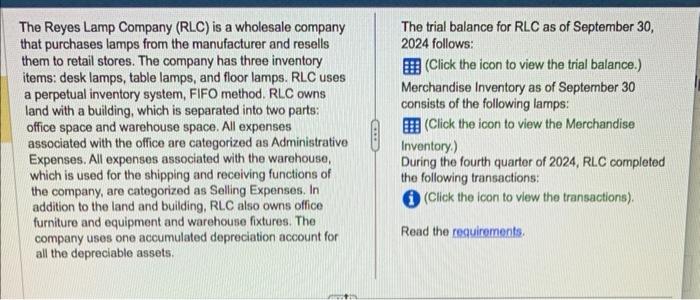

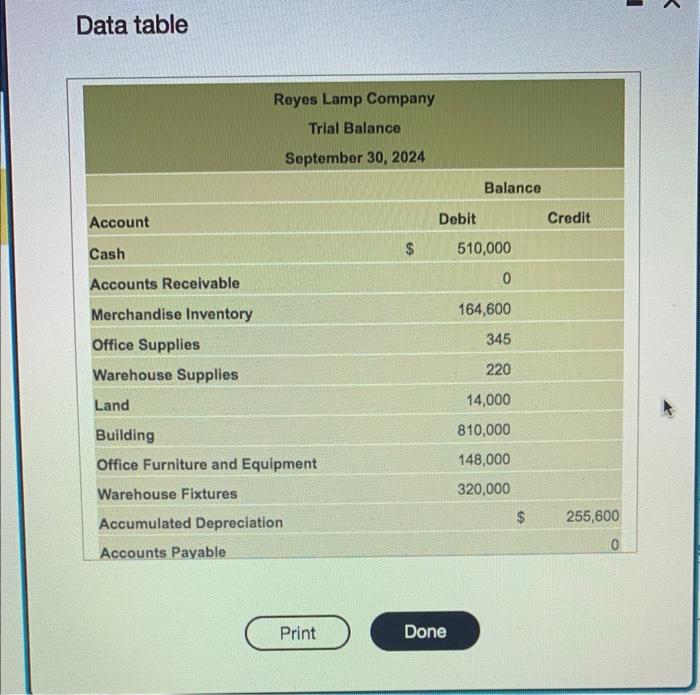

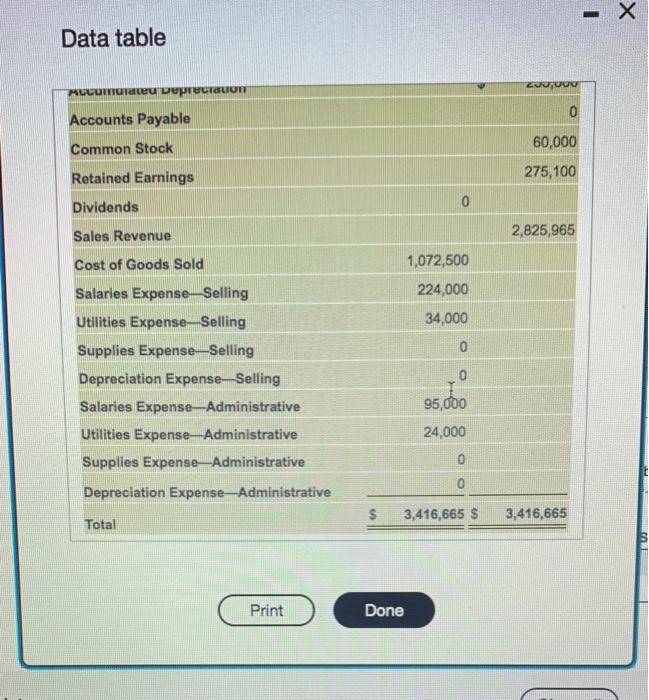

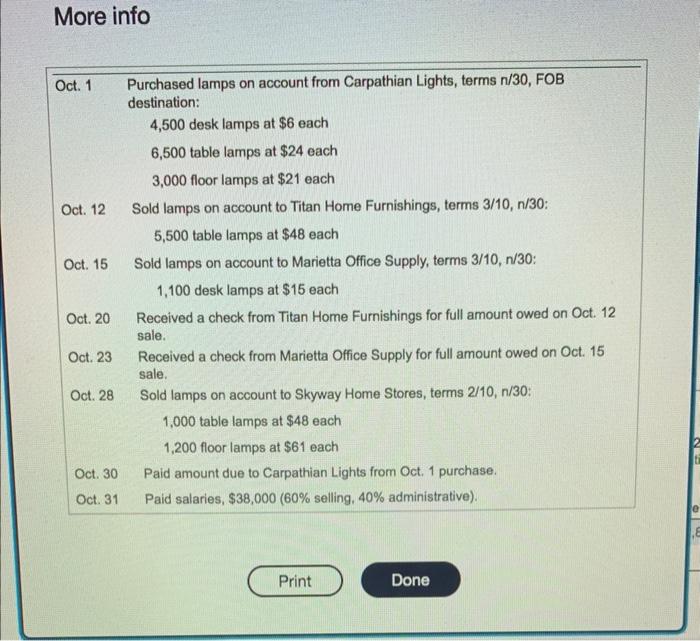

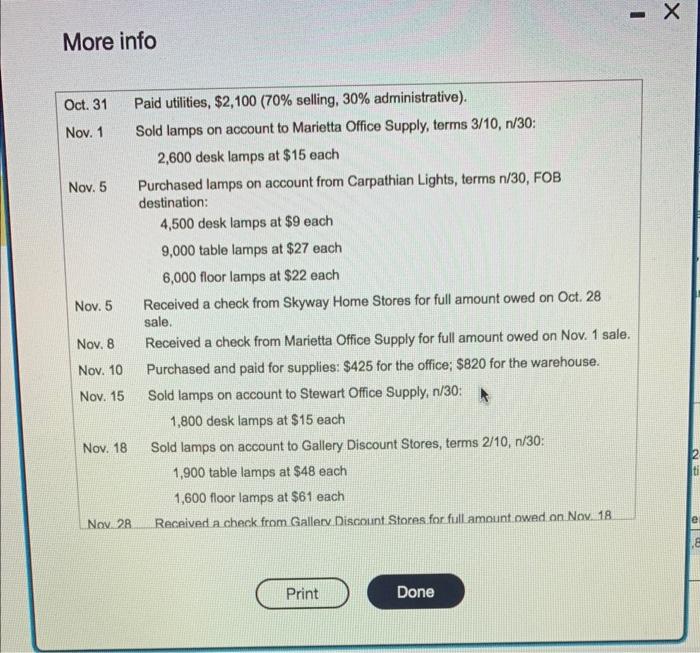

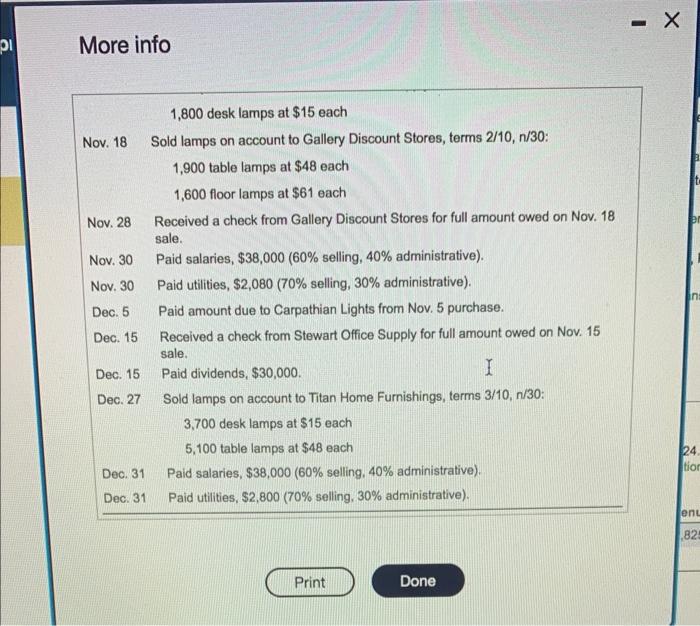

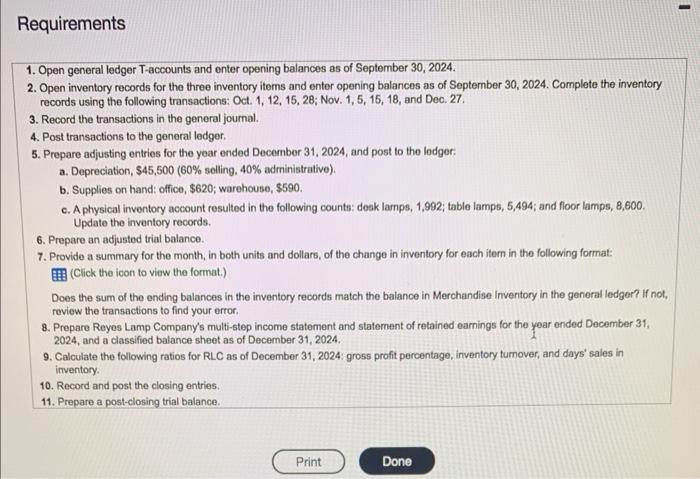

The Reyes Lamp Company (RLC) is a wholesale company that purchases lamps from the manufacturer and resells The trial balance for RLC as of September 30, them to retail stores. The company has three inventory items: desk lamps, table lamps, and floor lamps. RLC uses a perpetual inventory system, FIFO method. RLC owns land with a building, which is separated into two parts: 2024 follows: office space and warehouse space. All expenses associated with the office are categorized as Administrative Expenses. All expenses associated with the warehouse, (Click the icon to view the trial balance.) Merchandise Inventory as of September 30 consists of the following lamps: which is used for the shipping and receiving functions of the company, are categorized as Selling Expenses. In (Click the icon to view the Merchandise addition to the land and building, RLC also owns office Inventory.) During the fourth quarter of 2024, RL.C completed the following transactions: furniture and equipment and warehouse fixtures. The (Click the icon to view the transactions). company uses one accumulated depreciation account for Read the requirements. all the depreciable assets. Data table Data table Data table More info More info Oct. 31 Paid utilities, $2,100 (70\% selling, 30\% administrative). Nov. 1 Sold lamps on account to Marietta Office Supply, terms 3/10,n/30 : 2,600 desk lamps at $15 each Nov. 5 Purchased lamps on account from Carpathian Lights, terms n/30,FOB destination: 4,500 desk lamps at $9 each 9,000 table lamps at $27 each 6,000 floor lamps at $22 each Nov. 5 Received a check from Skyway Home Stores for full