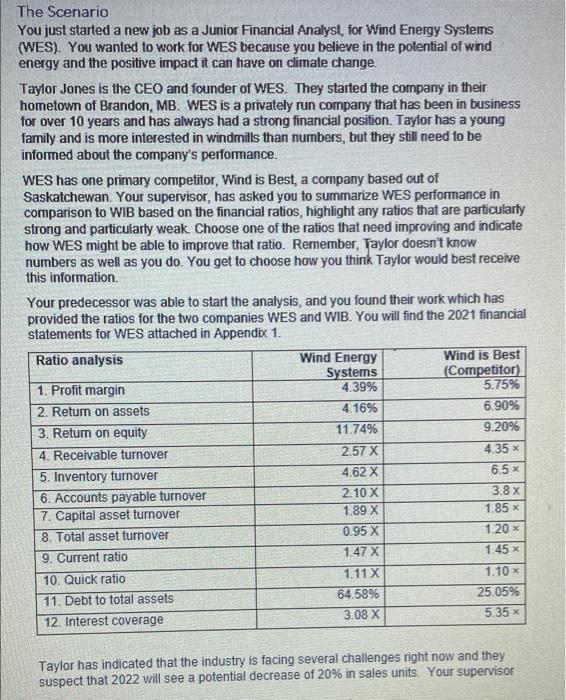

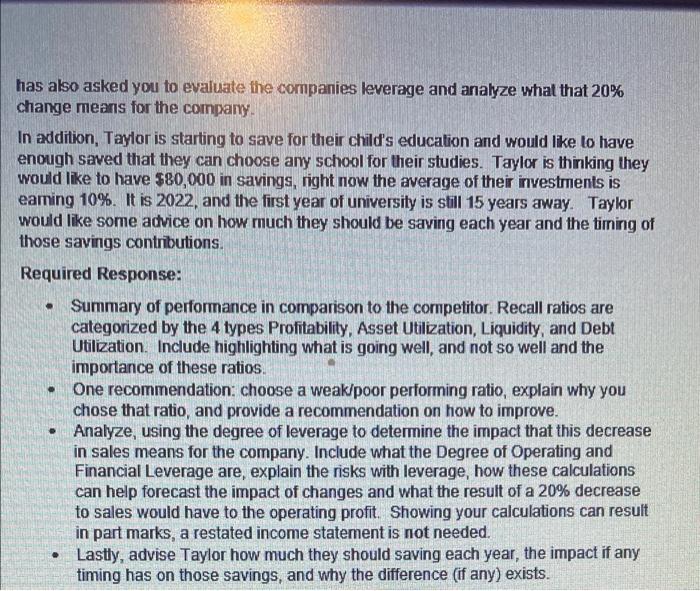

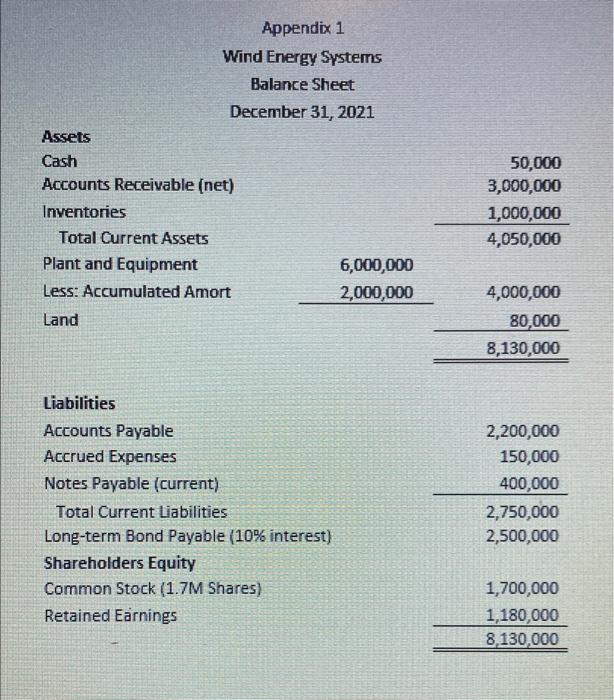

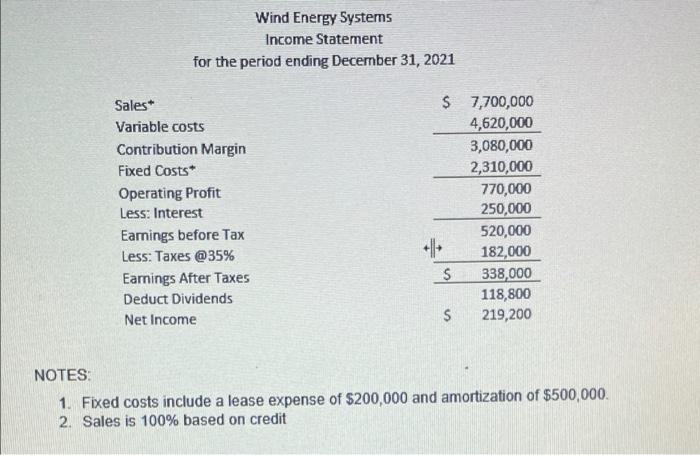

The Scenario You just started a new job as a Junior Financial Analyst, for Wind Energy Systems (WES). You wanted to work for WES because you believe in the potential of wind energy and the positive impact it can have on climate change, Taylor Jones is the CEO and founder of WES. They started the company in their hometown of Brandon, MB. WES is a privately run company that has been in business for over 10 years and has always had a strong financial position. Taylor has a young family and is more interested in windmills than numbers, but they still need to be informed about the company's performance. WES has one primary competitor, Wind is Best, a company based out of Saskatchewan. Your supervisor, has asked you to summarize WES performance in comparison to WIB based on the financial ratios, highlight any ratios that are particularly strong and particularly weak. Choose one of the ratios that need improving and indicate how WES might be able to improve that ratio. Remember, Taylor doesn't know numbers as well as you do. You get to choose how you think Taylor would best receive this information. Your predecessor was able to start the analysis, and you found their work which has provided the ratios for the two companies WES and WIB. You will find the 2021 financial statements for WES attached in Appendix 1. Ratio analysis Wind Energy Wind is Best Systems (Competitor) 1. Profit margin 4.39% 5.75% 2. Retum on assets 4.16% 6.90% 3. Return on equity 11.74% 9.20% 4. Receivable turnover 2.57 X 4.35 x 5. Inventory turnover 4.62 X 6.5 x 6. Accounts payable turnover 2.10 X 3.8 x 7. Capital asset turnover 1.89 X 1.85 8. Total asset turnover 0.95 X 1.20 x 9. Current ratio 1.47 X 1.45 x 10. Quick ratio 1.11 X 1.10 11. Debt to total assets 64.58% 25.05% 12. Interest coverage 3.08 X 5.35 Taylor has indicated that the industry is facing several challenges right now and they suspect that 2022 will see a potential decrease of 20% in sales units. Your supervisor has also asked you to evaluate the companies leverage and analyze what that 20% change means for the company. In addition, Taylor is starting to save for their child's education and would like to have enough saved that they can choose any school for their studies. Taylor is thinking they would like to have $80,000 in savings, right now the average of their investments is eaming 10%. It is 2022, and the first year of university is still 15 years away. Taylor would like some advice on how much they should be saving each year and the timing of those savings contributions. Required Response: Summary of performance in comparison to the competitor. Recall ratios are categorized by the 4 types Profitability, Asset Utilization, Liquidity, and Debt Utilization. Include highlighting what is going well, and not so well and the importance of these ratios. One recommendation: choose a weak/poor performing ratio, explain why you chose that ratio, and provide a recommendation