Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Robbins Corporation is an oil wholesaler. The firm's sales last year were $ 1 . 0 4 million, with the cost of goods sold

The Robbins Corporation is an oil wholesaler. The firm's sales last year were

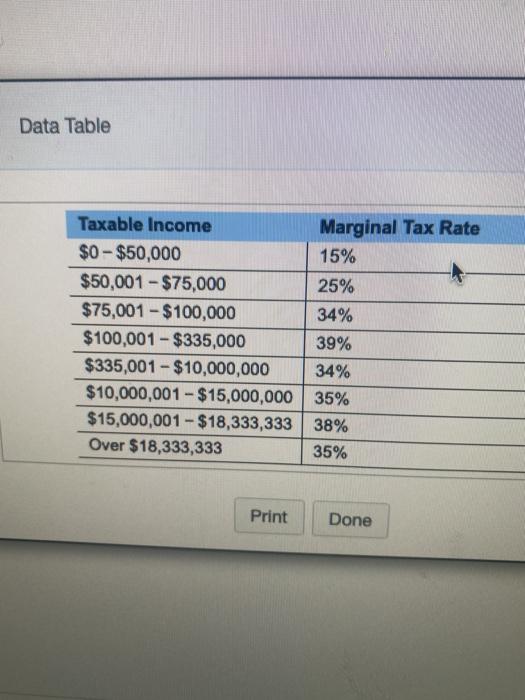

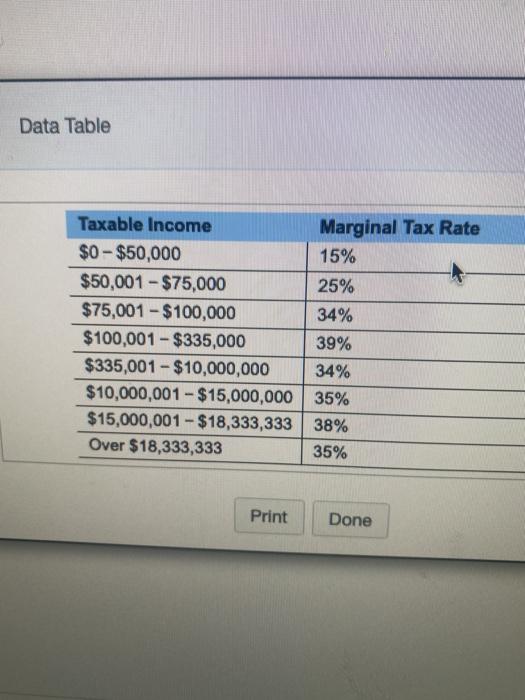

Data Table Taxable income Marginal Tax Rate $0 - $50,000 15% $50,001 - $75,000 25% $75,001 - $100,000 34% $100,001 - $335,000 39% $335,001 - $10,000,000 34% $10,000,001 - $15,000,000 35% $15,000,001 - $18,333,333 38% Over $18,333,333 35% Print Done $1.04

million, with the cost of goods sold equal to $610,000.

The firm paid interest of $223,250

and its cash operating expenses were $103,000.

Also, the firm received $41,000

in dividend income from a firm in which the firm owned 22%

of the shares, while paying only $10,000

in dividends to its stockholders. Depreciation expense was $52,000.

Use the corporate tax rates shown in the popup window, to compute the firm's tax liability. What are the firm's average and marginal tax rates?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started