Question

the RPS Case Study and apply basic financial analysis to renewable energy projects. Much of this is related to the material inEGEE 102(Links to an

the RPS Case Study and apply basic financial analysis to renewable energy projects. Much of this is related to the material inEGEE 102(Links to an external site.)

.(Feel free to refer back to that course for help.) Also note that this information is reviewed in this course at the end of Lesson 1.

Show all calculations - clearly indicate how you arrived at your answers. It is best to "walk me through" these calculations. Please organize your answers clearly, e.g. use 1), 2), 3), etc.

Visit thePA AEPS(Links to an external site.)

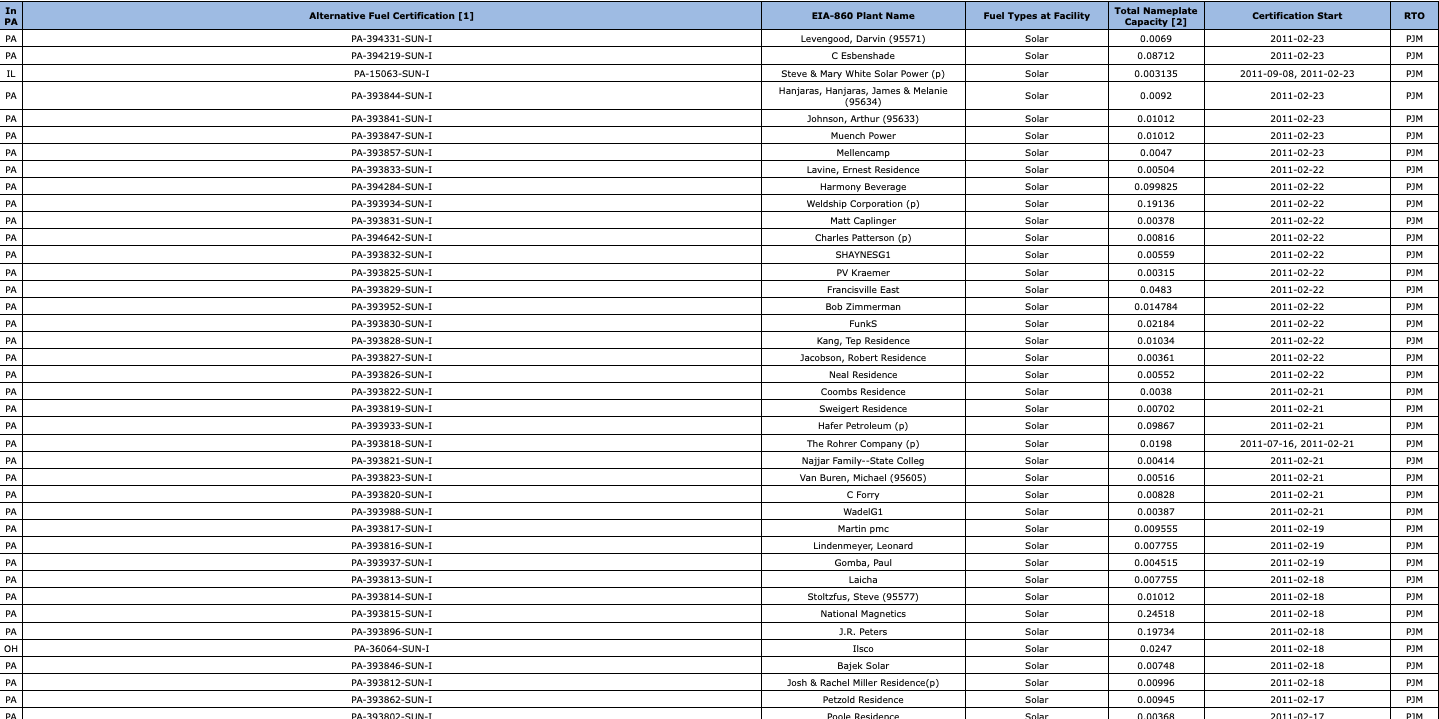

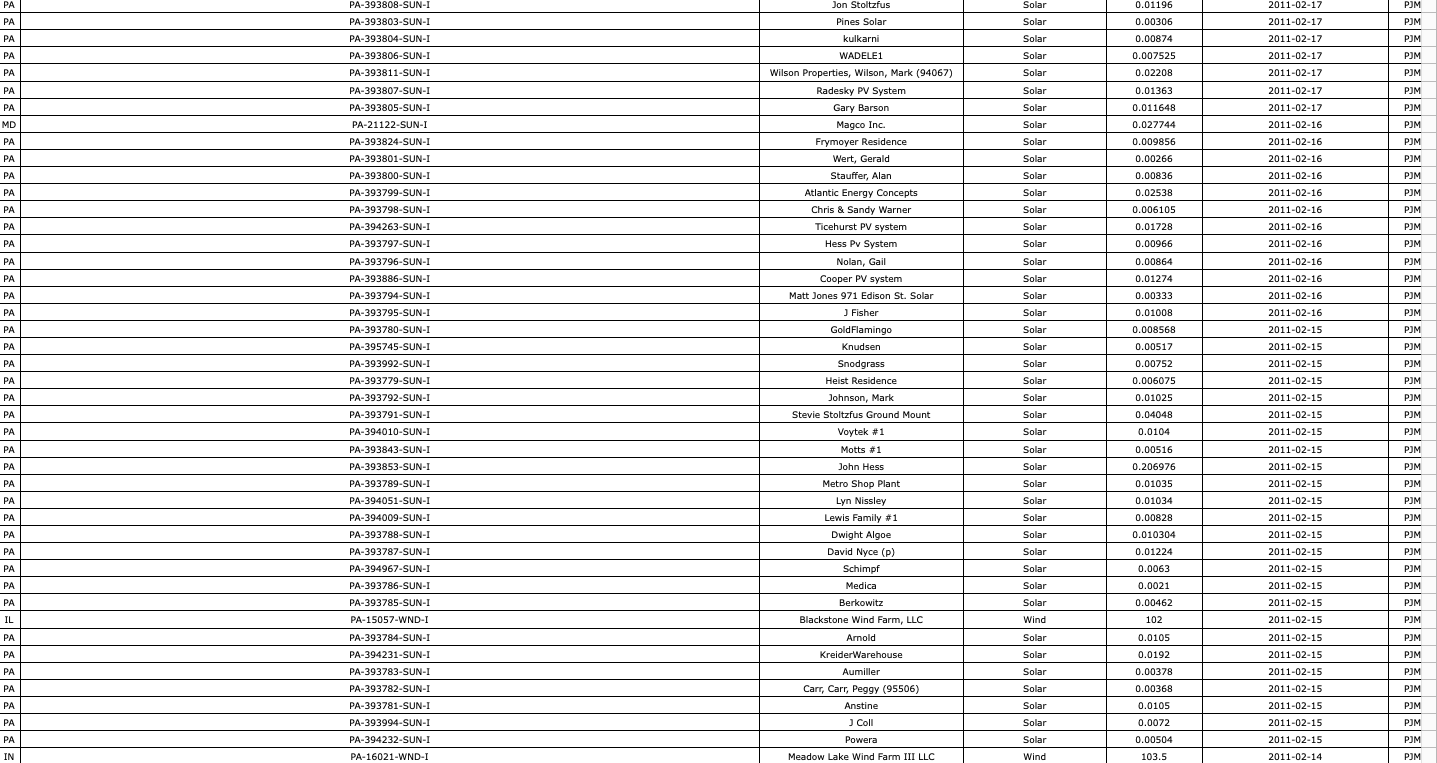

website. (Note that this is an archived page - you can hit the red "x" in the top right corner to remove the unnecessary heading.) On the "Qualified Facilities" page of the site, you'll find a list of all alternative energy facilities that qualify for the AEPS program. Go to this page and search for "U Rock". (Again, Istrongly suggestusing

- (1 pt)The PA AEPS gives the nameplate capacity in MW. What is the capacity of this system (U Rock) in MW? in kW?

- (2 pts) Based on the location, orientation, tilt, and components, this system is expected to generate about 1,200 kWhs per year per installed kW. How many kWh will the system generate each year?

- (2 pts)If electricity costs $0.12 per kWh, how much will I save on electricity bills each year? (Assume that the house is using more electricity than the system generates, so solar electricity will just make each month's bill smaller.)

- (2 pts) Assume that the total installation cost was $4.25/W at the time it was installed (including all labor, components, balance of system, taxes, permitting). How much did the system cost? (It would be much closer to $3/W now, but it was installed about 15 years ago.)

- (2 pts) Assuming a 30% Federal Tax Credit, what was the final cost of the system?

- (2 pts) How many SRECs can she expect to earn each year, based on the information above? Round to two decimal places.

- (4 pts) To realize a simple payback of 10 years, what would the average selling price of S-RECs need to be? (Assume no maintenance costs and do not consider time value of money.) Think through this carefully! Show your work.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started