the second question

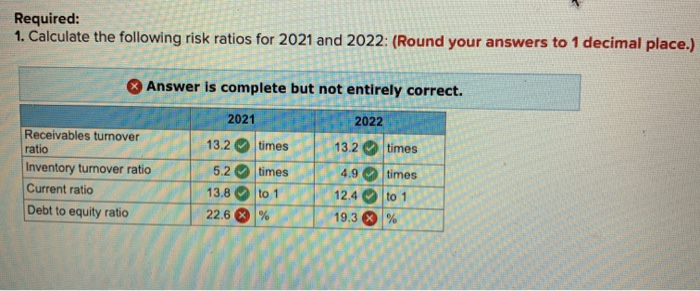

just answer the red boxes the one i got rung

i will give a like if the answer is right

thank u

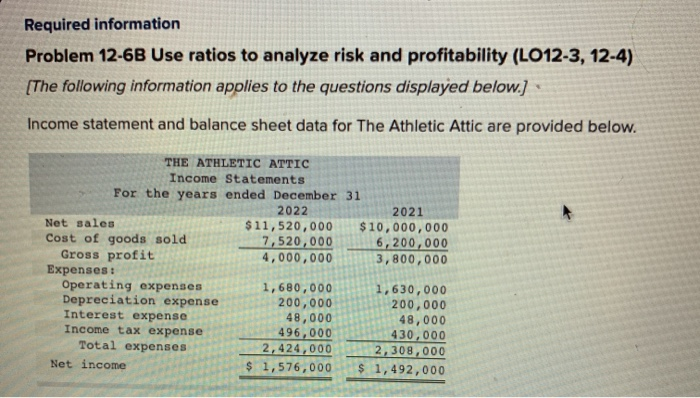

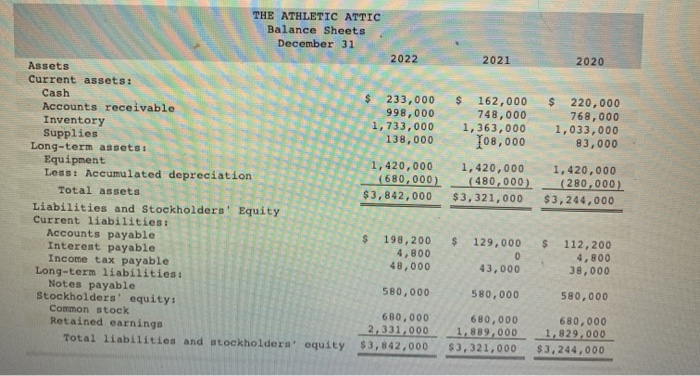

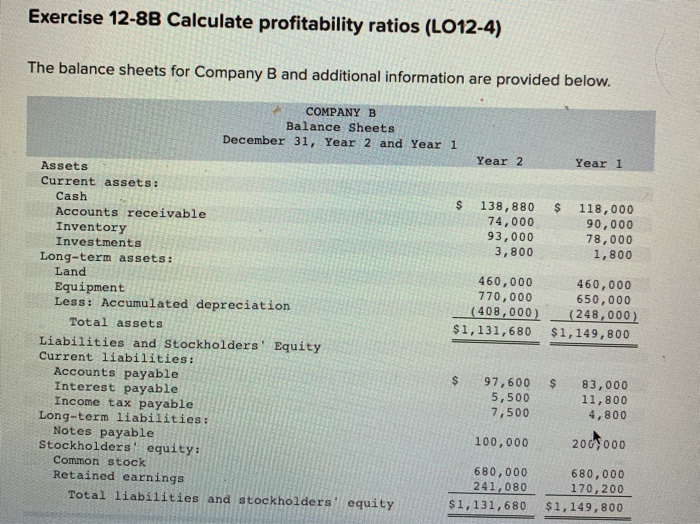

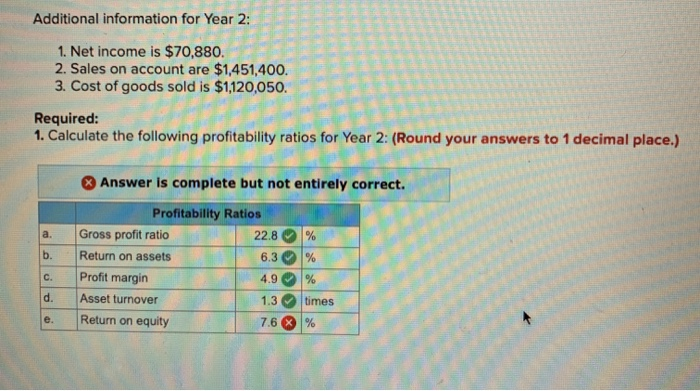

Required information Problem 12-6B Use ratios to analyze risk and profitability (LO12-3, 12-4) [The following information applies to the questions displayed below.) Income statement and balance sheet data for The Athletic Attic are provided below. THE ATHLETIC ATTIC Income Statements For the years ended December 31 2022 2021 Net sales $11,520,000 7,520,000 4,000,000 $10,000,000 Cost of goods sold Gross profit Expenses: Operating expenses Depreciation expense Interest expense Income tax expense 6,200,000 3,800,000 1,680,000 200,000 48,000 496,000 2,424,000 $1,576,000 1,630,000 200,000 48,000 430,000 2,308,000 $ 1,492,000 Total expenses Net income THE ATHLETIC ATTIC Balance Sheets December 31 2022 2020 2021 Assets Current assets: Cash Accounts receivable Inventory Supplies Long-term assets Equipment Less: Accumulated depreciation S 233,000 S 162,000 748,000 1,363,000 I08,000 220,000 768,000 1,033,000 83,000 998,000 1,733,000 138,000 1,420,000 1,420,000 (480,000) $3,321,000 1,420,000 (680,000) (280,000) $3,842,000 Total assets $3,244,000 Liabilities and Stockholders' Equity Current 1iabilities: Accounts payable Interest payable Income tax payable Long-term liabilities Notes payable Stockholders' equity: $ 198,200 S 129,000 112,200 4,800 38,000 4,800 48,000 0 43,000 580,000 