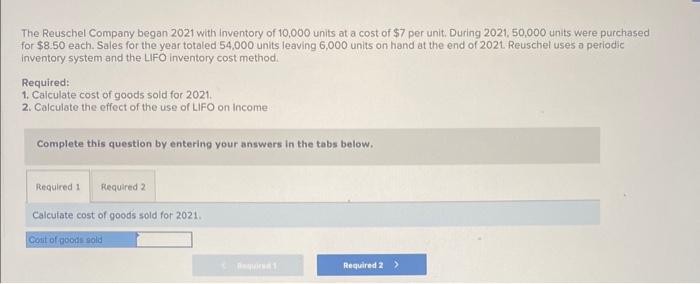

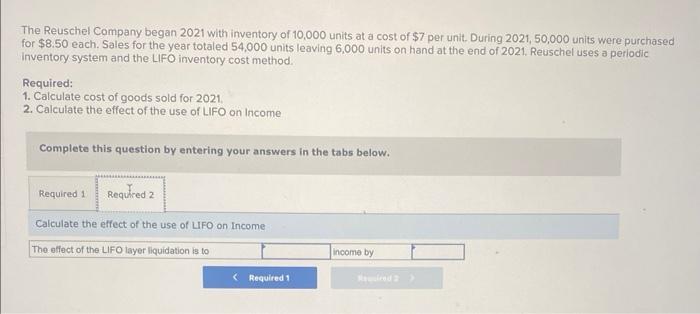

The Reuschel Company began 2021 with inventory of 10,000 units at a cost of $7 per unit, During 2021,50,000 units were purchased for $8.50 each. Sales for the year totaled 54,000 units leaving 6,000 units on hand at the end of 2021 . Reuschel uses a periodic inventory system and the LIFO inventory cost method. Required: 1. Calculate cost of goods sold for 2021 . 2. Calculate the effect of the use of LiFO on Income Complete this question by entering your answers in the tabs below. Calculate cost of goods sold for 2021 . The Reuschel Company began 2021 with inventory of 10,000 units at a cost of $7 per unit. During 2021,50,000 units were purchased for $8.50 each. Sales for the year totaled 54,000 units leaving 6,000 units on hand at the end of 2021 . Reuschel uses a periodic inventory system and the LIFO inventory cost method. Required: 1. Calculate cost of goods sold for 2021 . 2. Calculate the effect of the use of LIFO on income Complete this question by entering your answers in the tabs below. Calculate the effect of the use of LIFO on income The Reuschel Company began 2021 with inventory of 10,000 units at a cost of $7 per unit, During 2021,50,000 units were purchased for $8.50 each. Sales for the year totaled 54,000 units leaving 6,000 units on hand at the end of 2021 . Reuschel uses a periodic inventory system and the LIFO inventory cost method. Required: 1. Calculate cost of goods sold for 2021 . 2. Calculate the effect of the use of LiFO on Income Complete this question by entering your answers in the tabs below. Calculate cost of goods sold for 2021 . The Reuschel Company began 2021 with inventory of 10,000 units at a cost of $7 per unit. During 2021,50,000 units were purchased for $8.50 each. Sales for the year totaled 54,000 units leaving 6,000 units on hand at the end of 2021 . Reuschel uses a periodic inventory system and the LIFO inventory cost method. Required: 1. Calculate cost of goods sold for 2021 . 2. Calculate the effect of the use of LIFO on income Complete this question by entering your answers in the tabs below. Calculate the effect of the use of LIFO on income