Answered step by step

Verified Expert Solution

Question

1 Approved Answer

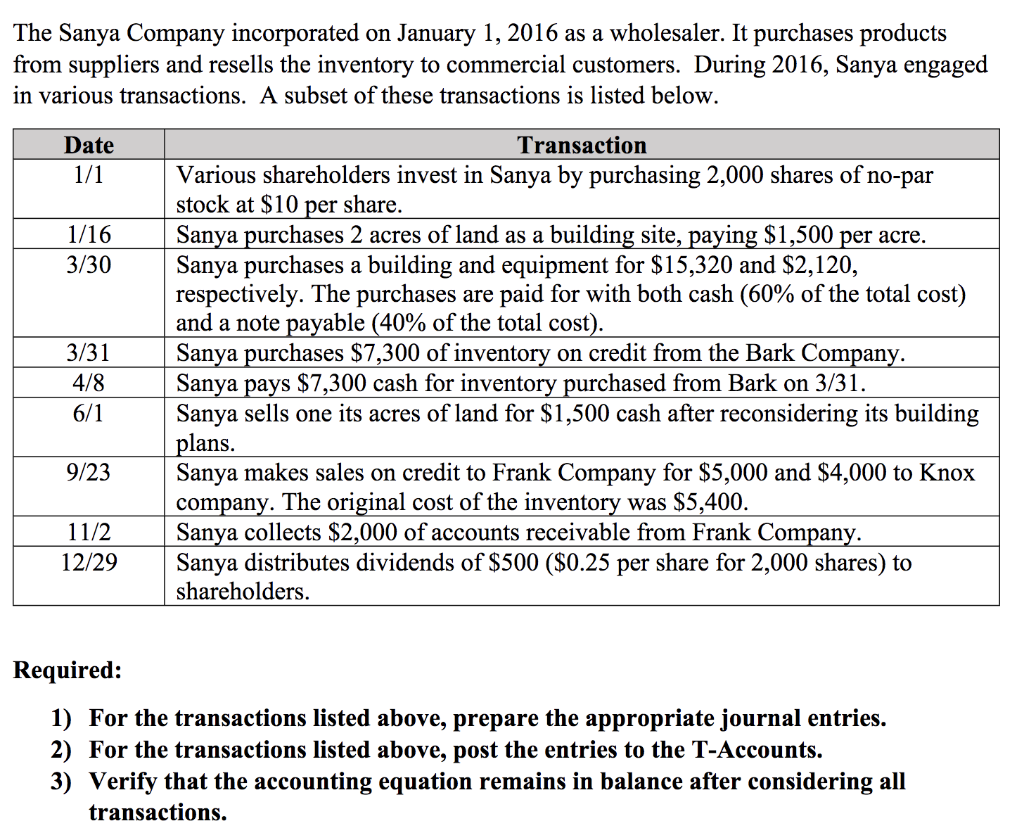

The Sanya Company incorporated on January 1, 2016 as a wholesaler. It purchases products from suppliers and resells the inventory to commercial customers. During 2016,

The Sanya Company incorporated on January 1, 2016 as a wholesaler. It purchases products

from suppliers and resells the inventory to commercial customers. During 2016, Sanya engaged

in various transactions. A subset of these transactions is listed below.

Here are templates that are useful, but I am still confused with the processes and how to set them up.

