Answered step by step

Verified Expert Solution

Question

1 Approved Answer

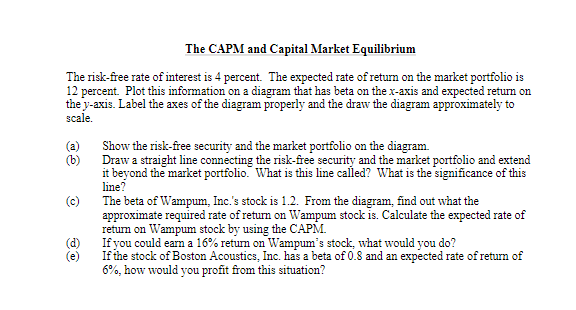

The risk-free rate of interest is 4 percent. The expected rate of return on the market portfolio is 12 percent. Plot this information on a

The risk-free rate of interest is 4 percent. The expected rate of return on the market portfolio is 12 percent. Plot this information on a diagram that has beta on the x-axis and expected return on the y-axis. Label the axes of the diagram properly and the draw the diagram approximately to scale. (a) Show the risk-free security and the market portfolio on the diagram. (b) Draw a straight line connecting the risk-free security and the market portfolio and extend it beyond the market portfolio. What is this line called? What is the significance of this line? (c) The beta of Wampum, Inc.'s stock is 1.2. From the diagram, find out what the approximate required rate of return on Wampum stock is. Calculate the expected rate of return on Wampum stock by using the CAPM. (d) If you could earn a 16% return on Wampum's stock, what would you do? (e) If the stock of Boston Acoustics, Inc. has a beta of 0.8 and an expected rate of return of 6%, how would you profit from this situation

The risk-free rate of interest is 4 percent. The expected rate of return on the market portfolio is 12 percent. Plot this information on a diagram that has beta on the x-axis and expected return on the y-axis. Label the axes of the diagram properly and the draw the diagram approximately to scale. (a) Show the risk-free security and the market portfolio on the diagram. (b) Draw a straight line connecting the risk-free security and the market portfolio and extend it beyond the market portfolio. What is this line called? What is the significance of this line? (c) The beta of Wampum, Inc.'s stock is 1.2. From the diagram, find out what the approximate required rate of return on Wampum stock is. Calculate the expected rate of return on Wampum stock by using the CAPM. (d) If you could earn a 16% return on Wampum's stock, what would you do? (e) If the stock of Boston Acoustics, Inc. has a beta of 0.8 and an expected rate of return of 6%, how would you profit from this situation Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started