Answered step by step

Verified Expert Solution

Question

1 Approved Answer

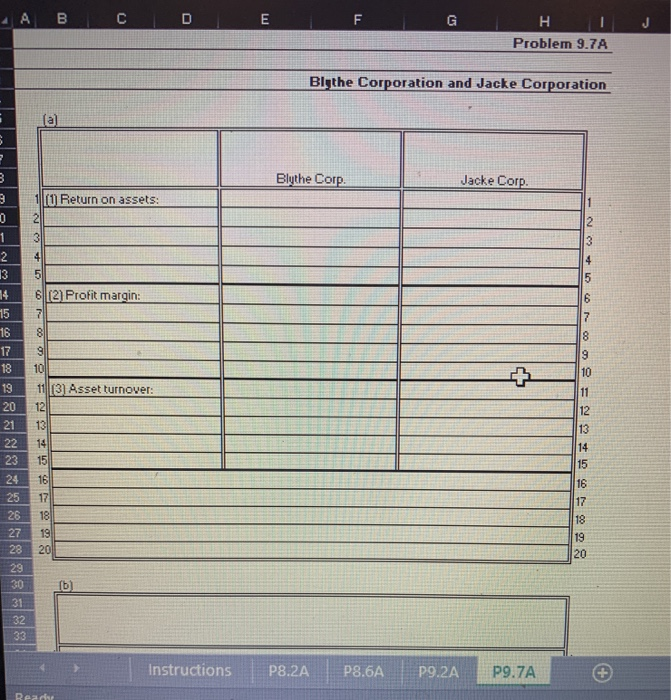

the second photo is if the spreadsheet we were provided by the instructor P9.7A (LO 5), AN Blythe Corporation and Jacke Corporation, two companies of

the second photo is if the spreadsheet we were provided by the instructor

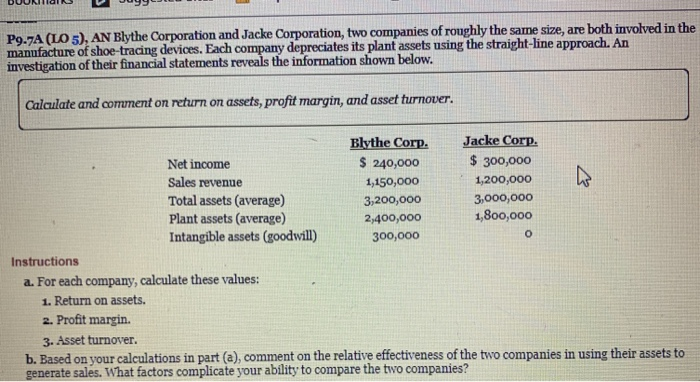

P9.7A (LO 5), AN Blythe Corporation and Jacke Corporation, two companies of roughly the same size, are both involved in the manufacture of shoe-tracing devices. Each company depreciates its plant assets using the straight-line approach. An investigation of their financial statements reveals the information shown below. Calculate and comment on return on assets, profit margin, and asset turnover. Blythe Corp. Jacke Corp. Net income $ 240,000 $ 300,000 Sales revenue 1,150,000 1,200,000 Total assets (average) 3,200,000 3,000,000 Plant assets (average) 2,400,000 1,800,000 Intangible assets (goodwill) 300,000 Instructions a. For each company, calculate these values: 1. Return on assets. 2. Profit margin. 3. Asset turnover. b. Based on your calculations in part (a), comment on the relative effectiveness of the two companies in using their assets to generate sales. What factors complicate your ability to compare the two companies? E G H I Problem 9.7A Blythe Corporation and Jacke Corporation Blythe Corp Jacke Corp. LO Return on assets: WS2 6 (2) Profit margin: 11 (3) Asset turnover: / BE LU / Instructions P8.2A P8.6A P9.2A P9.7A Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started