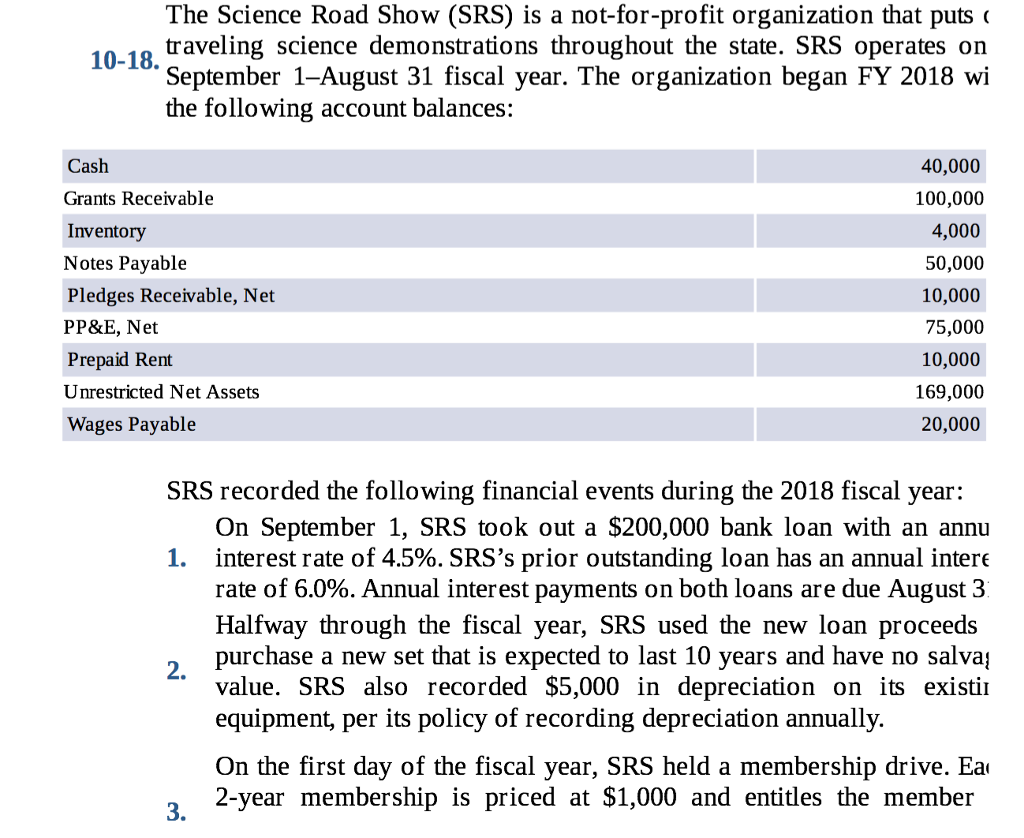

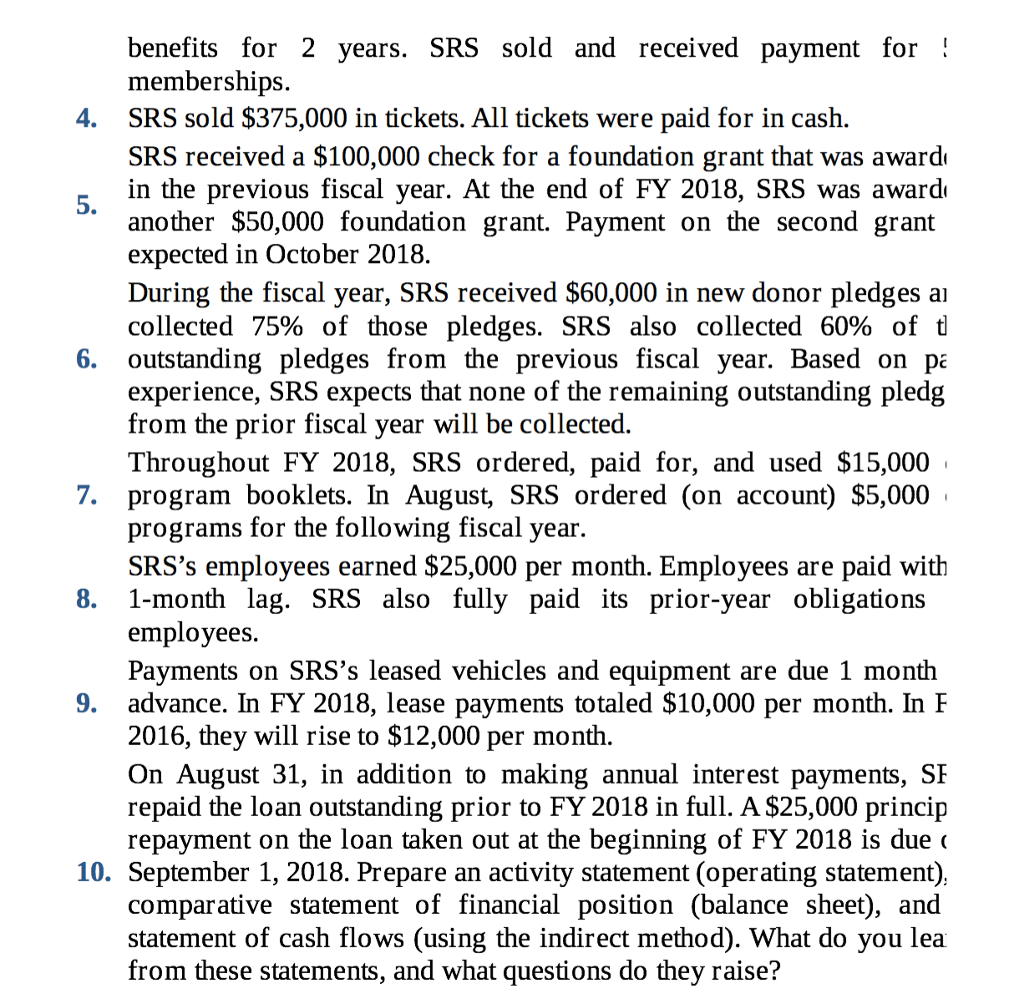

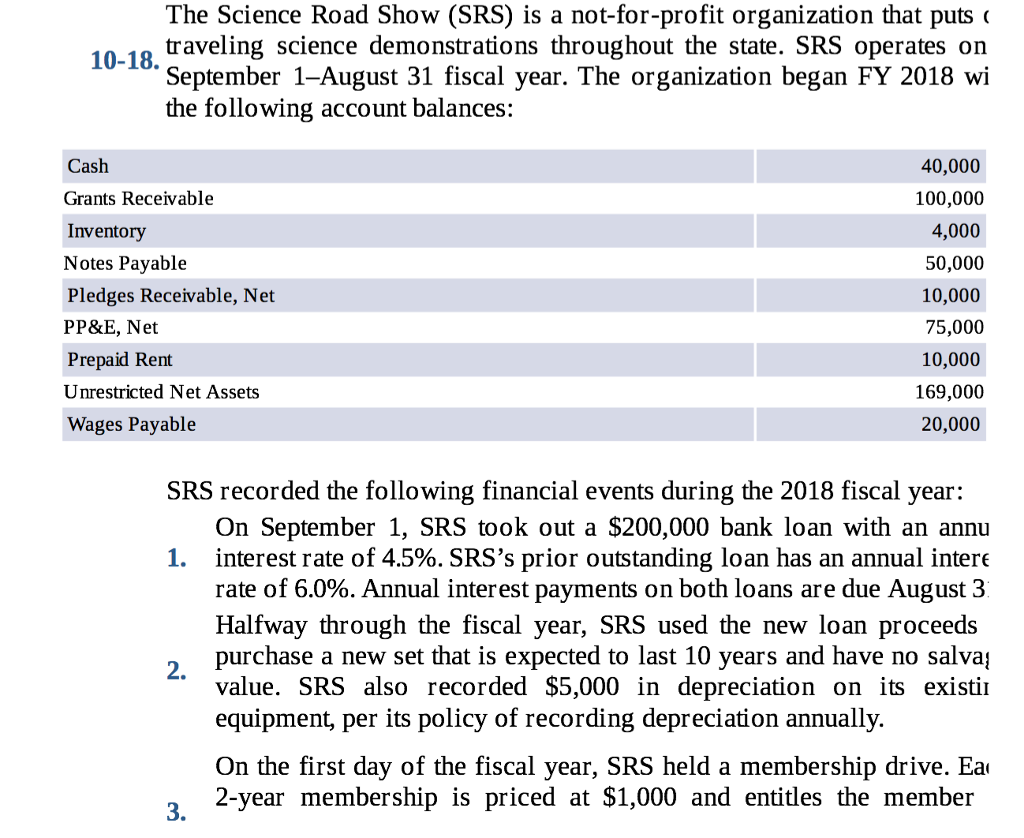

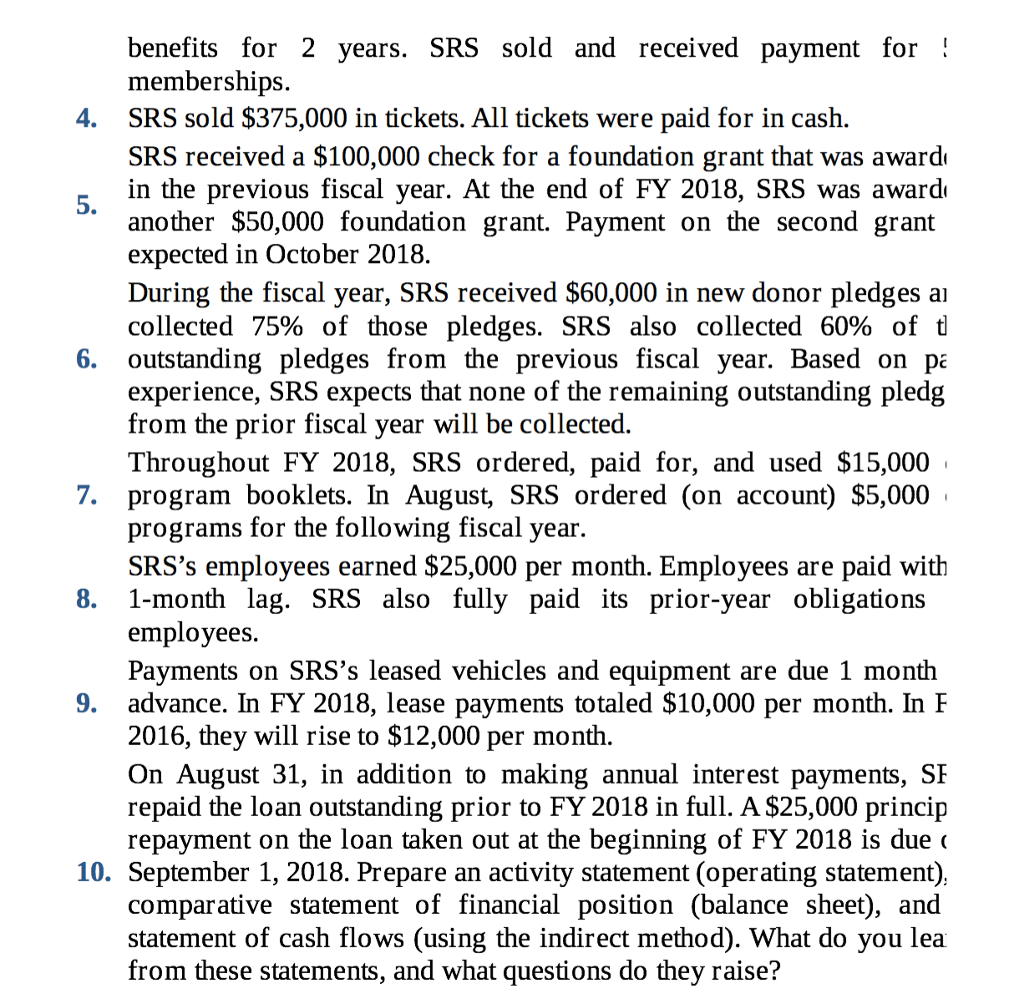

The Science Road Show (SRS is a not-for-profit organization that puts traveling science demonstrations throughout the state. SRS operates on 10-18. September 1-August 31 fiscal year. The organization began FY 2018 wi the following account balances: 40,000 Cash 100,000 Grants Receivable 4,000 Inventory 50,000 Notes Payable 10,000 Pledges Receivable, Net 75,000 PP&E, Net Prepaid Rent 10,000 Unrestricted Net Assets 169,000 wages payable 20,000 SRS recorded the following financial events during the 2018 fiscal year: On September 1, SRS took out a $200,000 bank loan with an annu 1. interest rate of 4.5%. SRS's prior outstanding loan