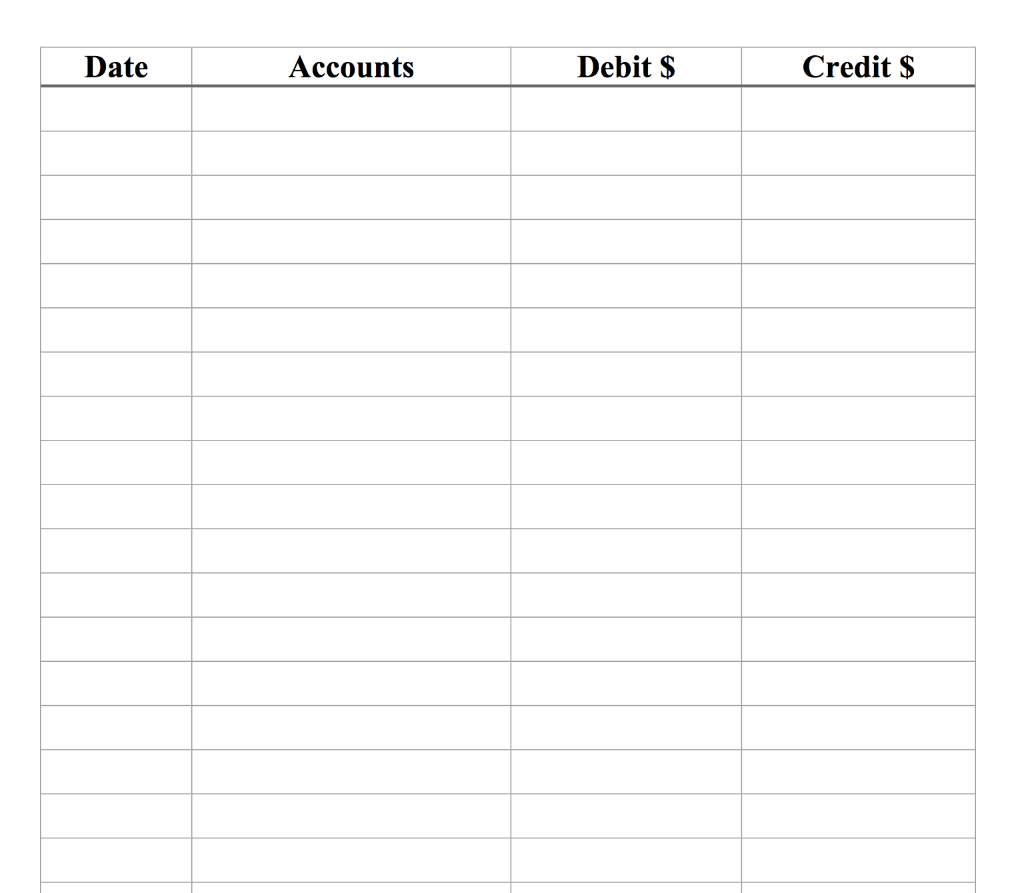

1)

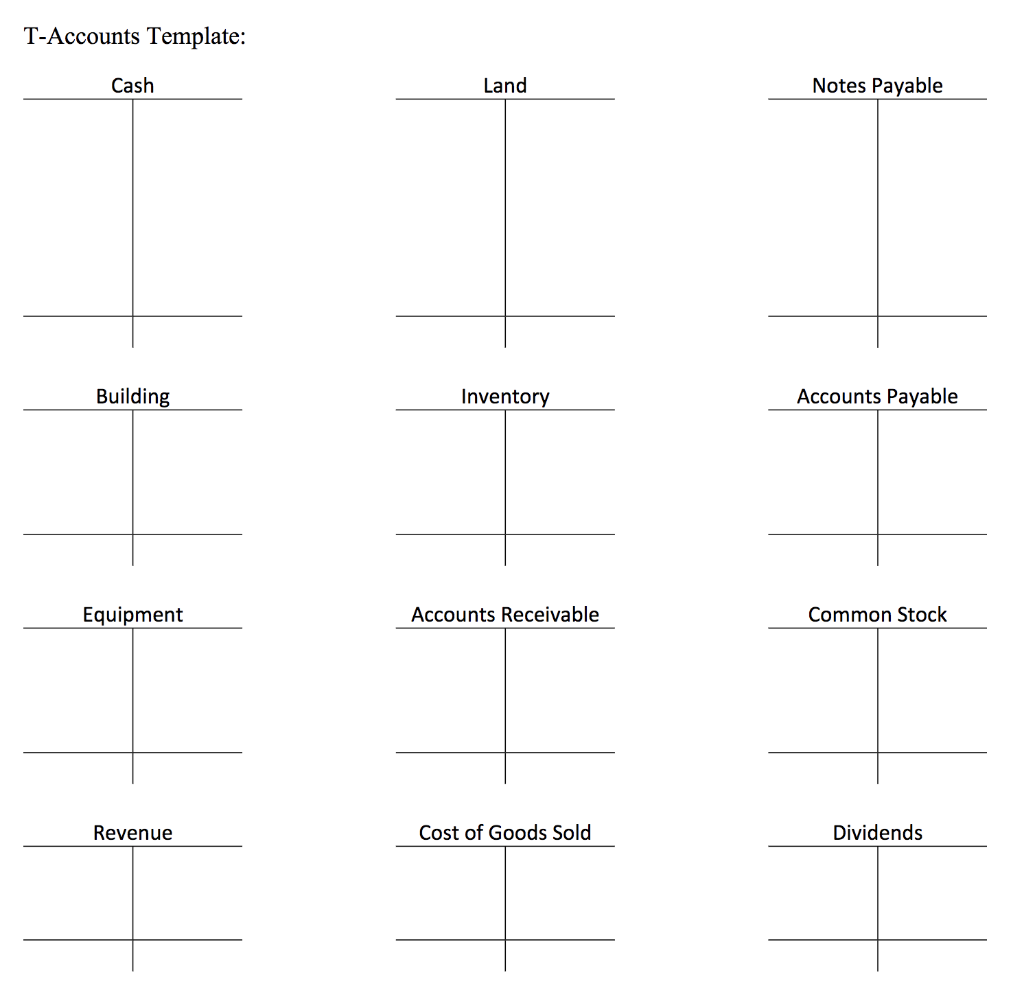

2)

