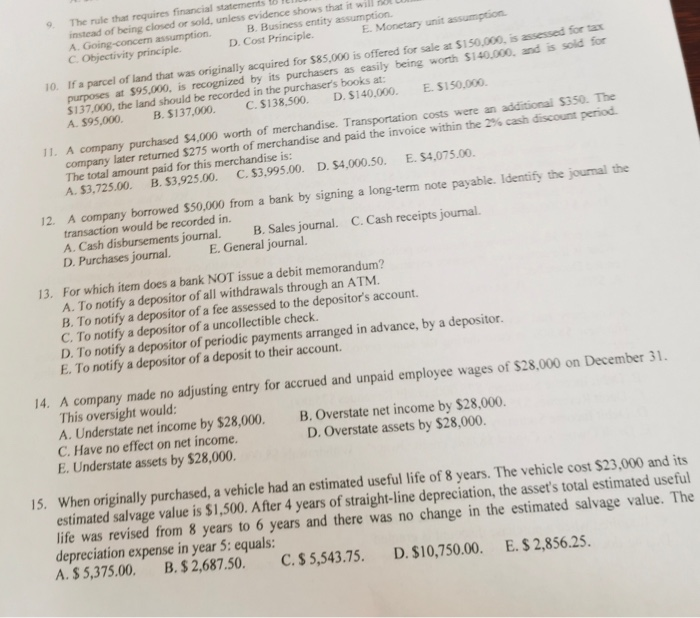

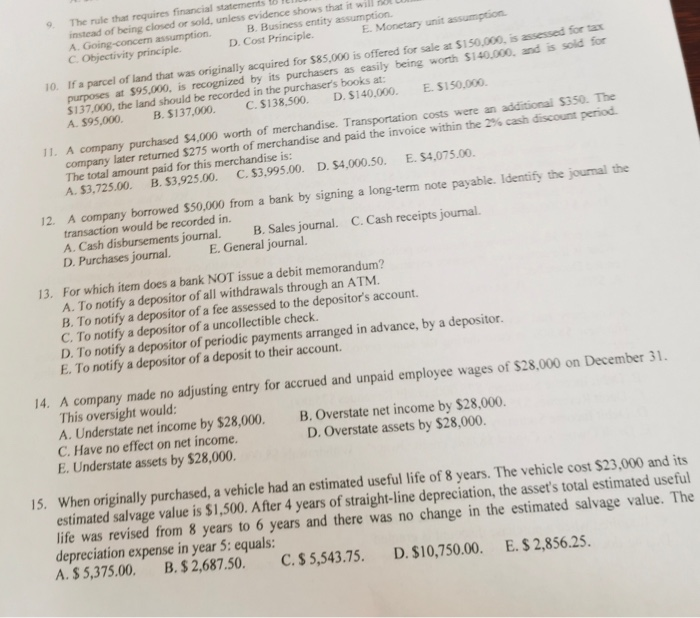

The rule that requires financial statements instead of being closed or sold, unless evidence shows that it will not A Going-concern assumption. B. Business entity assumption C. Objectivity principle. D. Cost Principle. E Monetary unit assumption 10. If a parcel of land that was originally acquired for $85.000 is offered for sale at $150,000, is assessed for the purposes at $95.000, is recognized by its purchasers as easily being worth $140.000, and is sold for $137,000, the land should be recorded in the purchaser's books at: A. 595,000. B. $137.000. C. $138,500. D. $140,000. E. $150,000. 11. A company purchased $4,000 worth of merchandise. Transportation costs were an additional $350. The company later returned $275 worth of merchandise and paid the invoice within the 2% cash discount period The total amount paid for this merchandise is: A. $3,725.00. B. $3.925,00. C. $3.995.00. D. $4,000.50. E. 54.075.00. 12. A company borrowed $50,000 from a bank by signing a long-term note payable. Identify the journal the transaction would be recorded in. A. Cash disbursements journal. B. Sales journal. C. Cash receipts journal. D. Purchases journal. E. General journal. 13. For which item does a bank NOT issue a debit memorandum? A. To notify a depositor of all withdrawals through an ATM. B. To notify a depositor of a fee assessed to the depositor's account. C. To notify a depositor of a uncollectible check D. To notify a depositor of periodic payments arranged in advance, by a depositor. E. To notify a depositor of a deposit to their account. 14. A company made no adjusting entry for accrued and unpaid employee wages of $28.000 on December 31. This oversight would: A. Understate net income by $28,000. B. Overstate net income by $28,000. C. Have no effect on net income. D. Overstate assets by $28,000. E. Understate assets by $28,000. 15. When originally purchased, a vehicle had an estimated useful life of 8 years. The vehicle cost $23,000 and its estimated salvage value is $1,500. After 4 years of straight-line depreciation, the asset's total estimated useful life was revised from 8 years to 6 years and there was no change in the estimated salvage value. The depreciation expense in year 5: equals: A. $ 5,375.00. B. $ 2,687.50. C. $ 5,543.75. D. $10,750.00. E. $ 2,856.25