Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The second picture is the question the first picture is a sample of how to solve the question, either excel functions or financial calculator functions

The second picture is the question the first picture is a sample of how to solve the question, either excel functions or financial calculator functions can be used, thank you.

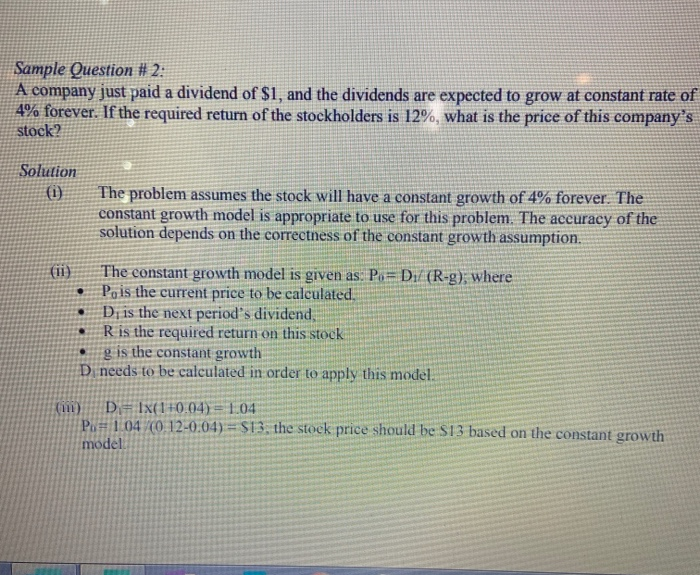

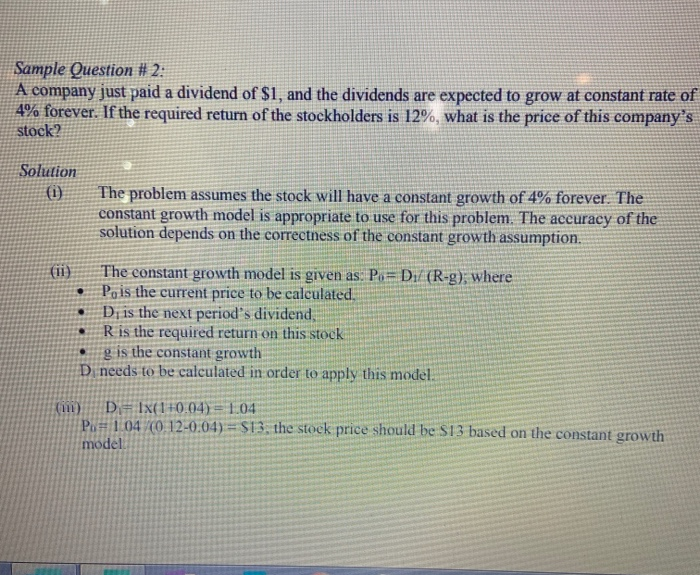

Sample Question # 2: A company just paid a dividend of $1, and the dividends are expected to grow at constant rate of 4% forever. If the required return of the stockholders is 12%, what is the price of this company's stock? Solution (0) The problem assumes the stock will have a constant growth of 4% forever. The constant growth model is appropriate to use for this problem. The accuracy of the solution depends on the correctness of the constant growth assumption. (11) The constant growth model is given as Pos Dr(R-), where Po is the current price to be calculated. Di is the next period's dividend, R is the required return on this stock g is the constant growth D needs to be calculated in order to apply this model. D = Ix(1 +0.04) = 1.04 P.= 104 (0.12-004) = $13, the stock price should be $13 based on the constant growth 8. Hackworth Company's common stock is expected to pay a $4.10 dividend in the coming year. If investors require a 13% return and the growth rate in dividends is expected to be 8%, what should the market price of the stock be? Round to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started