has an annual intere rate of 6.0%. Annual interest payments on both loans are due August 3 Halfway through the fiscal year, SRS used the new loan proceeds purchase a new set that is expected to last 10 years and have no salvag 2. value. SRS also recorded $5,000 in depreciation on its existin equipment, per its policy of recording depreciation annually. On the first day of the fiscal year, SRS held a membership drive. Ea 2-year membership is priced at $1,000 and entitles the member 3. The Science Road Show (SRS is a not-for-profit organization that puts traveling science demonstrations throughout the state. SRS operates on 10-18. September 1-August 31 fiscal year. The organization began FY 2018 wi the following account balances: 40,000 Cash 100,000 Grants Receivable 4,000 Inventory 50,000 Notes Payable 10,000 Pledges Receivable, Net 75,000 PP&E, Net Prepaid Rent 10,000 Unrestricted Net Assets 169,000 wages payable 20,000 SRS recorded the following financial events during the 2018 fiscal year: On September 1, SRS took out a $200,000 bank loan with an annu 1. interest rate of 4.5%. SRS's prior outstanding loan has an annual intere rate of 6.0%. Annual interest payments on both loans are due August 3 Halfway through the fiscal year, SRS used the new loan proceeds purchase a new set that is expected to last 10 years and have no salvag 2. value. SRS also recorded $5,000 in depreciation on its existin equipment, per its policy of recording depreciation annually. On the first day of the fiscal year, SRS held a membership drive. Ea 2-year membership is priced at $1,000 and entitles the member 3