Question

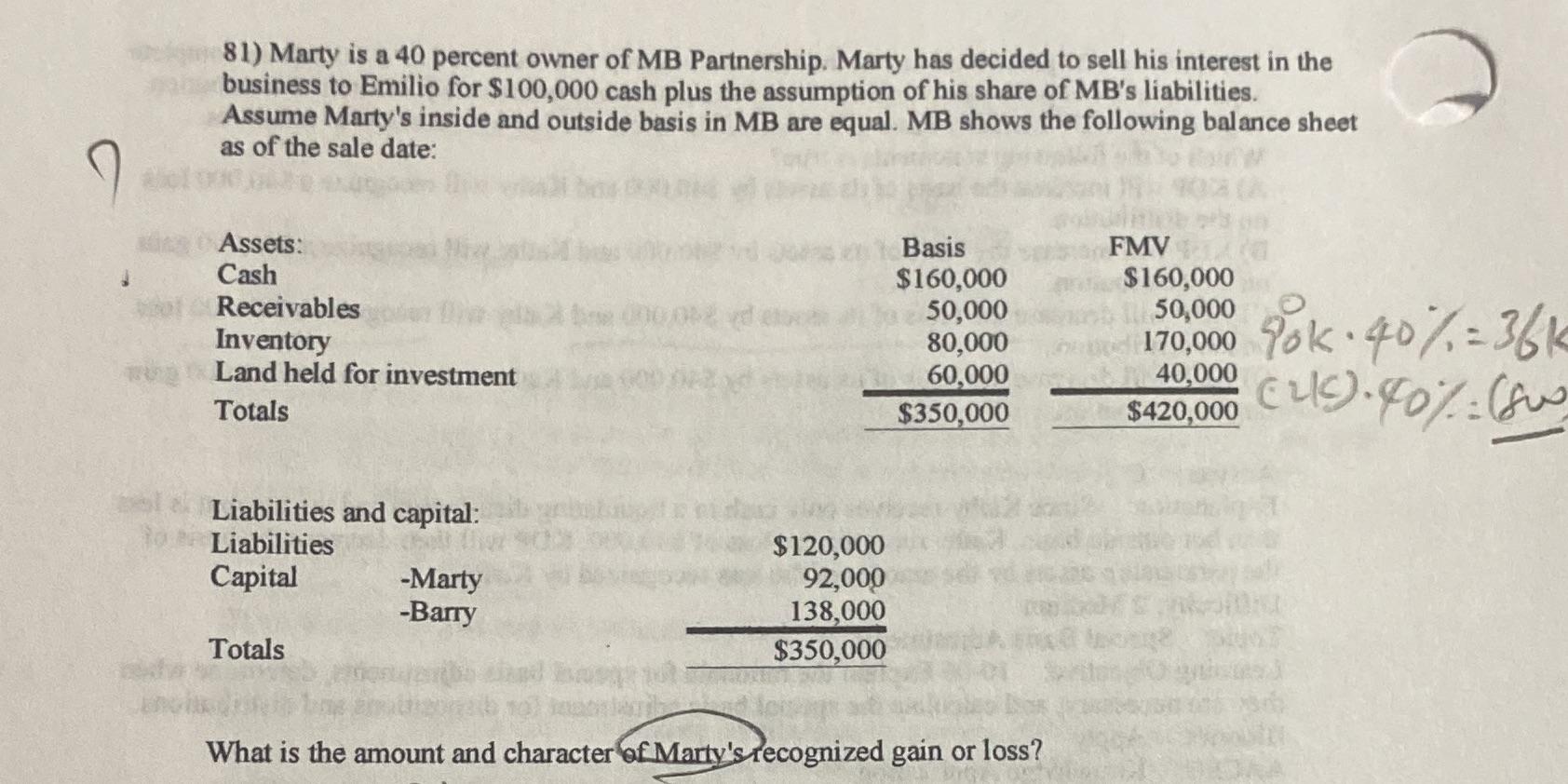

81) Marty is a 40 percent owner of MB Partnership. Marty has decided to sell his interest in the business to Emilio for $100,000

81) Marty is a 40 percent owner of MB Partnership. Marty has decided to sell his interest in the business to Emilio for $100,000 cash plus the assumption of his share of MB's liabilities. Assume Marty's inside and outside basis in MB are equal. MB shows the following balance sheet as of the sale date: Kia Assets: Cash Receivables Inventory Land held for investment Totals Liabilities and capital: Liabilities Capital Totals -Marty -Barry bax000,002 v $120,000 92,000 138,000 $350,000 Basis $160,000 50,000 80,000 60,000 $350,000 What is the amount and character of Marty's recognized gain or loss? FMV $160,000 50,000 170,000 40,000 $420,000 Pok. 40%=361 (45) 40% (80

Step by Step Solution

3.32 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Monthly Demand 5000 units Annual Demand Monthly Demand 12 500012 60000 Standard deviation of monthly demand 200 units Per unit cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Customer Service Career Success Through Customer Loyalty

Authors: Paul R. Timm

6th edition

133056252, 978-0132553001, 132553007, 978-0133056259

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App