on how to improve. Analyze, using the degree of leverage to determine the impact that this decrease in sales means for the company. Include what the Degree of Operating and Financial Leverage are, explain the risks with leverage, how these calculations can help forecast the impact of changes and what the result of a 20% decrease to sales would have to the operating profit. Showing your calculations can result in part marks, a restated income statement is not needed. Lastly, advise Taylor how much they should saving each year, the impact if any timing has on those savings, and why the difference (if any) exists. . Appendix 1 Wind Energy Systems Balance Sheet December 31, 2021 Assets Cash Accounts Receivable (net) Inventories Total Current Assets Plant and Equipment 6,000,000 Less: Accumulated Amort 2,000,000 Land 50,000 3,000,000 1,000,000 4,050,000 4,000,000 80,000 8,130,000 Liabilities Accounts Payable Accrued Expenses Notes Payable (current) Total Current Liabilities Long-term Bond Payable (10% interest) Shareholders Equity Common Stock (1.7M Shares) Retained Earnings 2,200,000 150,000 400,000 2,750,000 2,500,000 1,700,000 1,180,000 8,130,000 Wind Energy Systems Income Statement for the period ending December 31, 2021 Sales* Variable costs Contribution Margin Fixed Costs Operating Profit Less: Interest Earnings before Tax Less: Taxes @35% Earnings After Taxes Deduct Dividends Net Income $ 7,700,000 4,620,000 3,080,000 2,310,000 770,000 250,000 520,000 182,000 S 338,000 118,800 S 219,200 +1 NOTES: 1. Fixed costs include a lease expense of $200,000 and amortization of $500,000. 2. Sales is 100% based on credit The Scenario You just started a new job as a Junior Financial Analyst, for Wind Energy Systems (WES). You wanted to work for WES because you believe in the potential of wind energy and the positive impact it can have on climate change, Taylor Jones is the CEO and founder of WES. They started the company in their hometown of Brandon, MB. WES is a privately run company that has been in business for over 10 years and has always had a strong financial position. Taylor has a young family and is more interested in windmills than numbers, but they still need to be informed about the company's performance. WES has one primary competitor, Wind is Best, a company based out of Saskatchewan. Your supervisor, has asked you to summarize WES performance in comparison to WIB based on the financial ratios, highlight any ratios that are particularly strong and particularly weak. Choose one of the ratios that need improving and indicate how WES might be able to improve that ratio. Remember, Taylor doesn't know numbers as well as you do. You get to choose how you think Taylor would best receive this information. Your predecessor was able to start the analysis, and you found their work which has provided the ratios for the two companies WES and WIB. You will find the 2021 financial statements for WES attached in Appendix 1. Ratio analysis Wind Energy Wind is Best Systems (Competitor) 1. Profit margin 4.39% 5.75% 2. Retum on assets 4.16% 6.90% 3. Return on equity 11.74% 