Answered step by step

Verified Expert Solution

Question

1 Approved Answer

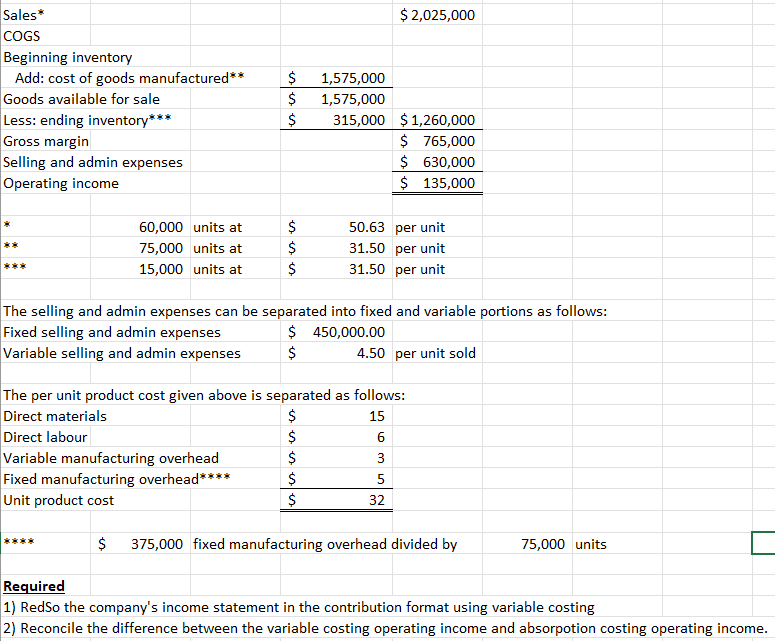

The selling and admin expenses can be separated into fixed and variable portions as follows: Fixed selling and admin expenses $450,000.00 Variable selling and admin

The selling and admin expenses can be separated into fixed and variable portions as follows: Fixed selling and admin expenses $450,000.00 Variable selling and admin expenses $4.50 per unit sold The per unit product cost given above is separated as follows: \begin{tabular}{l|rr} Direct materials & $ & 15 \\ Direct labour & $ & 6 \\ Variable manufacturing overhead & $ & 3 \\ \hline Fixed manufacturing overhead**** & $ & 5 \\ \hline Unit product cost & $ & 32 \\ \hline \hline \end{tabular} $375,000 fixed manufacturing overhead divided by 75,000 units Required 1) RedSo the company's income statement in the contribution format using variable costing 2) Reconcile the difference between the variable costing operating income and absorpotion costing operating income. The selling and admin expenses can be separated into fixed and variable portions as follows: Fixed selling and admin expenses $450,000.00 Variable selling and admin expenses $4.50 per unit sold The per unit product cost given above is separated as follows: \begin{tabular}{l|rr} Direct materials & $ & 15 \\ Direct labour & $ & 6 \\ Variable manufacturing overhead & $ & 3 \\ \hline Fixed manufacturing overhead**** & $ & 5 \\ \hline Unit product cost & $ & 32 \\ \hline \hline \end{tabular} $375,000 fixed manufacturing overhead divided by 75,000 units Required 1) RedSo the company's income statement in the contribution format using variable costing 2) Reconcile the difference between the variable costing operating income and absorpotion costing operating income

The selling and admin expenses can be separated into fixed and variable portions as follows: Fixed selling and admin expenses $450,000.00 Variable selling and admin expenses $4.50 per unit sold The per unit product cost given above is separated as follows: \begin{tabular}{l|rr} Direct materials & $ & 15 \\ Direct labour & $ & 6 \\ Variable manufacturing overhead & $ & 3 \\ \hline Fixed manufacturing overhead**** & $ & 5 \\ \hline Unit product cost & $ & 32 \\ \hline \hline \end{tabular} $375,000 fixed manufacturing overhead divided by 75,000 units Required 1) RedSo the company's income statement in the contribution format using variable costing 2) Reconcile the difference between the variable costing operating income and absorpotion costing operating income. The selling and admin expenses can be separated into fixed and variable portions as follows: Fixed selling and admin expenses $450,000.00 Variable selling and admin expenses $4.50 per unit sold The per unit product cost given above is separated as follows: \begin{tabular}{l|rr} Direct materials & $ & 15 \\ Direct labour & $ & 6 \\ Variable manufacturing overhead & $ & 3 \\ \hline Fixed manufacturing overhead**** & $ & 5 \\ \hline Unit product cost & $ & 32 \\ \hline \hline \end{tabular} $375,000 fixed manufacturing overhead divided by 75,000 units Required 1) RedSo the company's income statement in the contribution format using variable costing 2) Reconcile the difference between the variable costing operating income and absorpotion costing operating income Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started