Question

The risk-free rate is 0.06, the return on the market portfolio is 0.11, and the variance of the market portfolio's return is 0.25. An

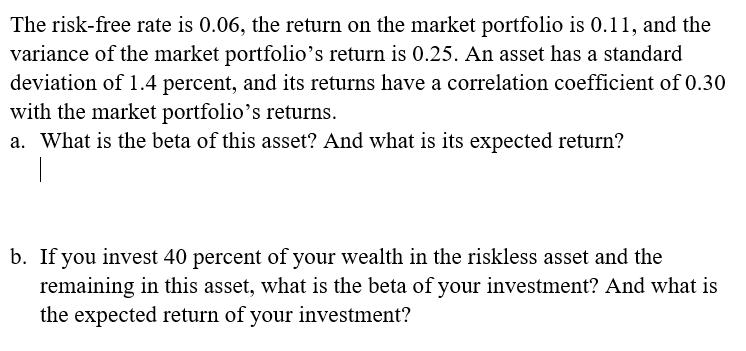

The risk-free rate is 0.06, the return on the market portfolio is 0.11, and the variance of the market portfolio's return is 0.25. An asset has a standard deviation of 1.4 percent, and its returns have a correlation coefficient of 0.30 with the market portfolio's returns. a. What is the beta of this asset? And what is its expected return? | b. If you invest 40 percent of your wealth in the riskless asset and the remaining in this asset, what is the beta of your investment? And what is the expected return of your investment?

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a The beta of the asset can be calculated using the formula beta correlation co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials Of Business Statistics

Authors: Bruce Bowerman, Richard Connell, Emily Murphree, Burdeane Or

5th Edition

978-1259688867, 1259688860, 78020530, 978-0078020537

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App