Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Sandhill Mills Company has just disclosed the following financial information in its annual report: sales of $1.48 million, cost of zoods sold of $818,600,

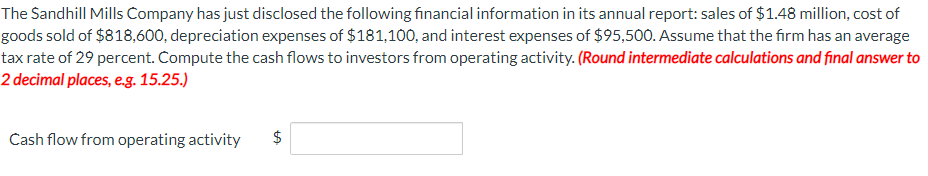

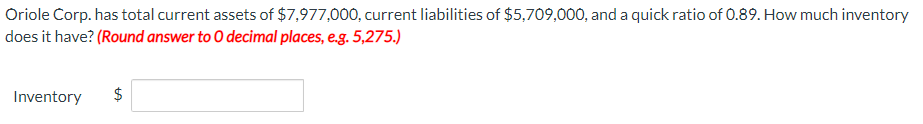

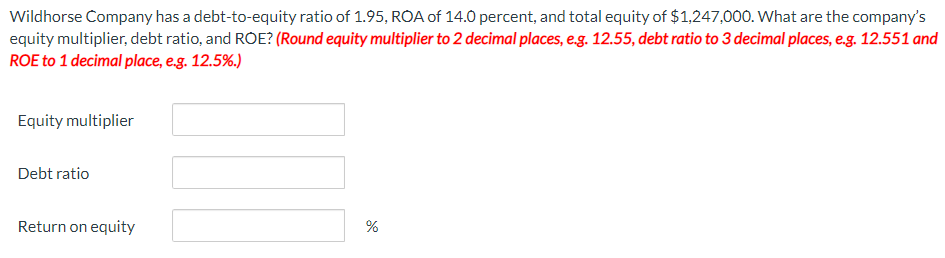

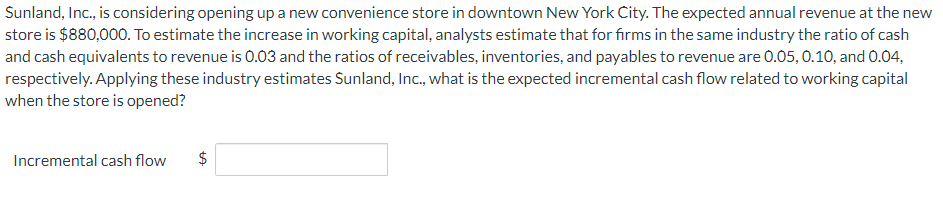

The Sandhill Mills Company has just disclosed the following financial information in its annual report: sales of $1.48 million, cost of zoods sold of $818,600, depreciation expenses of $181,100, and interest expenses of $95,500. Assume that the firm has an average ax rate of 29 percent. Compute the cash flows to investors from operating activity. (Round intermediate calculations and final answer to decimal places, e.g. 15.25.) Cash flow from operating activity $ Oriole Corp. has total current assets of $7,977,000, current liabilities of $5,709,000, and a quick ratio of 0.89 . How much inventory does it have? (Round answer to 0 decimal places, e.g. 5,275.) Inventory \$ Wildhorse Company has a debt-to-equity ratio of 1.95,ROA of 14.0 percent, and total equity of $1,247,000. What are the company's equity multiplier, debt ratio, and ROE? (Round equity multiplier to 2 decimal places, e.g. 12.55 , debt ratio to 3 decimal places, e.g. 12.551 and ROE to 1 decimal place, e.g. 12.5\%.) Equity multiplier Debt ratio Return on equity % Sunland, Inc., is considering opening up a new convenience store in downtown New York City. The expected annual revenue at the new store is $880,000. To estimate the increase in working capital, analysts estimate that for firms in the same industry the ratio of cash and cash equivalents to revenue is 0.03 and the ratios of receivables, inventories, and payables to revenue are 0.05,0.10, and 0.04 , respectively. Applying these industry estimates Sunland, Inc., what is the expected incremental cash flow related to working capital when the store is opened? Incremental cash flow $

The Sandhill Mills Company has just disclosed the following financial information in its annual report: sales of $1.48 million, cost of zoods sold of $818,600, depreciation expenses of $181,100, and interest expenses of $95,500. Assume that the firm has an average ax rate of 29 percent. Compute the cash flows to investors from operating activity. (Round intermediate calculations and final answer to decimal places, e.g. 15.25.) Cash flow from operating activity $ Oriole Corp. has total current assets of $7,977,000, current liabilities of $5,709,000, and a quick ratio of 0.89 . How much inventory does it have? (Round answer to 0 decimal places, e.g. 5,275.) Inventory \$ Wildhorse Company has a debt-to-equity ratio of 1.95,ROA of 14.0 percent, and total equity of $1,247,000. What are the company's equity multiplier, debt ratio, and ROE? (Round equity multiplier to 2 decimal places, e.g. 12.55 , debt ratio to 3 decimal places, e.g. 12.551 and ROE to 1 decimal place, e.g. 12.5\%.) Equity multiplier Debt ratio Return on equity % Sunland, Inc., is considering opening up a new convenience store in downtown New York City. The expected annual revenue at the new store is $880,000. To estimate the increase in working capital, analysts estimate that for firms in the same industry the ratio of cash and cash equivalents to revenue is 0.03 and the ratios of receivables, inventories, and payables to revenue are 0.05,0.10, and 0.04 , respectively. Applying these industry estimates Sunland, Inc., what is the expected incremental cash flow related to working capital when the store is opened? Incremental cash flow $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started