Question

The Righter Shoe Store Company prepares monthly financial statements for its bank. The November 30 and December 31, 2024, trial balances contained the following account

The Righter Shoe Store Company prepares monthly financial statements for its bank. The November 30 and December 31, 2024, trial balances contained the following account information:

| November 30 | December 31 | |||

|---|---|---|---|---|

| Debit | Credit | Debit | Credit | |

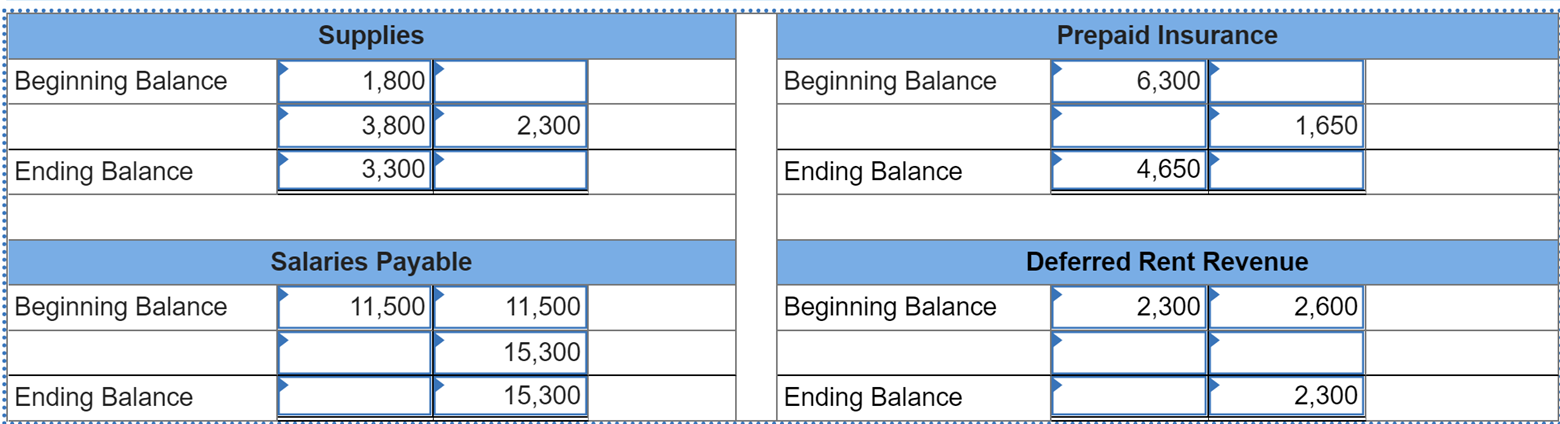

| Supplies | 1,800 | 3,300 | ||

| Prepaid insurance | 6,300 | 4,650 | ||

| Salaries payable | 11,500 | 15,300 | ||

| Deferred rent revenue | 2,600 | 1,300 | ||

The following information also is known:

The December income statement reported $2,300 in supplies expense.

No insurance payments were made in December.

$11,500 was paid to employees during December for salaries.

On November 1, 2024, a tenant paid Righter $3,900 in advance rent for the period November through January. Deferred rent revenue was credited at the time cash was received.

Required:

Using the above information for December, complete the T-accounts below. The beginning balances should be the balances as of November 30.

Using the above information, prepare the adjusting entries Righter recorded for the month of December.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started