Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Rim Department Stores, Inc. chief executive officer (CEO) has asked you to compare the company's profit performance and financial position with the averages

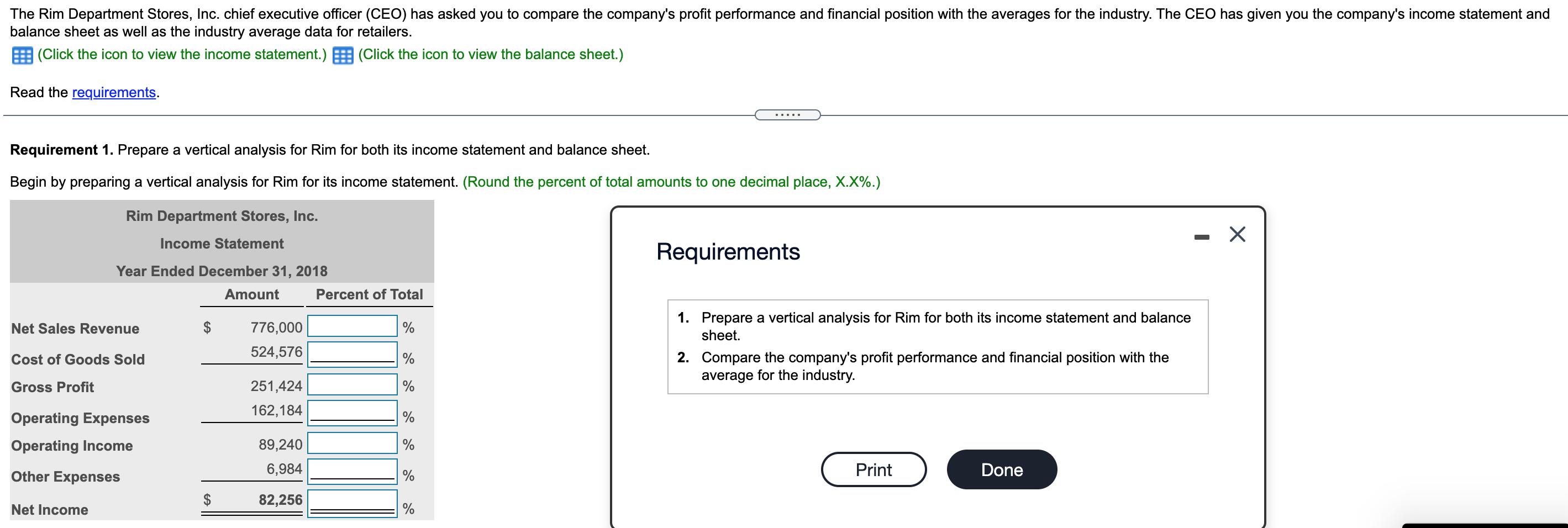

The Rim Department Stores, Inc. chief executive officer (CEO) has asked you to compare the company's profit performance and financial position with the averages for the industry. The CEO has given you the company's income statement and balance sheet as well as the industry average data for retailers. (Click the icon to view the income statement.) Read the requirements. (Click the icon to view the balance sheet.) Requirement 1. Prepare a vertical analysis for Rim for both its income statement and balance sheet. Begin by preparing a vertical analysis for Rim for its income statement. (Round the percent of total amounts to one decimal place, X.X%.) Rim Department Stores, Inc. Income Statement Year Ended December 31, 2018 Requirements Amount Percent of Total Net Sales Revenue 776,000 % 1. Prepare a vertical analysis for Rim for both its income statement and balance sheet. 524,576 Cost of Goods Sold % 2. Compare the company's profit performance and financial position with the average for the industry. Gross Profit 251,424 % 162,184 Operating Expenses % Operating Income 89,240 % 6,984 Other Expenses % Print Done 82,256 Net Income % - Rim Department Stores, Inc. Income Statement Compared with Industry Average Year Ended December 31, 2018 Industry Rim Average Net Sales Revenue EA $ 776,000 100.0 % 524,576 65.8 Cost of Goods Sold Gross Profit 251,424 34.2 162,184 19.7 Operating Expenses Operating Income 89,240 14.5 6,984 0.4 Other Expenses EA $ 82,256 14.1 % Net Income Rim Department Stores, Inc. Balance Sheet Compared with Industry Average December 31, 2018 Current Assets Property, Plant, and Equipment, Net Intangible Assets, Net Other Assets Total Assets Industry Rim Average EA $ 316,310 70.9% 123,140 23.6 7,520 0.8 23,030 4.7 470,000 100.0 % Current Liabilities $ 215,260 48.1% Long-term Liabilities 107,160 16.6 Total Liabilities 322,420 64.7 147,580 35.3 Stockholders' Equity $ 470,000 100.0 % Total Liabilities and Stockholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare a vertical analysis for Rim Department Stores we need to calculate the percentage of each ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started