amount owed on Oct. 28 sale. Nov. 8 Received a check from Marietta Office Supply for full amount owed on Nov. 1 sale. Nov. 10 Purchased and paid for supplies: $425 for the office; $820 for the warehouse. Nov. 15 Sold lamps on account to Stewart Office Supply, n/30: 1,800 desk lamps at $15 each Nov. 18 Sold lamps on account to Gallery Discount Stores, terms 2/10, n/30: 1,900 table lamps at $48 each 1,600 floor lamps at $61 each Nov. 28 Received a check from Gallerv Discount Stores for full amount owed on Nov. 18 More info 1. Open general ledger T-accounts and onter opening balances as of September 30, 2024. 2. Open inventory records for the three inventory items and enter opening balances as of September 30,2024 . Complete the inventory records using the following transactions: Oct. 1, 12, 15, 28; Nov. 1, 5, 15, 18, and Dec. 27. 3. Record the transactions in the general joumal. 4. Post transactions to the general ledger. 5. Prepare adjusting entries for the yoar ended December 31, 2024, and post to the ledger: a. Depreciation, $45,500 ( 60% selling, 40% administrative). b. Supplies on hand: office, \$620; warehouse, $590. c. A physical inventory account resulted in the following counts: desk lamps, 1,992; table lamps, 5,494; and floor lamps, 8,600. Update the inventory records. 6. Prepare an adjusted trial balance. 7. Provide a summary for the month, in both units and dollars, of the change in inventory for each itern in the following format: IZ (Click the icon to view the format.) Does the sum of the ending balances in the inventory records match the balance in Merchandise Inventory in the general ledger? If not, review the transactions to find your error. 8. Prepare Reyes Lamp Company's multi-step income statement and statement of retained earnings for the yoar onded December 31 , 2024 , and a classified balance sheet as of December 31,2024 . 