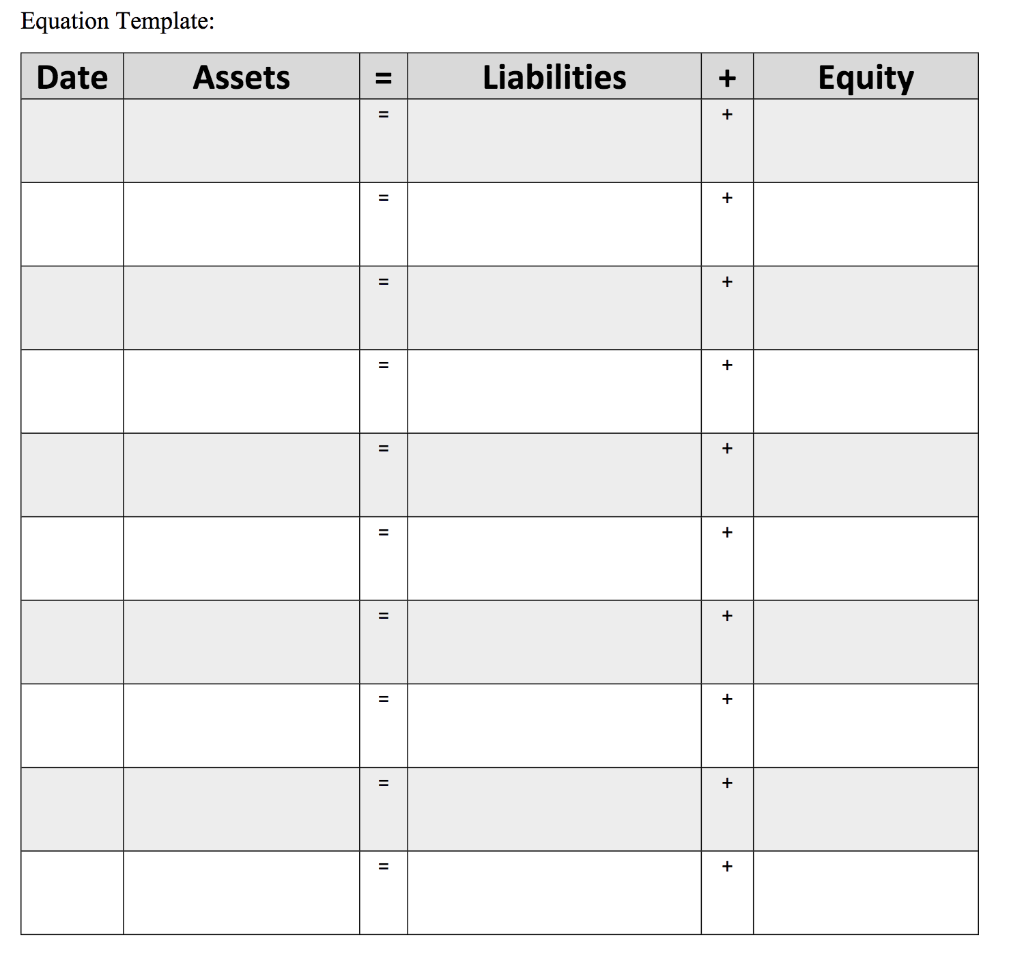

3)

The Sanya Company incorporated on January 1, 2016 as a wholesaler. It purchases products from suppliers and resells the inventory to commercial customers. During 2016, Sanya engaged in various transactions. A subset of these transactions is listed below Date Transaction Various shareholders invest in Sanya by purchasing 2,000 shares of no-par stock at $10 per share. Sanya purchases 2 acres of land as a building site, paying $1.500 per acre Sanya purchases a building and equipment for $15,320 and $2,120, respectively. The purchases are paid for with both cash (60% of the total cost) and a note payable (40% of the total cost Sanya purchases $7,300 of inventory on credit from the Bark Compan Sanya pays $7,300 cash for inventory purchased from Bark on 3/31 Sanya sells one its acres of land for $1,500 cash after reconsidering its building 1/16 3/30 3/31 4/8 lans. Sanya makes sales on credit to Frank Company for S5,000 and $4,000 to Knox company. The original cost of the inventory was $5.400. Sanya collects $2,000 of accounts receivable from Frank Compan 9/23 11/2 12/29Sanya distributes dividends of S500 (S0.25 per share for 2,000 shares) to shareholders Required: 1) For the transactions listed above, prepare the appropriate journal entries. 2) For the transactions listed above, post the entries to the T-Accounts. 3) Verify that the accounting equation remains in balance after considering all transactions Credit $ Debit S Accounts Date T-Accounts Template: Land Cash Notes Payable Building Accounts Payable Inventory Equipment Accounts Receivable Common Stock Cost of Goods Sold Dividends Revenue Equation Template: Date Assets Liabilities Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started