The same question. it just long

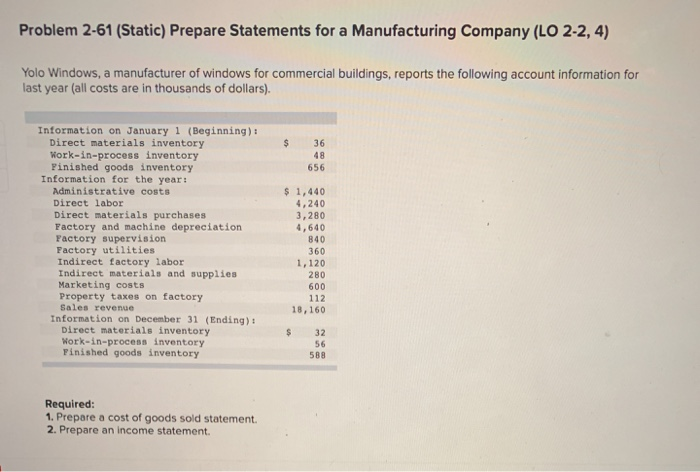

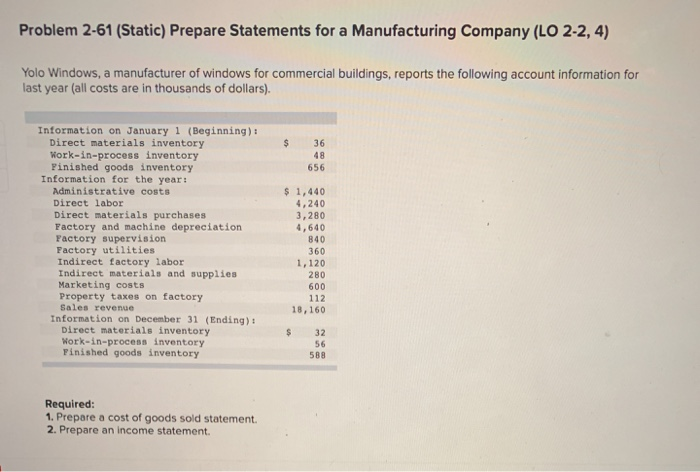

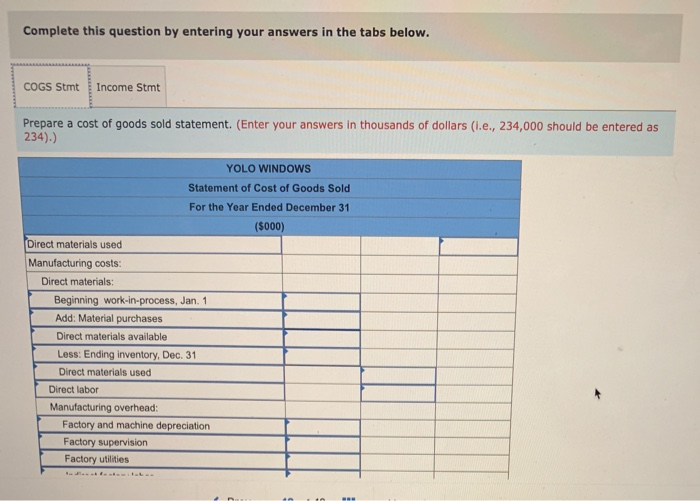

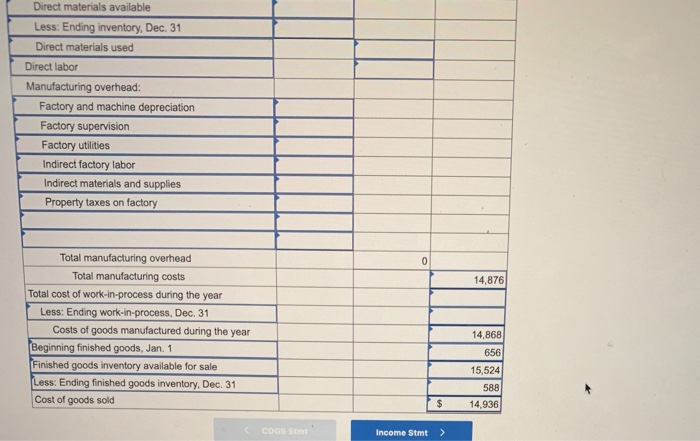

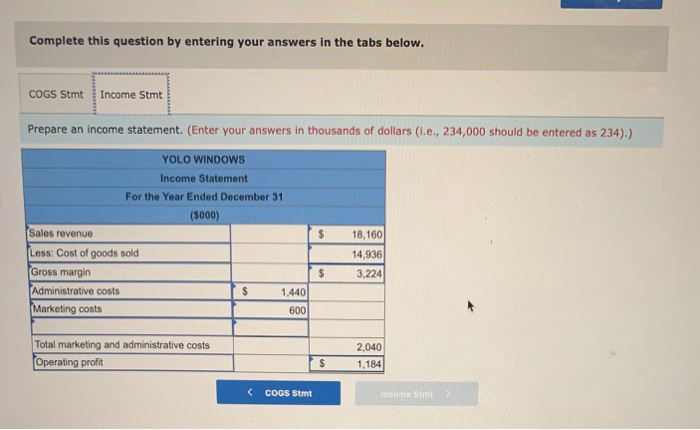

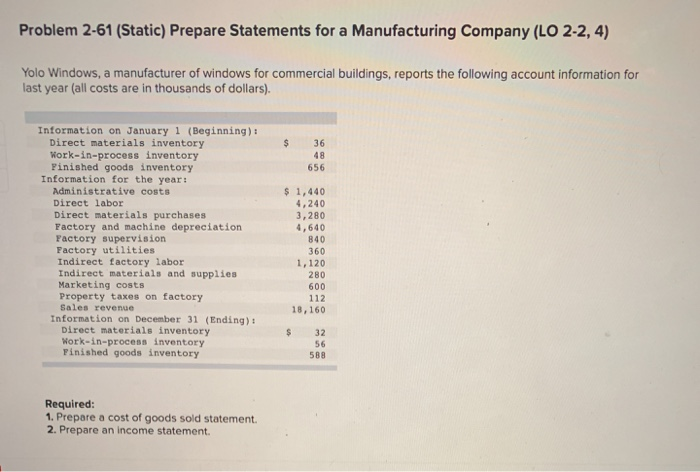

Problem 2-61 (Static) Prepare Statements for a Manufacturing Company (LO 2-2, 4) Yolo Windows, a manufacturer of windows for commercial buildings, reports the following account information for last year (all costs are in thousands of dollars). $ 36 48 656 Information on January 1 (Beginning): Direct materials inventory Work-in-process inventory Pinished goods inventory Information for the year: Administrative costs Direct labor Direct materials purchases Factory and machine depreciation Factory supervision Factory utilities Indirect factory labor Indirect materials and supplies Marketing costs Property taxes on factory Sales revenue Information on December 31 (Ending): Direct materials inventory Work-in-process inventory Finished goods inventory $ 1,440 4,240 3.280 4,640 840 360 1,120 280 600 112 18,160 $ 32 588 Required: 1. Prepare a cost of goods sold statement. 2. Prepare an income statement. Complete this question by entering your answers in the tabs below. COGS Stmt Income Stmt Prepare a cost of goods sold statement. (Enter your answers in thousands of dollars (I.e., 234,000 should be entered as 234).) YOLO WINDOWS Statement of Cost of Goods Sold For the Year