9. Calculate the following ratios for RLC as of December 31, 2024: gross profit percentage, inventory turnover, and days' sales in inventory. 10. Record and post the closing entries. The Reyes Lamp Company (RLC) is a wholesale company that purchases lamps from the manufacturer and resells The trial balance for RLC as of September 30, them to retail stores. The company has three inventory items: desk lamps, table lamps, and floor lamps. RLC uses a perpetual inventory system, FIFO method. RLC owns land with a building, which is separated into two parts: 2024 follows: office space and warehouse space. All expenses associated with the office are categorized as Administrative Expenses. All expenses associated with the warehouse, (Click the icon to view the trial balance.) Merchandise Inventory as of September 30 consists of the following lamps: which is used for the shipping and receiving functions of the company, are categorized as Selling Expenses. In (Click the icon to view the Merchandise addition to the land and building, RLC also owns office Inventory.) During the fourth quarter of 2024, RL.C completed the following transactions: furniture and equipment and warehouse fixtures. The (Click the icon to view the transactions). company uses one accumulated depreciation account for Read the requirements. all the depreciable assets. Data table Data table Data table More info More info Oct. 31 Paid utilities, $2,100 (70\% selling, 30\% administrative). Nov. 1 Sold lamps on account to Marietta Office Supply, terms 3/10,n/30 : 2,600 desk lamps at $15 each Nov. 5 Purchased lamps on account from Carpathian Lights, terms n/30,FOB destination: 4,500 desk lamps at $9 each 9,000 table lamps at $27 each 6,000 floor lamps at $22 each Nov. 5 Received a check from Skyway Home Stores for full amount owed on Oct. 28 sale. Nov. 8 Received a check from Marietta Office Supply for full amount owed on Nov. 1 sale. Nov. 10 Purchased and paid