Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Reynolds Corporation buys from its suppliers on terms of 3/18, net 65. Reynolds has not been utilizing the discounts offered and has been

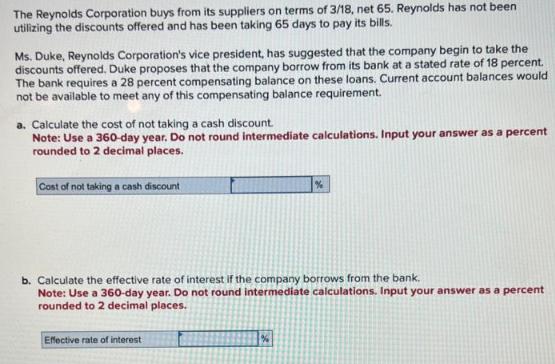

The Reynolds Corporation buys from its suppliers on terms of 3/18, net 65. Reynolds has not been utilizing the discounts offered and has been taking 65 days to pay its bills. Ms. Duke, Reynolds Corporation's vice president, has suggested that the company begin to take the discounts offered. Duke proposes that the company borrow from its bank at a stated rate of 18 percent. The bank requires a 28 percent compensating balance on these loans. Current account balances would not be available to meet any of this compensating balance requirement. a. Calculate the cost of not taking a cash discount. Note: Use a 360-day year. Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places. Cost of not taking a cash discount b. Calculate the effective rate of interest if the company borrows from the bank. Note: Use a 360-day year. Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places. Effective rate of interest %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663ddcdd45578_961544.pdf

180 KBs PDF File

663ddcdd45578_961544.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started