Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your firm faces a(n) 16% chance of a potential loss of $9 million next year. If your firm implements new policies, it can reduce

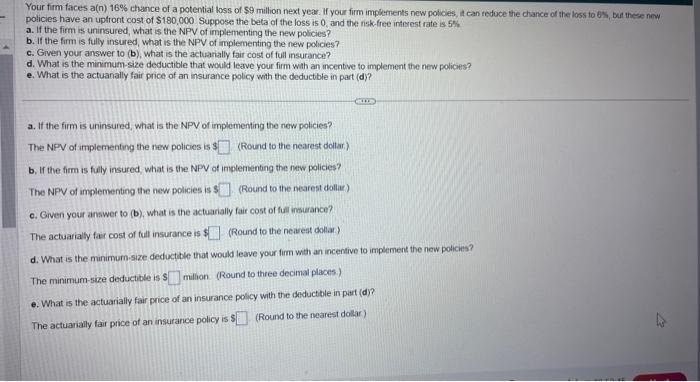

Your firm faces a(n) 16% chance of a potential loss of $9 million next year. If your firm implements new policies, it can reduce the chance of the loss to 6%, but these new policies have an upfront cost of $180,000 Suppose the beta of the loss is 0, and the risk-free interest rate is 5% a. If the firm is uninsured, what is the NPV of implementing the new policies? b. If the firm is fully insured, what is the NPV of implementing the new policies? c. Given your answer to (b), what is the actuarially fair cost of full insurance? d. What is the minimum-size deductible that would leave your firm with an incentive to implement the new policies? e. What is the actuanally fair price of an insurance policy with the deductible in part (d)? a. If the firm is uninsured, what is the NPV of implementing the new policies? The NPV of implementing the new policies is $(Round to the nearest dollar.) b. If the firm is fully insured, what is the NPV of implementing the new policies? The NPV of implementing the new policies is $ c. Given your answer to (b), what is the actuarially (Round to the nearest dollar) fair cost of full insurance? The actuarially fair cost of full insurance is $ (Round to the nearest dollar) d. What is the minimum-size deductible that would leave your firm with an incentive to implement the new policies? The minimum-size deductible is $million (Round to three decimal places.) e. What is the actuarially fair price of an insurance policy with the deductible in part (d)? The actuarially fair price of an insurance policy is $(Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To solve this problem we need to calculate the Net Present Value NPV for each scenario and determine the actuarially fair cost of full insuranc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started