Part - already answered unless I have it wrong.. 2nd part - answer 3rd Part

The Return on bonds of varying risk (Answer All)

The Return on bonds of varying risk (Answer All)

1st Part - already answered unless I have it wrong.. 2nd part - answer 3rd Part - decrease or increase || risk exposure operational burden on National Gas Producers or Prospective Bond Holders' risk exposures 4th part - answer all multiple choice

Thanks in Advance.

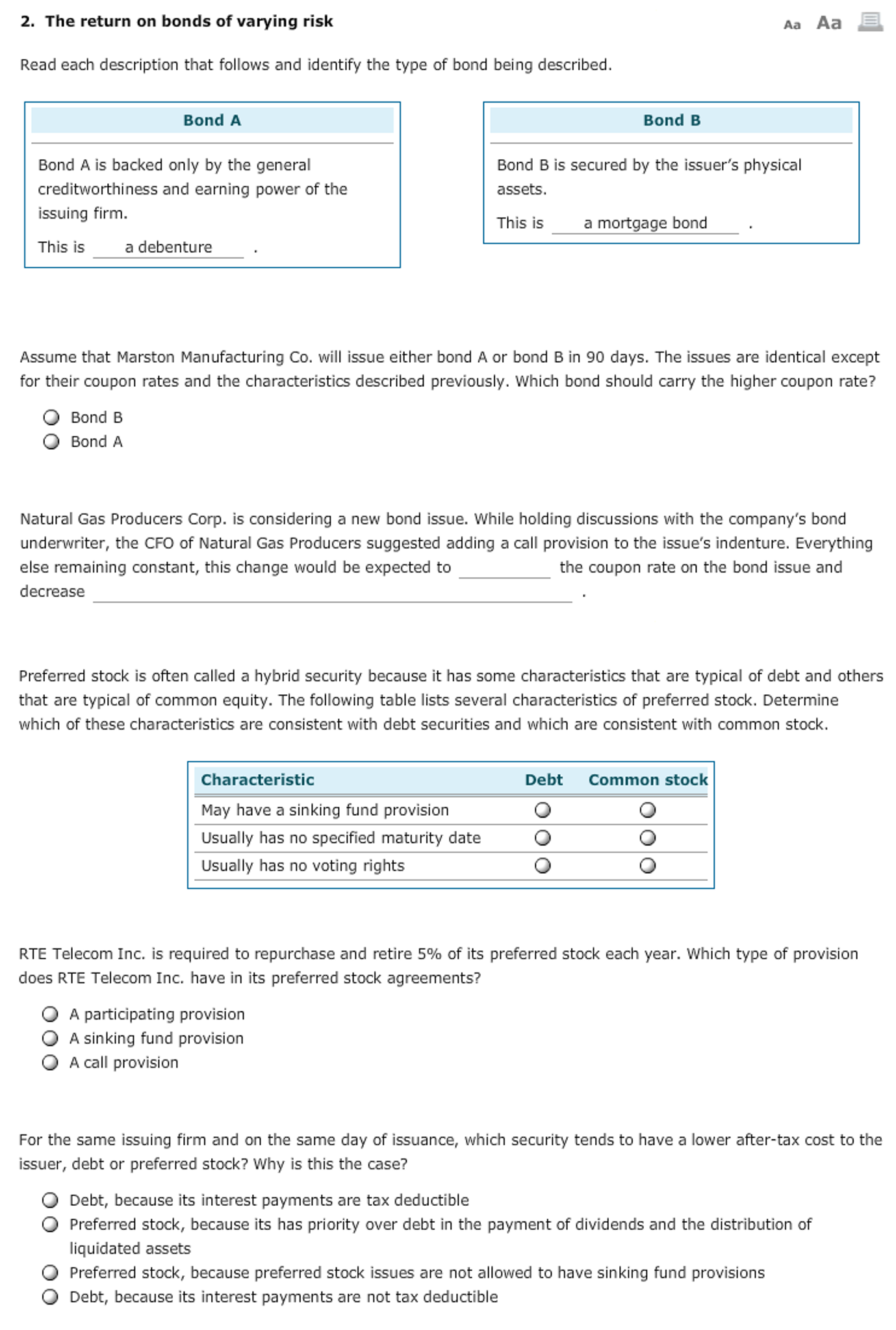

2. The return on bonds of varying risk Aa Aa Read each description that follows and identify the type of bond being described. Bond A Bond B Bond A is backed only by the general creditworthiness and earning power of the issuing firm. This is Bond B is secured by the issuer's physical assets This is a mortgage bond a debenture Assume that Marston Manufacturing Co. l issue either bond A or bond B in 90 days. The issues are identical except for their coupon rates and the characteristics described previously. Which bond should carry the higher coupon rate? Bond B Bond A Natural Gas Producers Corp. is considering a new bond issue. While holding discussions with the company's bond underwriter, the CFO of Natural Gas Producers suggested adding a call provision to the issue's indenture. Everything else remaining constant, this change would be expected to decrease the coupon rate on the bond issue and Preferred stock is often called a hybrid security because it has some characteristics that are typical of debt and others that are typical of common equity. The following table lists several characteristics of preferred stock. Determine which of these characteristics are consistent with debt securities and which are consistent with common stock. Characteristic May have a sinking fund provision Usually has no specified maturity date Usually has no voting rights Debt Common stock RTE Telecom Inc. is required to repurchase and retire 5% of its preferred stock each year. which type of provision does RTE Telecom Inc. have in its preferred stock agreements? A participating provision A sinking fund provision O A call provision For the same issuing firm and on the same day of issuance, which security tends to have a lower after-tax cost to the issuer, debt or preferred stock? Why is this the case? O Debt, because its interest payments are tax deductible O Preferred stock, because its has priority over debt in the payment of dividends and the distribution of liquidated assets O Preferred stock, because preferred stock issues are not allowed to have sinking fund provisions O Debt, because its interest payments are not tax deductible

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started