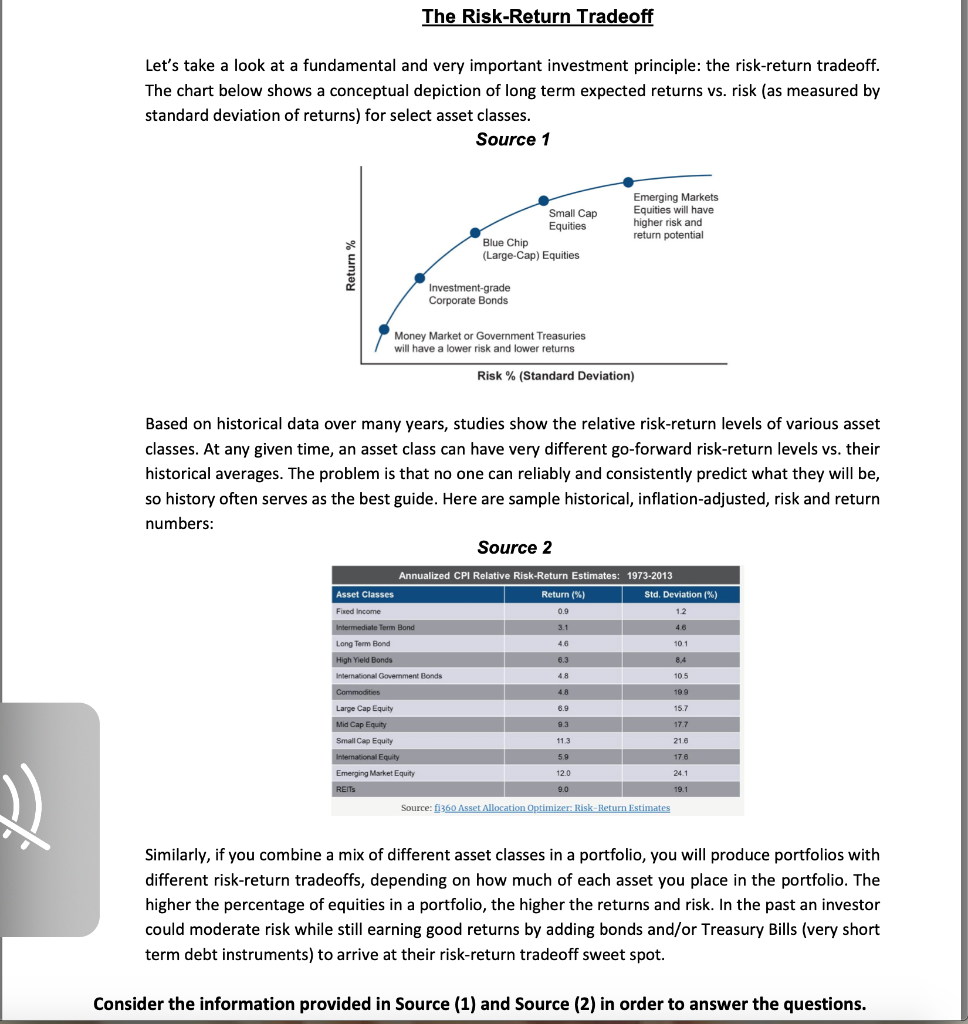

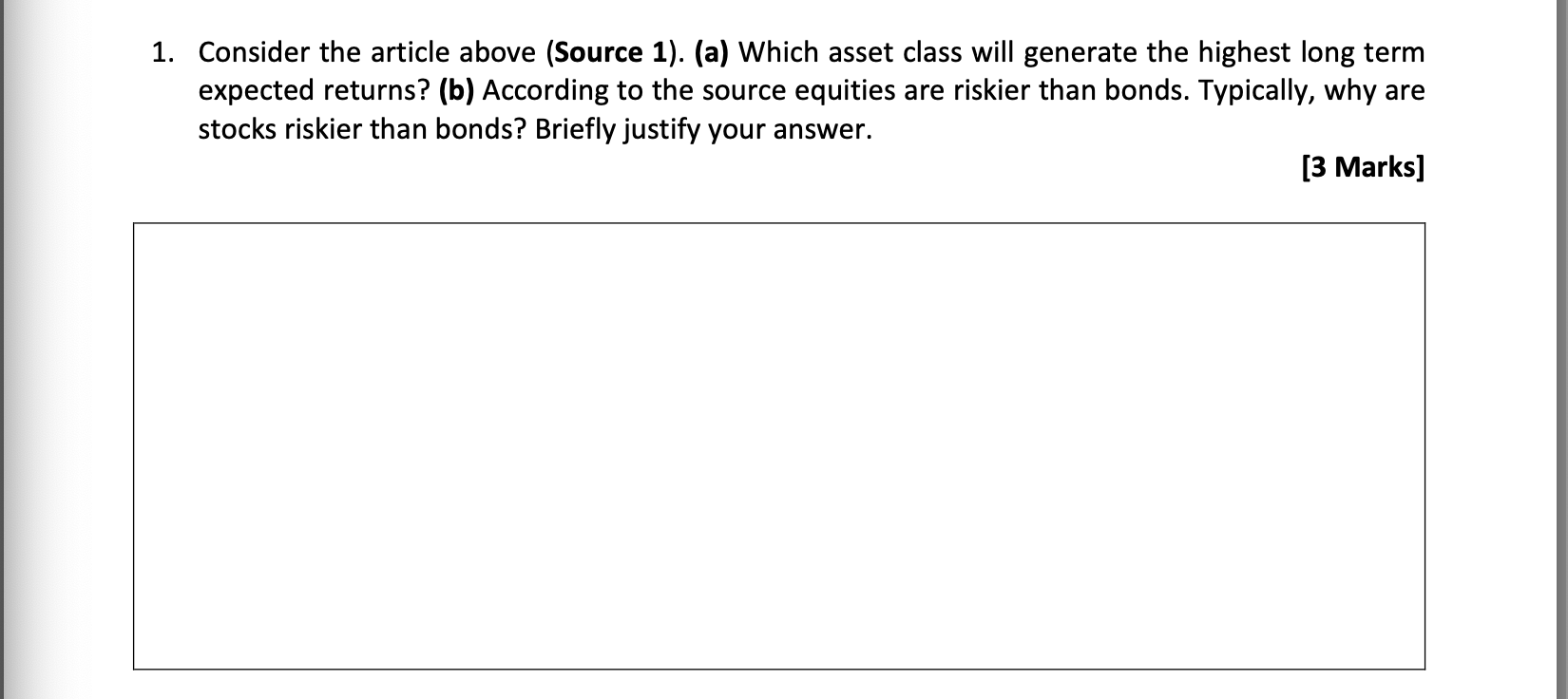

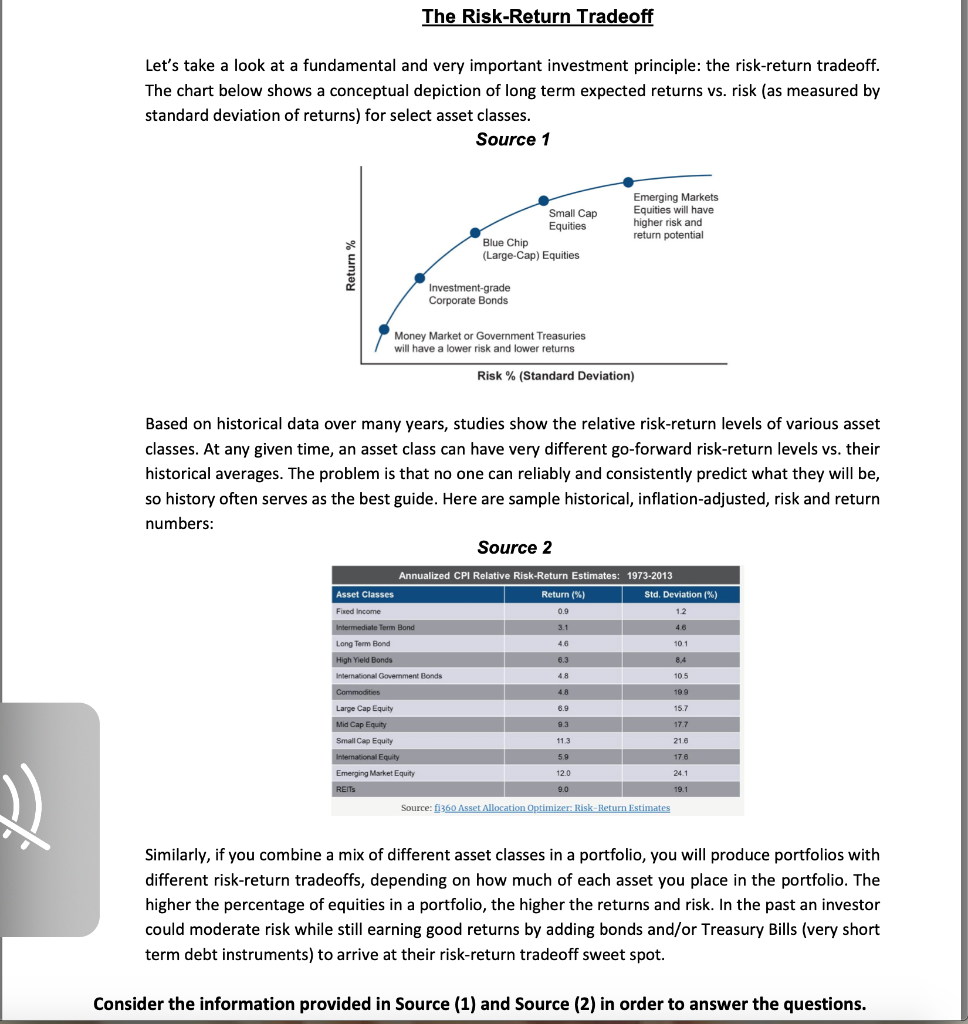

The Risk-Return Tradeoff Let's take a look at a fundamental and very important investment principle: the risk-return tradeoff. The chart below shows a conceptual depiction of long term expected returns vs. risk (as measured by standard deviation of returns) for select asset classes. Source 1 Small Cap Equities Blue Chip (Large-Cap) Equities Emerging Markets Equities will have higher risk and return potential Investment-grade Corporate Bonds Money Market or Government Treasures will have a lower risk and lower returns Risk % (Standard Deviation) Based on historical data over many years, studies show the relative risk-return levels of various asset classes. At any given time, an asset