Ended December 31 (5000) Direct materials used Manufacturing costs: Direct materials: Beginning work-in-process, Jan. 1 Add: Material purchases Direct materials available Less: Ending inventory, Dec. 31 Direct materials used Direct labor Manufacturing overhead: Factory and machine depreciation Factory supervision Factory utilities Direct materials available Less: Ending inventory, Dec. 31 Direct materials used Direct labor Manufacturing overhead: Factory and machine depreciation Factory supervision Factory utilities Indirect factory labor Indirect materials and supplies Property taxes on factory 14.876 Total manufacturing overhead Total manufacturing costs Total cost of work-in-process during the year Less: Ending work-in-process, Dec. 31 Costs of goods manufactured during the year Beginning finished goods, Jan. 1 Finished goods inventory available for sale Less: Ending finished goods inventory, Dec. 31 Cost of goods sold 14,868 656 15.524 588 $ 14,936 COGS Income Stml> Complete this question by entering your answers in the tabs below. COGS Stmt Income Stmt Prepare an income statement. (Enter your answers in thousands of dollars (i.e., 234,000 should be entered as 234).) YOLO WINDOWS Income Statement For the Year Ended December 31 (5000) Sales revenue Less: Cost of goods sold Gross margin 'Administrative costs Marketing costs $ 18,160 14,936 3,224 $ 1.440 600 Total marketing and administrative costs Operating profit 2.040 1.184 $ (COGS Stmt