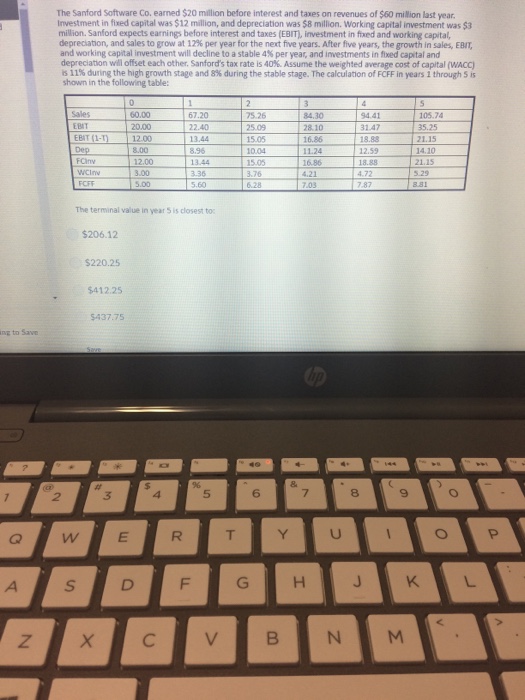

The Sanford Software Co. earned $20 million before interest and taxes on revenues of $60 million last year Investment in fixed capital was $12 million, and depreciation was $8 million. Working capital investment was $3 million. Sanford expects earnings before interest and taxes (EBIT), investment in frxed and working capital, depreciation, and sales to grow at 12% per year for the next five years. After five years, the growth in sales, Eat and working capital investment will decline to a stable 4% per year, and investments in fixed capital and depreciation will offset each other. Sanford's tax rate is 40%. Assume the weighted average cost of capital (WACC) 611% during the high growth stage and 8% during the stable stage. The calculation of FCFF in years 1 through S is shown in the following table: 60.00 20.00 112.00 8.00 67.20 2.40 13.44 8.96 13.44 5.26 25.09 15.05 10.04 15.05 3.76 6.28 84.30 28.10 16.86 11.24 16.86 4.21 .03 4.41 31.47 18.88 2.59 18.88 105.74 EBIT 5.25 21.15 14.10 21.15 .29 EBIT (1-T) 5.00 The terminal value in year 5 is closest to $206.12 $220.25 $412.25 $437.75 ng to Save 5 6 8 The Sanford Software Co. earned $20 million before interest and taxes on revenues of $60 million last year Investment in fixed capital was $12 million, and depreciation was $8 million. Working capital investment was $3 million. Sanford expects earnings before interest and taxes (EBIT), investment in frxed and working capital, depreciation, and sales to grow at 12% per year for the next five years. After five years, the growth in sales, Eat and working capital investment will decline to a stable 4% per year, and investments in fixed capital and depreciation will offset each other. Sanford's tax rate is 40%. Assume the weighted average cost of capital (WACC) 611% during the high growth stage and 8% during the stable stage. The calculation of FCFF in years 1 through S is shown in the following table: 60.00 20.00 112.00 8.00 67.20 2.40 13.44 8.96 13.44 5.26 25.09 15.05 10.04 15.05 3.76 6.28 84.30 28.10 16.86 11.24 16.86 4.21 .03 4.41 31.47 18.88 2.59 18.88 105.74 EBIT 5.25 21.15 14.10 21.15 .29 EBIT (1-T) 5.00 The terminal value in year 5 is closest to $206.12 $220.25 $412.25 $437.75 ng to Save 5 6 8