580,000 580,000 Common stock Retained earnings 680,000 1,829,000 680,000 2,331,000 $3,842,000 680,000 1,889,000 Total liabilities and atockholders' equity $3,321,000 $3,244,000 Required: 1. Calculate the following risk ratios for 2021 and 2022: (Round your answers to 1 decimal place.) Answer is complete but not entirely correct. 2021 2022 Receivables tunover ratio 13.2 times 13.2 times Inventory turnover ratio Current ratio 5.2 times 4.9 times 13.8 to 1 12.4 to 1 Debt to equity ratio 22.6 % 19.3 % Exercise 12-8B Calculate profitability ratios (LO12-4) The balance sheets for Company B and additional information are provided below. COMPANY B Balance Sheets December 31, Year 2 and Year 1 Year 2 Year 1 Assets Current assets: Cash Accounts receivable 118,000 90,000 78,000 1,800 138,880 74,000 93,000 Inventory Investments 3,800 Long-term assets: Land 460,000 770,000 (408,000) $1,131,680 460,000 650,000 (248,000) $1,149,800 Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders equity: Common stock Retained earnings S 97,600 5,500 7,500 83,000 11,800 4,800 200 000 100,000 680,000 241,080 680,000 170,200 Total liabilities and stockholders equity $1,149, 800 $1,131,680 Additional information for Year 2: 1. Net income is $70,880. 2. Sales on account are $1,451,400. 3. Cost of goods sold is $1,120,050. Required: 1. Calculate the following profitability ratios for Year 2: (Round your answers to 1 decimal place.) Answer is complete but not entirely correct. Profitability Ratios Gross profit ratio 22.8 a. % b. Return on assets 6.3 % Profit margin C. 4.9 % d. Asset turnover 1.3 times Return on equity e. 7.6 %