Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The section of the IRS code governing partnerships. US citizens who reside and work on an extended basis in a foreign country. This is the

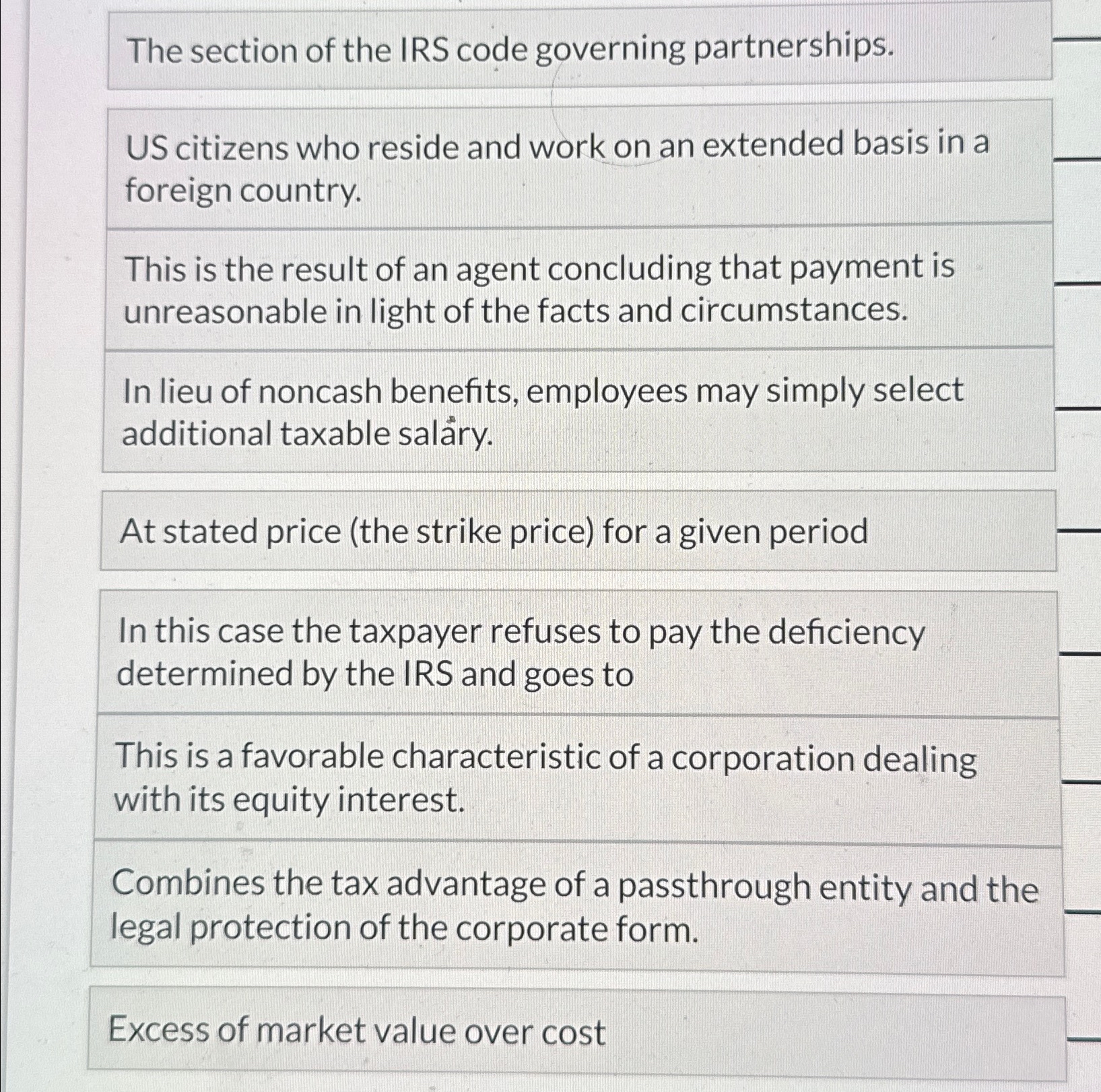

The section of the IRS code governing partnerships.

US citizens who reside and work on an extended basis in a foreign country.

This is the result of an agent concluding that payment is unreasonable in light of the facts and circumstances.

In lieu of noncash benefits, employees may simply select additional taxable salry

At stated price the strike price for a given period

In this case the taxpayer refuses to pay the deficiency determined by the IRS and goes to

This is a favorable characteristic of a corporation dealing with its equity interest.

Combines the tax advantage of a passthrough entity and the legal protection of the corporate form.

Excess of market value over cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started