Question

The second question: ** On January 1, 2014, a company acquired 100% of Chapman's shares. And on that date Abernethy: As Abernethy reads, the balance

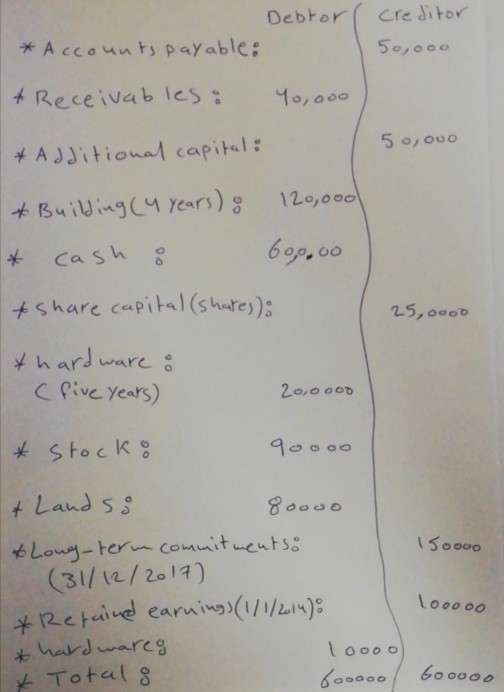

The second question: ** On January 1, 2014, a company acquired 100% of Chapman's shares. And on that date Abernethy: As Abernethy reads, the balance of audit was with Abernethy: (This table)

During 2014, Abernethy reported an income of $ 80,000 while it was paying off confusion of $ 10,000. During 2015, Abernethy recorded revenues of $ 110,000 while it was paying a dividend of $ 30,000. Notice the remaining operational life of the buildings account 4 years and the equipment account 5 years. And Abernethy, through the trial balance information of the company, purchased the Chapman shares shown above, assuming that the company had $ 500,000 in cash. Abernethy equipment and long term liabilities were valued at $ 220,000 and $ 120,000 used by Chapman respectively (fair value). Note that the company cost method for this investment. ** Confirm the necessary worksheet entries to prepare the consolidated financial statements on 12/31/2014 and 12/31/2015?

Debtor creditor 50,000 * Accounts payable: * Receivables : Yo,ooo 50,000 * Additional capital: * Building (4 years) & 120,oool cash i 600.00 to share capital (shares); 25,0000 & hardware : (five years) 20,0000 * stocko 90.oo 150000 & Landsi 80000 * Long-term commitments: (31/12/2017) *Retained earnings (1/1/2014): *hardwareg loooo * Total 600000 100000 6ooooo Debtor creditor 50,000 * Accounts payable: * Receivables : Yo,ooo 50,000 * Additional capital: * Building (4 years) & 120,oool cash i 600.00 to share capital (shares); 25,0000 & hardware : (five years) 20,0000 * stocko 90.oo 150000 & Landsi 80000 * Long-term commitments: (31/12/2017) *Retained earnings (1/1/2014): *hardwareg loooo * Total 600000 100000 6oooooStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started