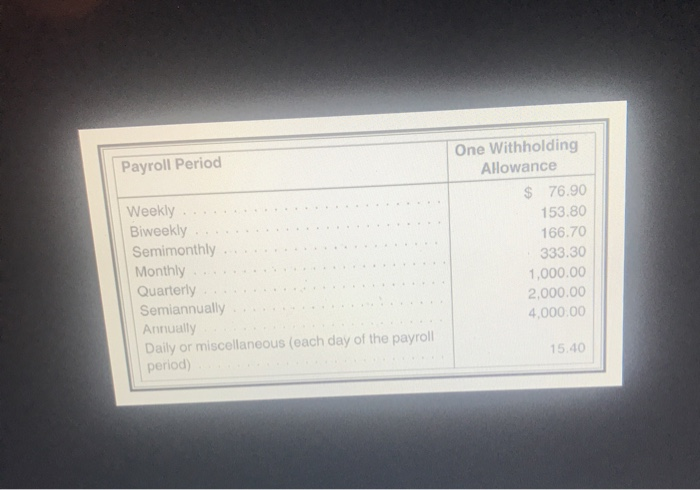

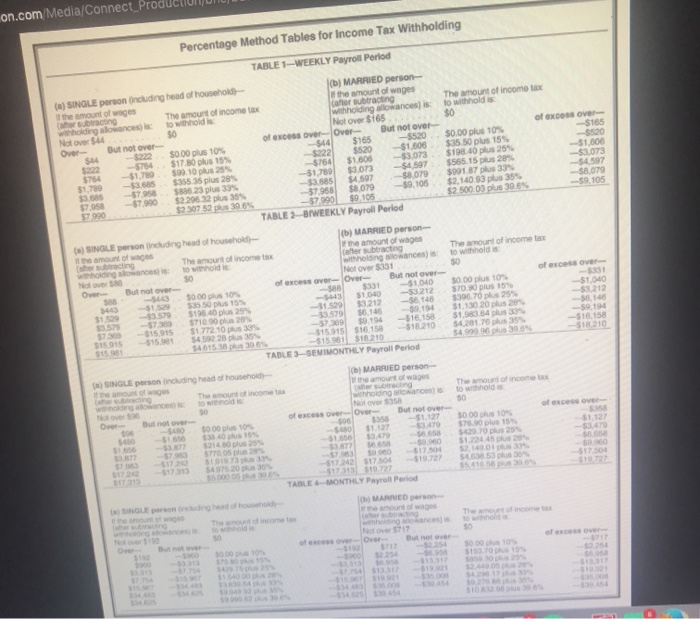

The San Bernardino County Fair hires about 170 people during fair time. Their wages range from $5.70 to $7.20. California has a state income tax of 9%. Sandy Denny earns $7.20 per hour: George Barney earns $5.70 per hour. They both worked 35 hours this week. Both are married; however, Sandy claims 2 exemptions and George claims 1 exemption. Assume a rate of 6.2% on $118,500 for Social Security and 145% for Medicare. a. What is Sandy's net pay after FIT (use the Table 71 and Table 72), Social Security tax, state income tax, and Medicare have been taken out? (Round your answer to the nearest cent.) Sandy's net pay after FIT b. What is George's net pay after the same deductions? (Round your answer to the nearest cent.) George's not pay after FIT c. How much more is Sandy's net pay versus George's net pay? (Round your answer to the nearest cent.) Difference in net pay Payroll Period Weekly ..... Biweekly .. Semimonthly Monthly Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll period) One Withholding Allowance $ 76.90 153.80 166.70 333.30 1,000.00 2,000.00 4,000.00 15.40 Percentage Method Tables for Income Tax Withholding TABLE 1-WEEKLY Payroll Period O () SINGLE person including head of household (b) MARRIED person the amount of wages the amount of wages for subtracing The amount of income tax car subtracting The amount of incomo wonganishoidis withholding s ist withholds Not Over 50 Not Over $165 But not over of Once Over Over Out not over of excess over SA 222S000 plus 10% $165 -5520 $0.00 plus 10% 5165 22 574 175 15% 22 $520 $1.506 5:15.50 plus 15% 574 -51, 25 5750 51 605 3.073 S198 40 25 $10 51 3 55 35 plus 2 31789 3.073 $4.507 556515 -3073 23 plus - 4 597 8079 S9017 33 -54597 -57.000 52.296 32 35% 37 079 59.108 2.140 3 35% SA 79 57920 2 307 52 39.6% - 57000 59105 52 500 03 plus 30.6% - 59105 TABLE WEEKLY Payroll Period () INOLE person including head household 11 ore amount of wages wornolang akowancealia to witnolds Not over OvBut notv 3 000 SO 15% 31 35 10 7 100 15315 5177200 SA $15.9 14615 D) MARRIED person me amount of wages Webtracting The amount of income wonolong allorances) a to withholda Netv5331 Over Butot over of excess over 1 S100 50.00 plus 10% - 100 -53212 570 1 5 51 319 3213 2025 157914601511020 14 16 18 ST 4 15155161 20 5151 S1213 5419 SEMIMONTHLY Payroll Period TABLE (0) SINGLE person including head of householth MARRIED person her The amount of income tas wanholang alokanom) is 30 of excess over-over- but not over 17 S 5000 515 $340 St 1117 S43 TABLE - MONTHLY Payroll Period 10 STEP