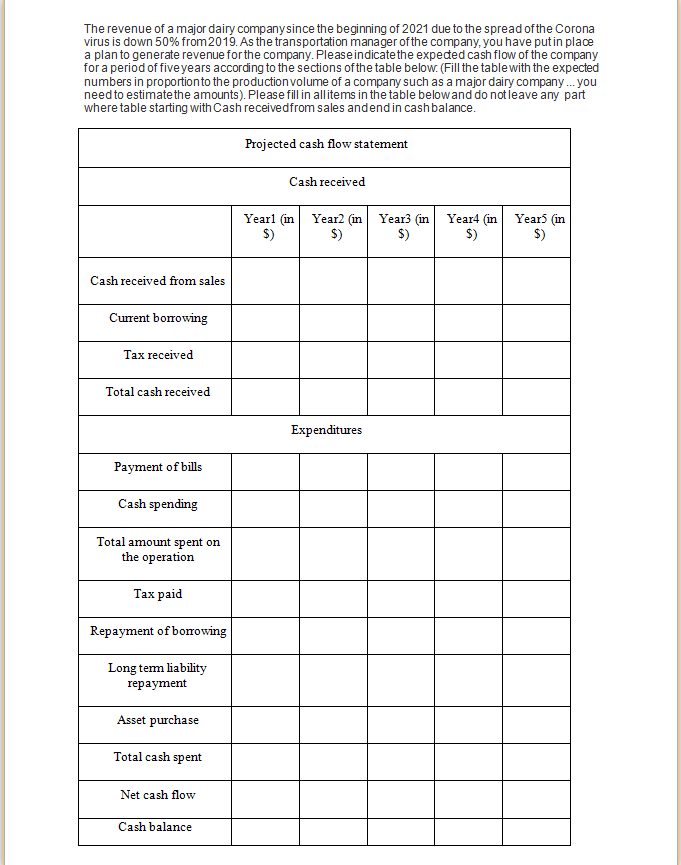

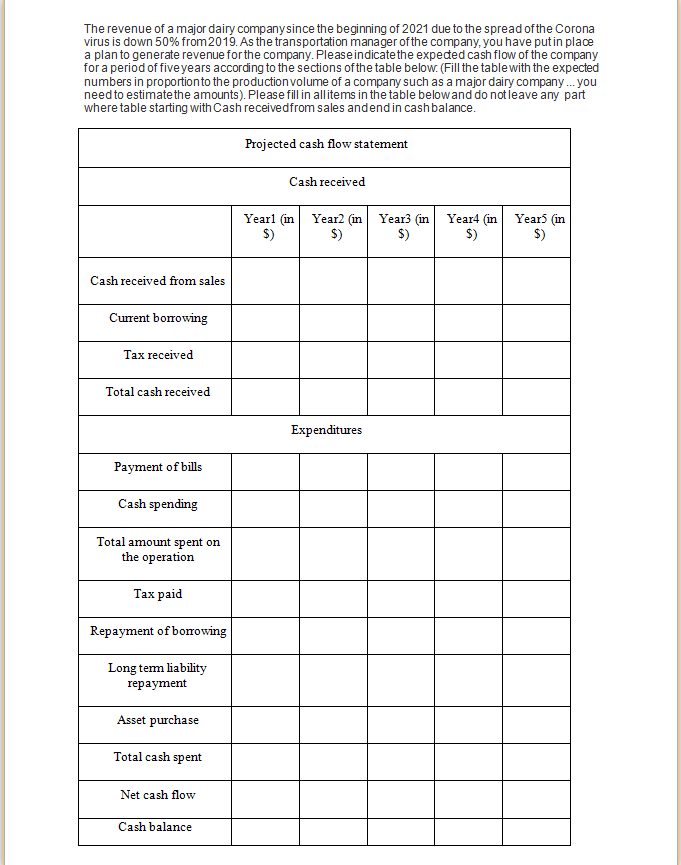

The revenue of a major dairy companysince the beginning of 2021 due to the spread of the Corona virus is down 50% from 2019. As the transportation manager of the company, you have put in place a plan to generate revenue for the company. Please indicate the expeded cash flow of the company for a period of five years according to the sections of the table below. (Fill the table with the expected numbers in proportion to the production volume of a company such as a major dairy company ...you need to estimate the amounts). Please fill in allitems in the table below and do not leave any part where table starting with Cash received from sales andend in cash balance. Projected cash flow statement Cash received Yearl (in $) Year2 (in Years in $) $) Year4 in $) Year) (in $) Cash received from sales Current borrowing Tax received Total cash received Expenditures Payment of bills Cash spending Total amount spent on the operation Tax paid Repayment of borrowing Long term liability repayment Asset purchase Total cash spent Net cash flow Cash balance The revenue of a major dairy companysince the beginning of 2021 due to the spread of the Corona virus is down 50% from 2019. As the transportation manager of the company, you have put in place a plan to generate revenue for the company. Please indicate the expeded cash flow of the company for a period of five years according to the sections of the table below. (Fill the table with the expected numbers in proportion to the production volume of a company such as a major dairy company ...you need to estimate the amounts). Please fill in allitems in the table below and do not leave any part where table starting with Cash received from sales andend in cash balance. Projected cash flow statement Cash received Yearl (in $) Year2 (in Years in $) $) Year4 in $) Year) (in $) Cash received from sales Current borrowing Tax received Total cash received Expenditures Payment of bills Cash spending Total amount spent on the operation Tax paid Repayment of borrowing Long term liability repayment Asset purchase Total cash spent Net cash flow Cash balance