Answered step by step

Verified Expert Solution

Question

1 Approved Answer

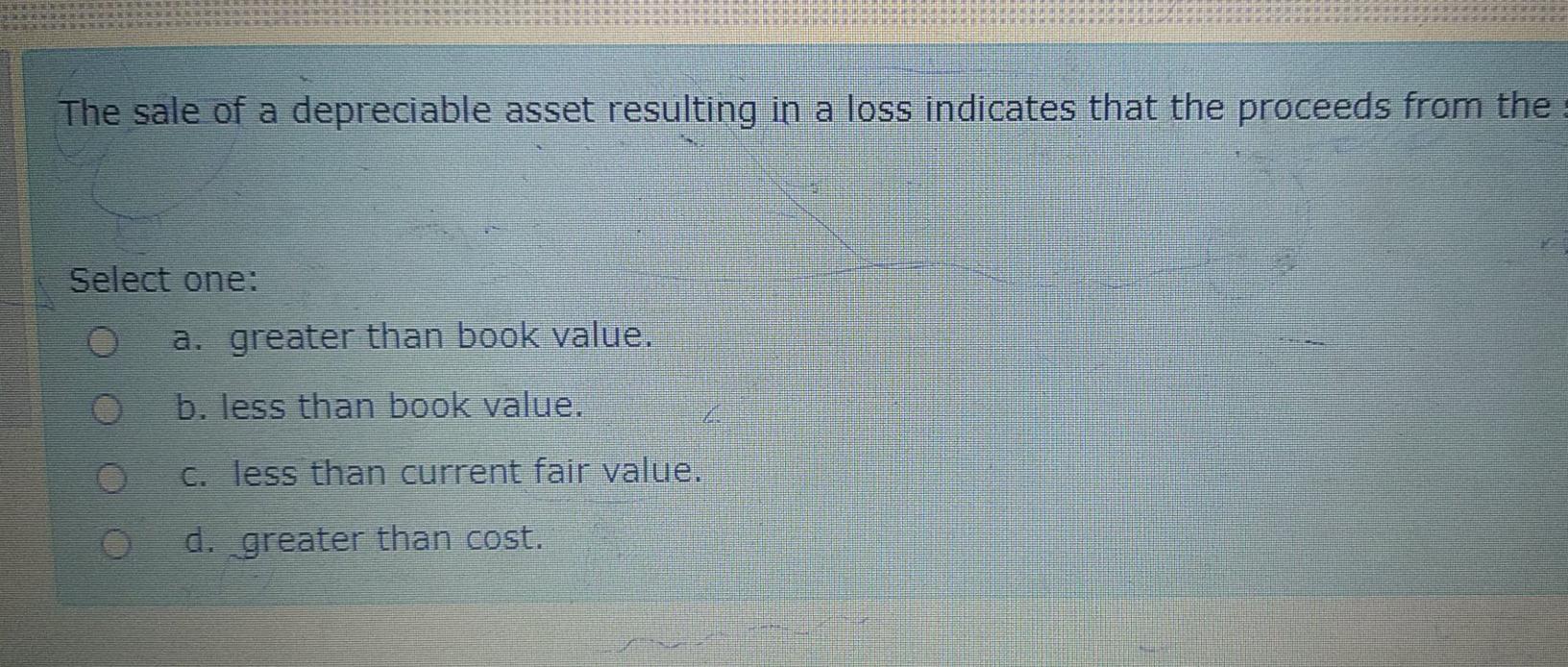

The sale of a depreciable asset resulting in a loss indicates that the proceeds from the Select one: a. greater than book value. b. less

