Answered step by step

Verified Expert Solution

Question

1 Approved Answer

THE SECOND PROPOSAL: GROFAST Under the second proposal GROFAST, the operations will last for 7 years. This proposal involves undertaking a more intensive publicity campaign

THE SECOND PROPOSAL: "GROFAST"

Under the second proposal "GROFAST", the operations will last for years. This proposal involves undertaking a

more intensive publicity campaign on which an expenditure of will be incurred in the first year of

operations. Similar to SURUCHI, this proposal also entails no investments in fixed assets. Revenues from the sale

of food items are estimated at LC in the first year of operations. These revenues are expected to grow at an

annual rate of per cent. In addition, miscellaneous income in year one is with an expected annual growth

rate of per cent.

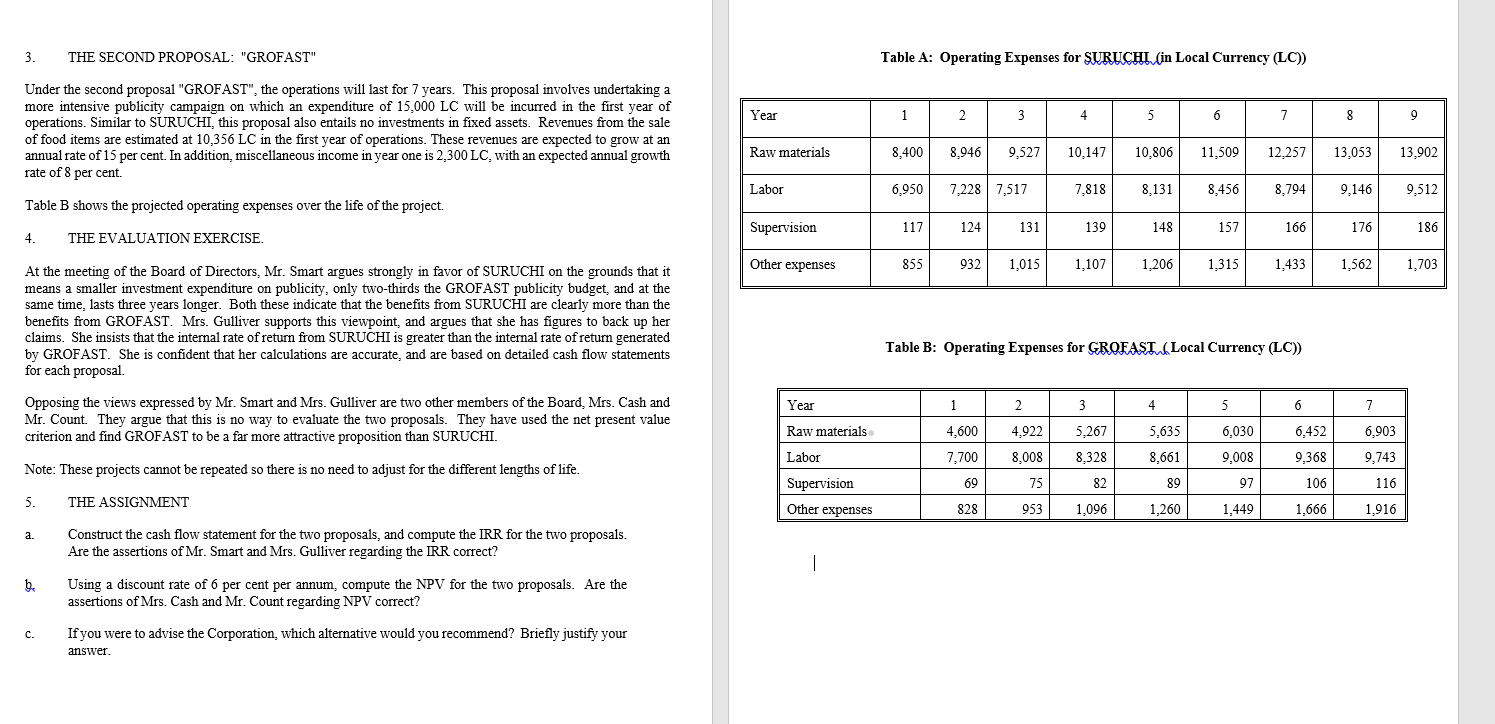

Table B shows the projected operating expenses over the life of the project.

THE EVALUATION EXERCISE.

At the meeting of the Board of Directors, Mr Smart argues strongly in favor of SURUCHI on the grounds that it

means a smaller investment expenditure on publicity, only twothirds the GROFAST publicity budget, and at the

same time, lasts three years longer. Both these indicate that the benefits from SURUCHI are clearly more than the

benefits from GROFAST. Mrs Gulliver supports this viewpoint, and argues that she has figures to back up her

claims. She insists that the internal rate of return from SURUCHI is greater than the internal rate of return generated

by GROFAST. She is confident that her calculations are accurate, and are based on detailed cash flow statements

for each proposal.

Opposing the views expressed by Mr Smart and Mrs Gulliver are two other members of the Board, Mrs Cash and

Mr Count. They argue that this is no way to evaluate the two proposals. They have used the net present value

criterion and find GROFAST to be a far more attractive proposition than SURUCHI.

Note: These projects cannot be repeated so there is no need to adjust for the different lengths of life.

THE ASSIGNMENT

a Construct the cash flow statement for the two proposals, and compute the IRR for the two proposals.

Are the assertions of Mr Smart and Mrs Gulliver regarding the IRR correct?

b Using a discount rate of per cent per annum, compute the NPV for the two proposals. Are the

assertions of Mrs Cash and Mr Count regarding NPV correct?

c If you were to advise the Corporation, which alternative would you recommend? Briefly justify your

answer.

Table A: Operating Expenses for SURUCHI in Local Currency LC

Table B: Operating Expenses for GROFASI Local Currency LC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started