9.20% 4. Receivable turnover 2.57 X 4.35 x 5. Inventory turnover 4.62 X 6.5 x 6. Accounts payable turnover 2.10 X 3.8 x 7. Capital asset turnover 1.89 X 1.85 8. Total asset turnover 0.95 X 1.20 x 9. Current ratio 1.47 X 1.45 x 10. Quick ratio 1.11 X 1.10 11. Debt to total assets 64.58% 25.05% 12. Interest coverage 3.08 X 5.35 Taylor has indicated that the industry is facing several challenges right now and they suspect that 2022 will see a potential decrease of 20% in sales units. Your supervisor has also asked you to evaluate the companies leverage and analyze what that 20% change means for the company. In addition, Taylor is starting to save for their child's education and would like to have enough saved that they can choose any school for their studies. Taylor is thinking they would like to have $80,000 in savings, right now the average of their investments is eaming 10%. It is 2022, and the first year of university is still 15 years away. Taylor would like some advice on how much they should be saving each year and the timing of those savings contributions. Required Response: Summary of performance in comparison to the competitor. Recall ratios are categorized by the 4 types Profitability, Asset Utilization, Liquidity, and Debt Utilization. Include highlighting what is going well, and not so well and the importance of these ratios. One recommendation: choose a weak/poor performing ratio, explain why you chose that ratio, and provide a recommendation on how to improve. Analyze, using the degree of leverage to determine the impact that this decrease in sales means for the company. Include what the Degree of Operating and Financial Leverage are, explain the risks with leverage, how these calculations can help forecast the impact of changes and what the result of a 20% decrease to sales would have to the operating profit. Showing your calculations can result in part marks, a restated income statement is not needed. Lastly, advise Taylor how much they should saving each year, the impact if any timing has on those savings, and why the difference (if any) exists. . Appendix 1 Wind Energy Systems Balance Sheet December 31, 2021 Assets Cash Accounts Receivable (net) Inventories Total Current Assets Plant and Equipment 6,000,000 Less: Accumulated Amort 2,000,000 Land 50,000 3,000,000 1,000,000 4,050,000 4,000,000 80,000 8,130,000 Liabilities Accounts Payable Accrued Expenses Notes Payable (current) Total Current Liabilities Long-term Bond Payable (10% interest) Shareholders Equity Common Stock (1.7M Shares) Retained Earnings 2,200,000 150,000 400,000 2,750,000 2,500,000 1,700,000 1,180,000 8,130,000 Wind Energy Systems Income Statement for the period ending December 31, 2021 Sales* Variable costs Contribution Margin Fixed Costs Operating Profit Less: Interest Earnings before Tax Less: Taxes @35% Earnings After Taxes Deduct Dividends Net Income $ 7,700,000 4,620,000 3,080,000 2,310,000 770,000 250,000 520,000 182,000 S 338,000 118,800 S 219,200 +1 NOTES: 1. Fixed costs include a lease expense of $200,000 and amortization of $500,000. 2. Sales is 100% based on credit