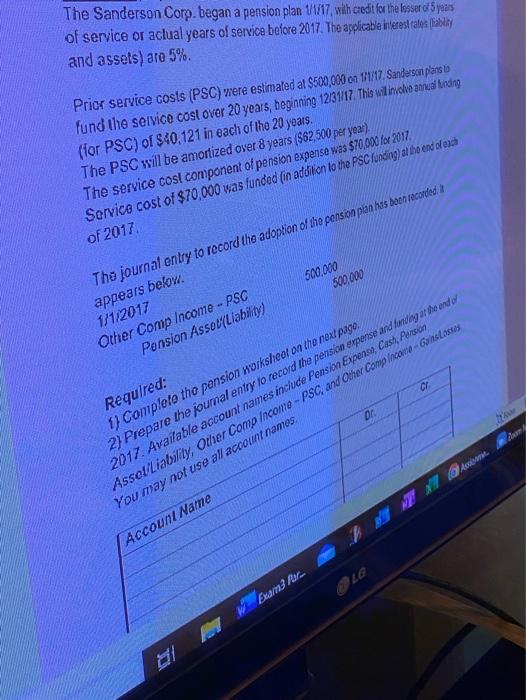

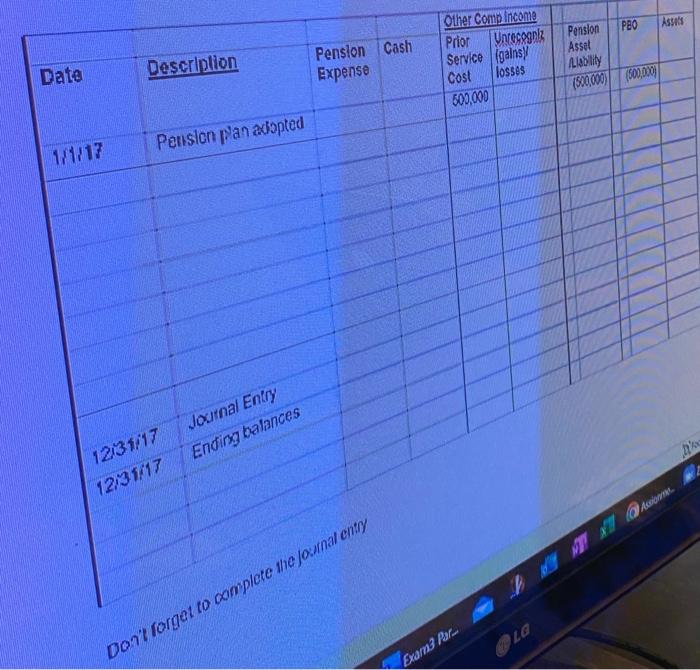

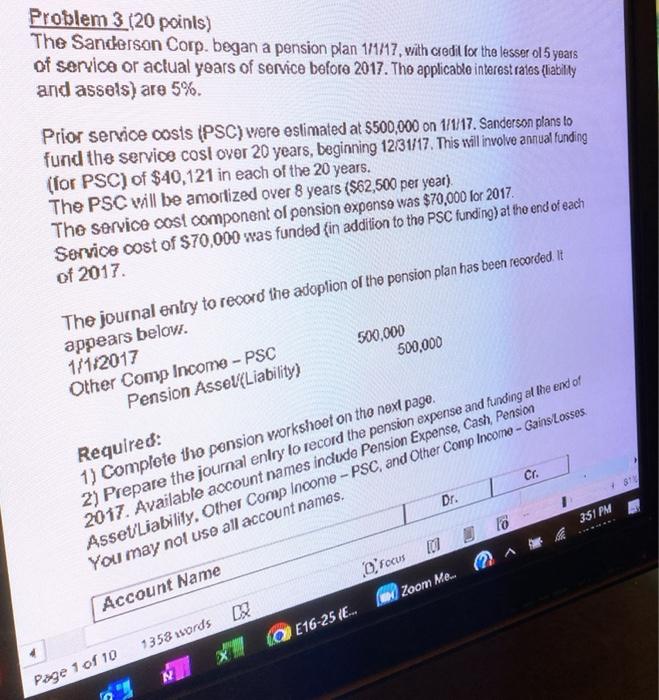

The Sanderson Corp. began a pension plan 1/1/17 with credit for the lesser d years of service or actual years of service before 2017. The applicable interest ralos liability and assets) are 5%. Prior service costs (PSC) were estimaled at $500,000 on 11/17 Sanderson plans to fund the service cost over 20 years, beginning 123117. This will involve annual bading (for PSC) of $40.121 in each of the 20 years. The PSC will be amortized over 8 years ($62,500 per year) The service cost component of pension expense was $70,000 for 2017 Service cost of $70,000 was funded (in adehition to the PSCfunding) at the end och of 2017 The journal entry to record the adoption of the pension plan has been recorded 500,000 50,000 appears below. 1/1/2017 Other Comp Income - PSC Pension Assou(Liability Or Required: 1) Complete the pension workshoot on the next page. 2) Prepare the joumal entry to record the penisi expense and landing at hoando 2017. Available account names include Pension Expense, Cast, Perosion Assot liability, Other Comp Income - PSC and Other Compleanno - Garnstosas You may not use all account names. Account Name Exam PBO Assets Prior Other Comp Income Vnreggel Service galns Cost losses Pension Cash Expense Pension Assal Alability Description Date (500.000 500.000 500.000 Pension pan adopted 1/1/17 Journal Entry Ending balances 12/31/17 12/31/17 NOT AT Scome Don't forget to complete the founal entry Exam Par Problem 3 (20 points) The Sanderson Corp. began a pension plan 111/17, with credit for the lesser ol 5 years of service or actual years of service before 2017. Tho applicable interest rates (lasitty and assets) are 5%. Prior service costs (PSC) were estimated at $500,000 on 171717. Sanderson plans to fund the service cost over 20 years, beginning 12/31/17. This will involve annual funding (for PSC) of $40,121 in each of the 20 years. The PSC will be amortized over 8 years ($62,500 per year). The service cost component of pension expense was $70,000 for 2017. Service cost of $70,000 was funded {in addition to the PSC funding) at the end of each of 2017 The journal entry to record the adoption of the pension plan has been recorded. It appears below. 1/1/2017 Other Comp Income - PSC 500,000 Pension Assel(Liability) 500,000 Cr. 878 Required: 1) Complete the pension worksheet on the next page. 2) Prepare the journal entry to record the pension expense and funding at the end of 2017. Available account names induxe Pension Expense, Cash, Pension Asset Liability. Other Comp Income - PSC, and Other Comp Income - Gains Losses You may not use all account names. Dr. 351 PM D'Focus Zoom Mew 2 Account Name E16-25 (E... 1358 usords LX Page 1 of 10