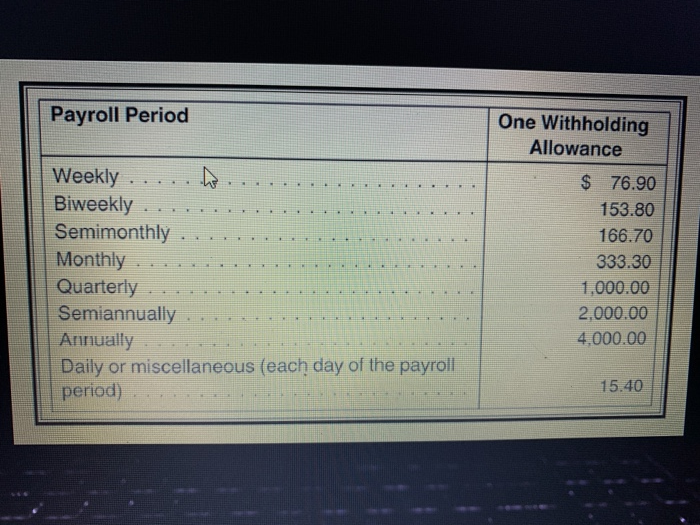

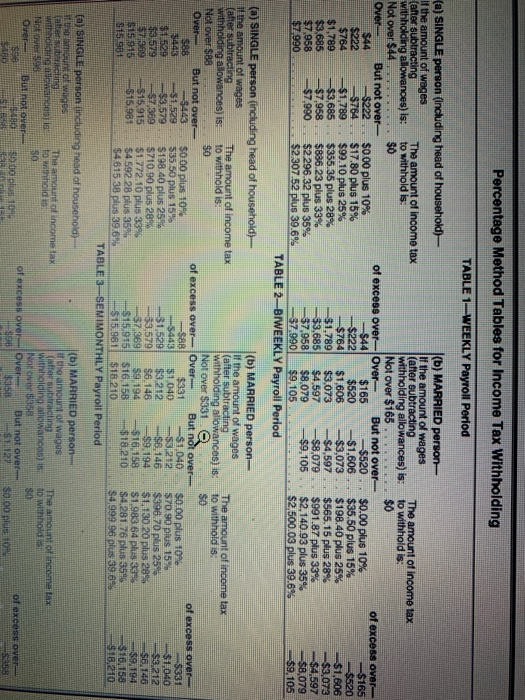

The San Bernardino County Fair hires about 105 people during fair time. Their wages range from $5.60 to $740. California has a state income tax of 9% Sandy Denny earns $7.40 per hour, George Barney earns $5.60 per hour. They both worked 38 hours this week Both are married; however, Sandy claims 2 exemptions and George claims 1 exemption. Assume a rate of 62% on $118,500 for Social Security and 1.45% for Medicare. a. What is Sandy's net pay after FIT (use the Table 71 and Table 72). Social Security tax, state income tax, and Medicare have been taken out? (Round your answer to the nearest cent.) Sandy's net pay after FIT b. What is George's net pay after the same deductions? (Round your answ George's net pay after FIT c. How much more is Sandy's net pay versus George's net pay Difference in net pay Payroll Period Weekly .....no Biweekly ...... Semimonthly ... Monthly.... Quarterly .... Semiannually Annually Daily or miscellaneous (each day of the payroll period) One Withholding Allowance $ 76.90 153.80 166.70 333.30 1,000.00 2,000.00 4,000.00 15.40 Percentage Method Tables for Income Tax Withholding TABLE 1WEEKLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $44.. ...... $0 Not over $165........ $0 Over But not over of excess over-Over But not over of excess over- - $222 $0.00 plus 10% -$44 $165 -$520. $0.00 plus 10% $165 $222 5764 $17.80 plus 15% $222 $520 $1.606 $35.50 plus 15% $520 $764 $1,789 $99.10 plus 25% $764 $1.606 $3,073 . . $198.40 plus 25% $1,606 $1,789 $3,685 $355.35 plus 28% $1,789 $3,073 -$4,597 $565.15 plus 28% $3,073 $3,685 $7,958 $836.23 plus 33% -33,685 $4,597 $8,079 $991.87 plus 33% $4,597 $7.958 $7.990 $2 296.32 plus 35% 37.958 $8,079 $9,105 $2,140.93 plus 35% $8,079 $7.990 $2.307.52 plus 39.6% 57.990 $9.105 $2.500.03 plus :39.695 $9,105 TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person the amount of wages of the amount of wages (alte subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is to withhold is withholding allowances) is: to withholdis: Not over $88 Not over $331 OverB ut not over- of excess over Over But not over- of excess over $88 9443 $000 plus 10% -$88 $331 $1.040 $0.00 plus 100% 5331 5443 $1,529 535,50 plus 15 943 $1.040 5 3212 570 90 plus 15 $1.040 $1.529 - 3.579 $198.40 plus 25% 31,529 $3.212 $6.146 $996.70 plus 254 43.212 53.579 $71369 $710 90 plus 28% 33,579 $6.148 -$9.194 $1.130.20 plus 28% $6,146 $369 $15.915 $1.772.10 plus 33% 57.369 59 194 $16.158 $15 915 $1.983 64 plus 3399 $9.194 $15.981 $459228 plus 35 $15.915 $16,158 $18.210 $4.281.76 plus 359 $15.981 $16.158 $4 615 38 plus 39.65 =$15.981 $18 210 $4.999 96 plus 39.69 $18.2.10 TABLE 3-SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person t amount of wages altes ting of the amount of wages Tha nt of income tax with all wance is Niter subtracting The amount of income tax to withholds NA withibalding allowances) is 10 withho Over Nor over 358 But not over excess ovel $180 5000 plus 109 Over But not over of excess over SABEL $ase $11270 .plus So