class can have very different go-forward risk-return levels vs. their historical averages. The problem is that no one can reliably and consistently predict what they will be, so history often serves as the best guide. Here are sample historical, inflation-adjusted, risk and return numbers: Source 2 Annualized CPI Relative Risk-Return Estimates: 1973-2013 Asset Classes Return (%) ) Std. Deviation (%) Fixed Income come 0.9 1.2 Intermediate Term Bond 3.1 Long Term Bond 4.6 101 High Yield Bonds 6.3 8.4 International Government Bonds 48 105 Commodities 48 199 Large Cap Equity Large 6.9 15.7 Mid Cap Equity 9.3 17.7 Small Cap Equity 113 210 International Equity 5.9 176 Emerging Market Equity 12.0 24.1 REITS 9.0 19.1 D Source: fi360 Asset Allocation Optimizer: Risk-Return Estimates Similarly, if you combine a mix of different asset classes in a portfolio, you will produce portfolios with different risk-return tradeoffs, depending on how much of each asset you place in the portfolio. The higher the percentage of equities in a portfolio, the higher the returns and risk. In the past an investor could moderate risk while still earning good returns by adding bonds and/or Treasury Bills (very short term debt instruments) to arrive at their risk-return tradeoff sweet spot. Consider the information provided in Source (1) and Source (2) in order to answer the questions. 1. Consider the article above (Source 1). (a) Which asset class will generate the highest long term expected returns? (b) According to the source equities are riskier than bonds. Typically, why are stocks riskier than bonds? Briefly justify your answer. [3 Marks]