for supplies: $425 for the office; $820 for the warehouse. Nov. 15 Sold lamps on account to Stewart Office Supply, n/30: 1,800 desk lamps at $15 each Nov. 18 Sold lamps on account to Gallery Discount Stores, terms 2/10, n/30: 1,900 table lamps at $48 each 1,600 floor lamps at $61 each Nov. 28 Received a check from Gallerv Discount Stores for full amount owed on Nov. 18 More info 1. Open general ledger T-accounts and onter opening balances as of September 30, 2024. 2. Open inventory records for the three inventory items and enter opening balances as of September 30,2024 . Complete the inventory records using the following transactions: Oct. 1, 12, 15, 28; Nov. 1, 5, 15, 18, and Dec. 27. 3. Record the transactions in the general joumal. 4. Post transactions to the general ledger. 5. Prepare adjusting entries for the yoar ended December 31, 2024, and post to the ledger: a. Depreciation, $45,500 ( 60% selling, 40% administrative). b. Supplies on hand: office, \$620; warehouse, $590. c. A physical inventory account resulted in the following counts: desk lamps, 1,992; table lamps, 5,494; and floor lamps, 8,600. Update the inventory records. 6. Prepare an adjusted trial balance. 7. Provide a summary for the month, in both units and dollars, of the change in inventory for each itern in the following format: IZ (Click the icon to view the format.) Does the sum of the ending balances in the inventory records match the balance in Merchandise Inventory in the general ledger? If not, review the transactions to find your error. 8. Prepare Reyes Lamp Company's multi-step income statement and statement of retained earnings for the yoar onded December 31 , 2024 , and a classified balance sheet as of December 31,2024 . 9. Calculate the following ratios for RLC as of December 31, 2024: gross profit percentage, inventory turnover, and days' sales in inventory. 10. Record and post the closing entries