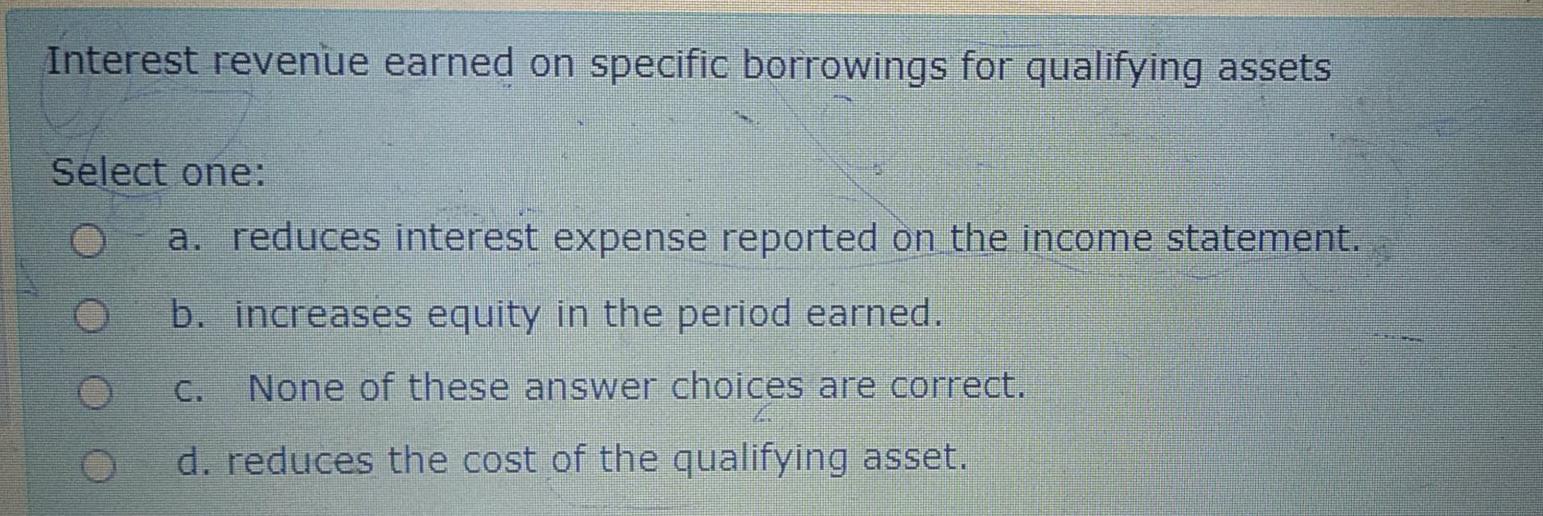

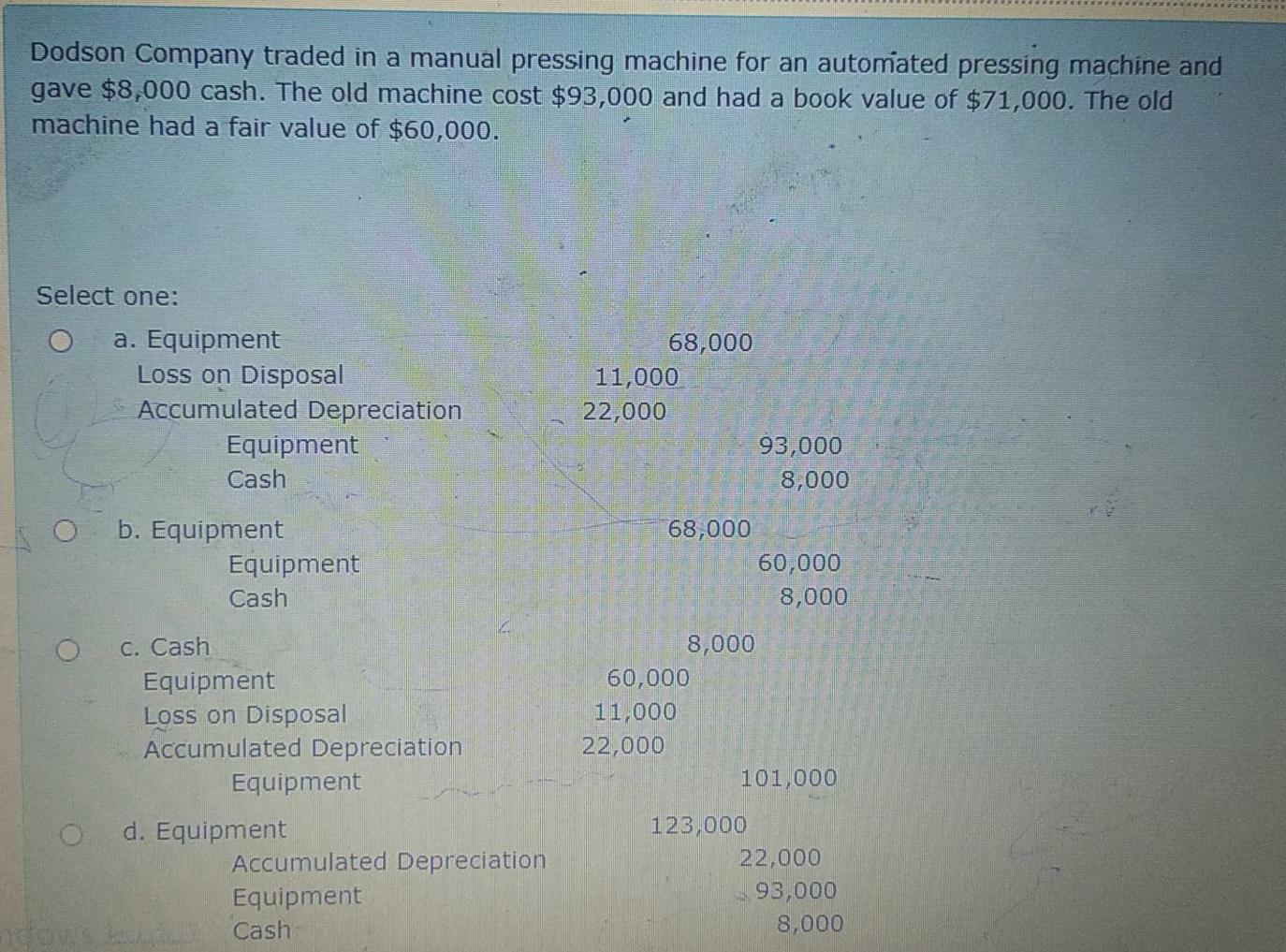

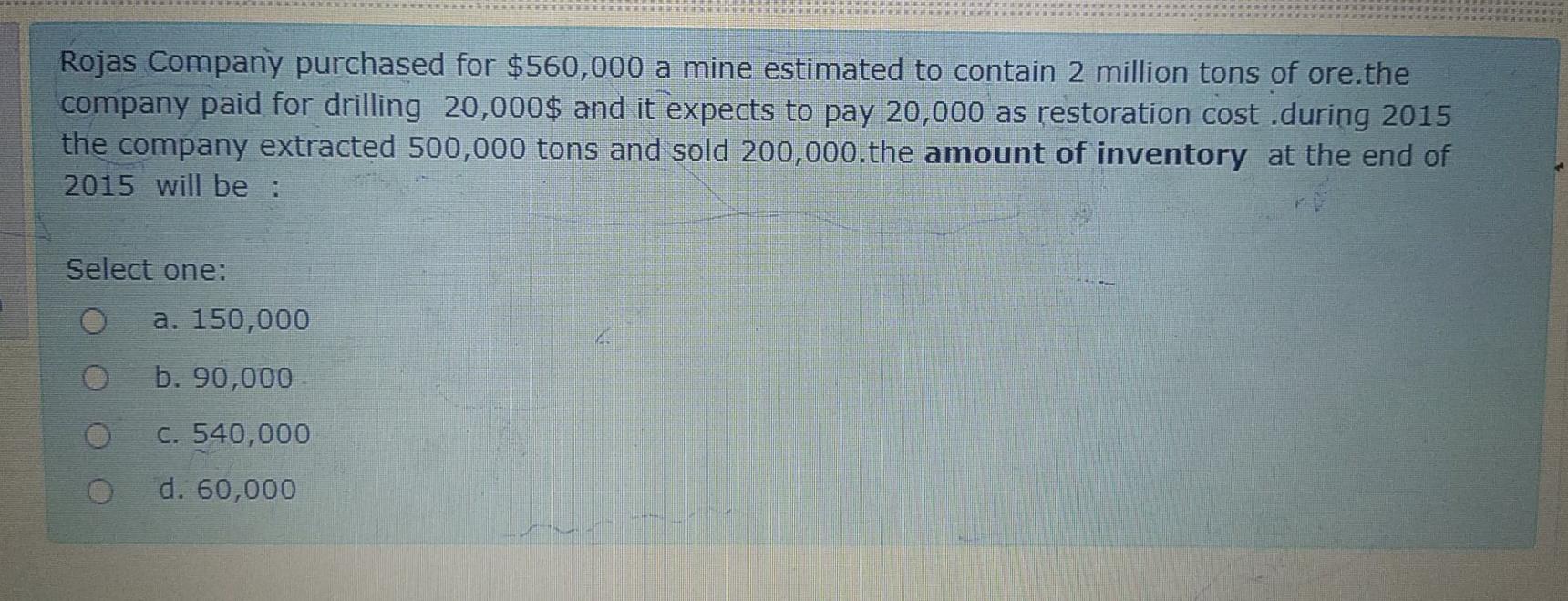

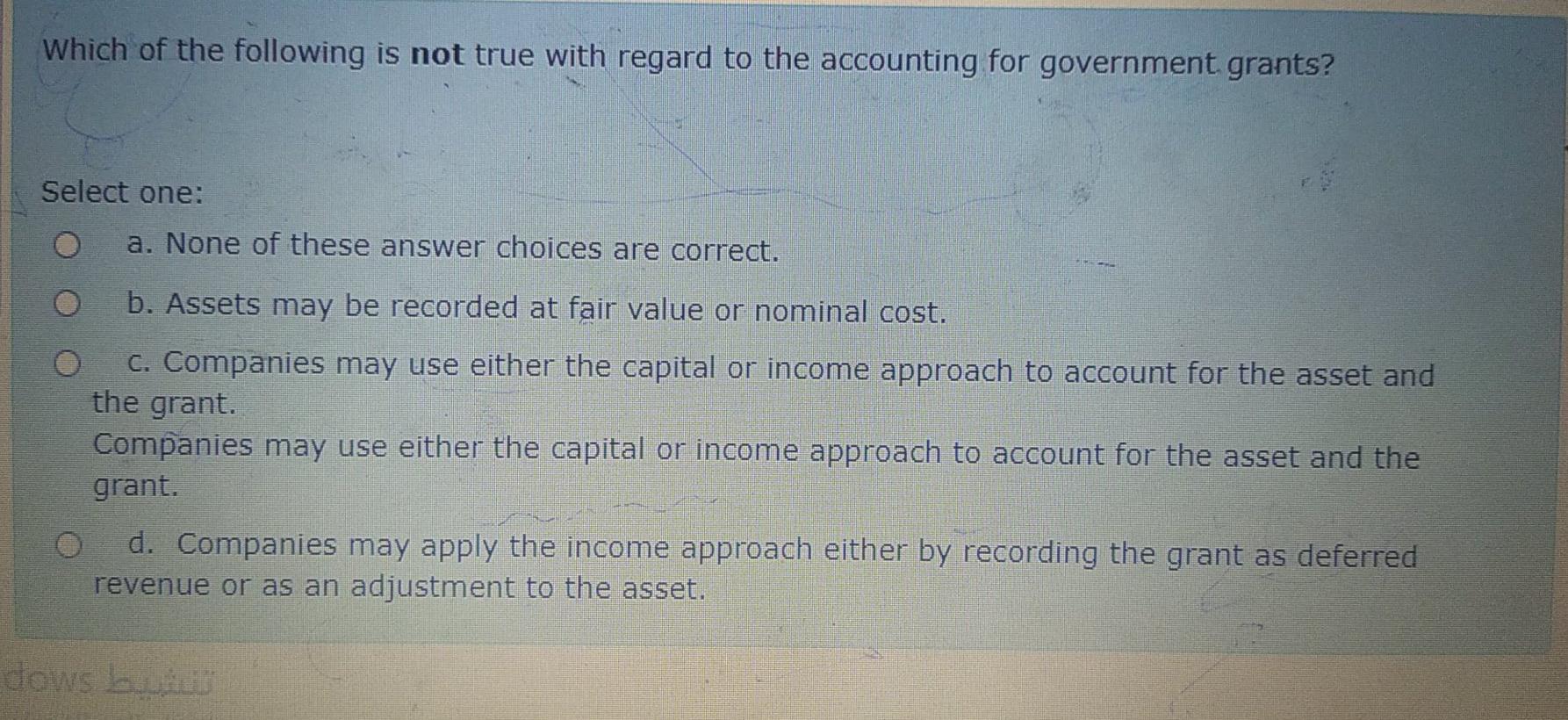

The sale of a depreciable asset resulting in a loss indicates that the proceeds from the Select one: a. greater than book value. b. less than book value. C. less than current fair value. c d. greater than cost. Rojas Company purchased for $560,000 a mine estimated to contain 2 million tons of ore.the company paid for drilling 20,000$ and it expects to pay 20,000 as restoration cost .during 2015 the company extracted 500,000 tons and sold 200,000.the amount of inventory at the end of 2015 will be : Select one: a. 150,000 b. 90,000 C. 540,000 c d. 60,000 Which of the following is not true with regard to the accounting for government grants? Select one: a. None of these answer choices are correct. b. Assets may be recorded at fair value or nominal cost. C. Companies may use either the capital or income approach to account for the asset and the grant. Companies may use either the capital or income approach to account for the asset and the grant. d. Companies may apply the income approach either by recording the grant as deferred revenue or as an adjustment to the asset. dows bu

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started