Question

The sales manager of Teak Plastics Limited (Teak), Naomi Moir, was concernedabout the companys record in winning bids. Teak was a small manufacturer of high-pressure

The sales manager of Teak Plastics Limited (Teak), Naomi Moir, was concernedabout the company’s record in winning bids. Teak was a small manufacturer of high-pressure injection-molded plastic parts, supplied mainly to the automotive industry.

Over the past few years, Teak’s success in winning large contracts had steadily declined, forcing Teak to pursue greater numbers of small contracts. This has become aserious problem; the company’s total business has dropped to such an extent that it iscurrently operating at only 70% of capacity.Naomi realized that there was something wrong with her method of preparingbids. In the past year, Naomi found that the rate of success in winning bids increasedas the total size of the contract decreased. In her attempt to increase the totalamount of sales for Teak during the past year, she had submitted almost double thenumber of bids compared to previous years. This resulted in two people from theaccounting department spending most of their time preparing the cost data forNaomi’s bids.

The teak used a standard full-cost accounting system, and bids were prepared withthe objective of earning a 20% markup on total costs. Standard hourly operatingrates were developed using regression analysis of monthly prior-period costs foreach machine and process. These costs included all labor, job setup, and mold development costs as well as fixed and variable processing overhead costs. The jobsetup and mold development costs were fairly constant from job to job. The coefficients from the regression analysis were used as the rates for variable-cost items and the intercept values were divided by full capacity processing hours to determine therates for fixed-cost items.

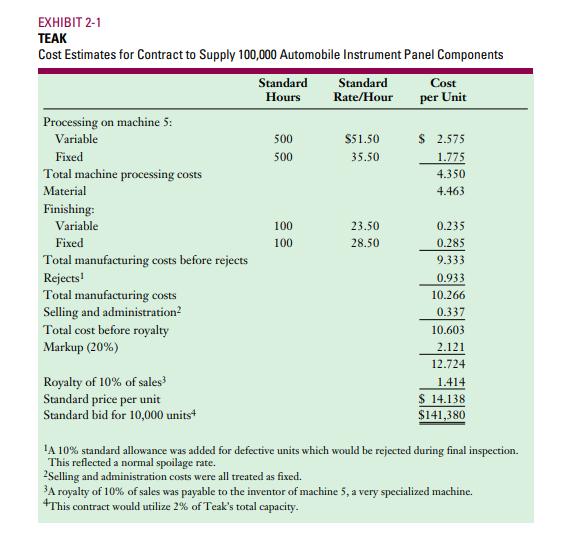

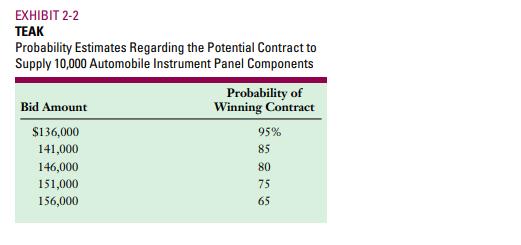

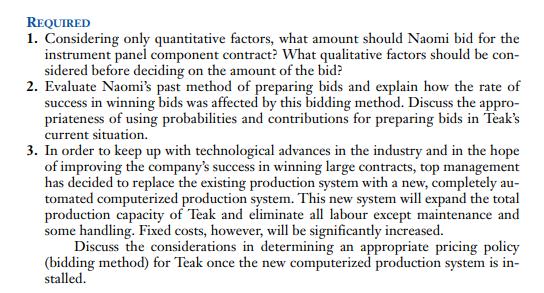

At a recent business luncheon seminar, Naomi had been impressed by thespeaker’s model for preparing bids. This model involved using contributions, probabilities, and expected values. Accordingly, she decided to test the approach inpreparing her next bid for a fairly small contract for instrument panel components.She started with her usual bidding method based on the cost estimate prepared bythe accounting department (Exhibit 2-1), and made a mental note that she wouldnormally have submitted a bid of $141,000. She then made her best estimates of theprobabilities of winning the contract at various bids (Exhibit 2-2).

EXHIBIT 2-1 TEAK Cost Estimates for Contract to Supply 100,000 Automobile Instrument Panel Components Processing on machine 5: Variable Fixed Total machine processing costs Material Finishing: Variable Fixed Total manufacturing costs before rejects Rejects! Total manufacturing costs Selling and administration Total cost before royalty Markup (20%) Royalty of 10% of sales Standard price per unit Standard bid for 10,000 units Standard Hours 500 500 100 100 Standard Rate/Hour $51.50 35.50 23.50 28.50 Cost per Unit $ 2.575 1.775 4.350 4.463 0.235 0.285 9.333 0.933 10.266 0.337 10.603 2.121 12.724 1.414 $ 14.138 $141,380 A 10% standard allowance was added for defective units which would be rejected during final inspection. This reflected a normal spoilage rate. 2Selling and administration costs were all treated as fixed. A royalty of 10% of sales was payable to the inventor of machine 5, a very specialized machine. This contract would utilize 2% of Teak's total capacity.

Step by Step Solution

3.50 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

1 There will be quantitative factors like profitability probability of bids success and contribution etc And qualitative factors will be social aspects goodwill etc 2 Past method should be dropped and focus should be on probability distribution of chances of bids success and their contribution to overall capacity 3 Cost based pricing can be best option for the company Stepbystep explanation 1 Teak plastics limited is currently working on 70 capacity So company need to changing its bid process to work on its full capacity Total cost of the for the 10000 unit is 10603 unit price 10000 total units 106030 So bidding of 141380 needed to get the 20 profit There are 85 chance that bid will be accepted at the 141380 price So if the company wants to improve the chances of bid then bid amount should be decreased But this will harm the company profit If the bid amount is set at 136000 then the chance will be 95 that bid will be accepted But then the markup price will be bid amount 1 1 10 136000 1 1 10 123636 Total profit Markup price Cost 1 123636 106030 1 166 So the profit will decrease from 20 to 166 if company want to increase profit Quantitative factor 1 Profitability in each bidding 2 How much this contract can utilize the unfilled capacity Qualitative factor There is some qualitative factor which will affect the decision 1 Effects on goodwill on making the bid decision 2 Relationship with customers 3 Future effects on profitability 4 Social aspect ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started